87

Malaysia’s broad investor base includes financial institutions, insurance companies,

takaful

operators and mutual funds. Leading institutions by the size of assets under management

(AUM) include the Employees Provident Fund (EPF), Kumpulan Wang Persaraan

(Diperbadankan) (KWAP), Permodalan Nasional Berhad (PNB) and Lembaga Tabung Haji

(LTH) (refer to Table 4.5). These entities can be regarded as cornerstone investors for the

sukuk market.

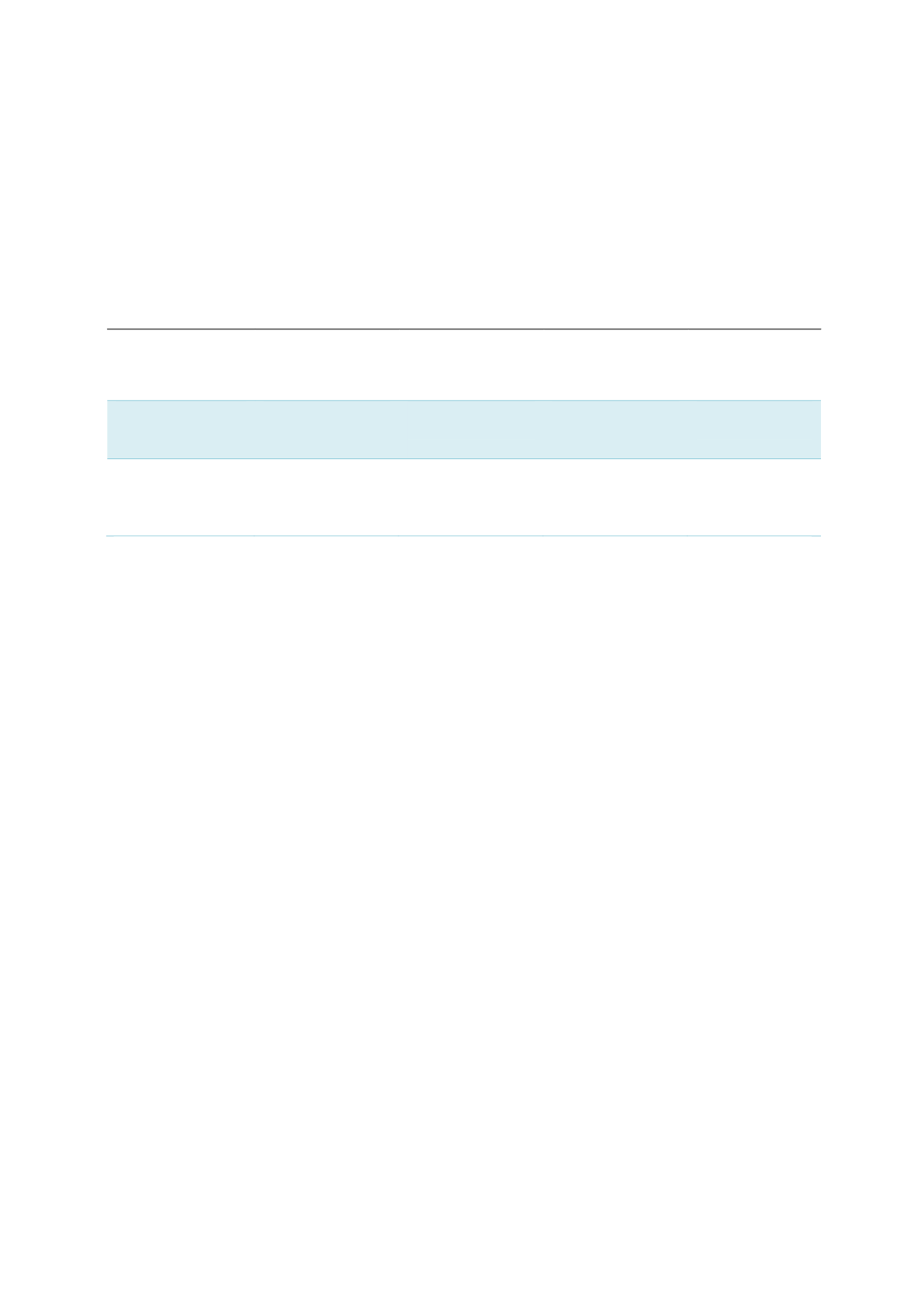

Table 4.5: Malaysian Institutional Investors

EPF

(Malaysia’s largest

retirement fund)

KWAP

(Malaysia’s 2

nd

largest retirement

fund)

PNB

(Malaysia’s largest

fund-management

company)

LTH

(Malaysia’s sole

pilgrimage fund)

AUM

RM731.1 billion

(end-2016)

RM126.8 billion

(estimate, end-

2016)

RM266.5 billion

(end-2016)

RM64 billion

(estimate, end-

2016)

Shariah-

compliant

investments out

of total AUM

45%

(end-2016)

49.7%

(end-September

2016)

Not available

100%

Sources: Annual Reports

Given the enlarged investor base (inclusive of Shariah-compliant investors) for sukuk

compared to conventional bonds and the growing appetite for Shariah-compliant assets, sukuk

yields have been more competitive than those of conventional bonds, as depicted in Charts 4.9

and 4.10. Between August 2005 and 2006, the spreads between Islamic and conventional debt

securities came up to double digits for tenures of 1 and 5 years. Since sukuk constitutes more

than 60% of new issues now, however, the price differential has been reduced to 5 bps. This

unique market-driven phenomenon adds to the conducive environment which, in combination

with the various tax and regulatory incentives, provides that tipping point to become the

preferred choice for issuers.