COMCEC Financial Outlook 2018

15

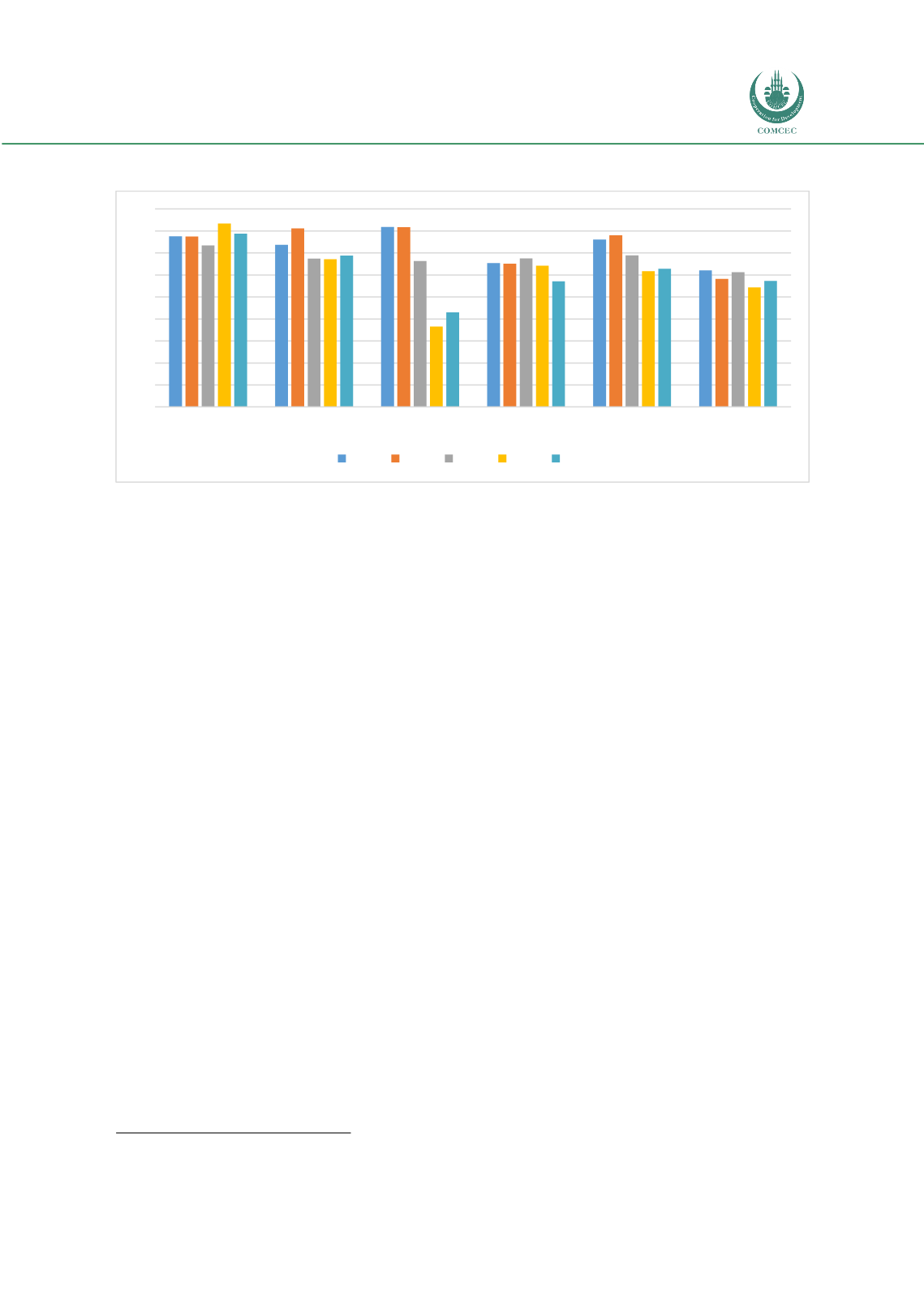

Figure 9: Bank Return on Equity (%, after tax)

Source: Authors’ calculation from the World Bank Database

As a result, in terms of the efficiency characteristic, the OIC average has performed slightly better

than the world average for the selected indicators over the period between 2012 and 2016. It

has been noted that the averages of the high and upper-middle-income group countries

performed better than the world average which highlights the level of development of the

financial markets and institutions in these countries. As for this characteristic, the low-income

segments of the countries should be targeted to increase financial efficiency in order to support

further economic development.

1.4 Financial Stability

The importance of financial stability is highlighted by the World Bank as following: ‘A stable

financial system is capable of efficiently allocating resources, assessing and managing financial

risks, maintaining employment levels close to the economy’s natural rate, and eliminating

relative price movements of real or financial assets that will affect monetary stability or

employment levels. A financial system is in a range of stability when it dissipates financial

imbalances that arise endogenously or as a result of significant adverse and unforeseen events.

In case of instability, the systemwill absorb the shocks primarily via self-correctivemechanisms,

preventing adverse events fromhaving a disruptive effect on the real economy or other financial

systems. Financial stability is paramount for economic growth, as most transactions in the real

economy are made through the financial system’

18

.

Financial stability is an essential feature of a well-functioning financial sector. The recent rapid

growth of the financial sector should be accompanied by proper risk management and

regulation in order to refrain from systemic risks that can be a severe threat to global financial

stability. In this framework, the system has created various mechanisms to measure systemic

risk, stress tests, and other tools for financial stability. As the global financial markets have been

integrated over the recent decades, the importance of financial stability has been increased since

it is closely connected with macroeconomic stability, economic growth, employment, etc.

18

http://www.worldbank.org/en/publication/gfdr/background/financial-stability15,7

13,8

8,6

11,4

12,6

0

2

4

6

8

10

12

14

16

18

OIC-LIG

OIC-LMIG

OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015 2016