COMCEC Financial Outlook 2018

20

against the financial crises. Therefore, Islamic finance has been recognized as part of global

finance with its growing customer base, asset size, diversified instruments, and geographical

spread. Also, the importance of Islamic finance in the global financial system has been

recognized by institutions ranging from international organizations to global financial

institutions.

Islamic finance has emerged as a useful tool for financing development worldwide, including in

non-Muslim countries. Major financial markets are discovering substantial evidence that Islamic

finance has already been mainstreamed within the global financial system. The Islamic finance

industry has expanded rapidly over the past decade, growing at 10-12% annually and total

assets are estimated at over USD2 trillion, covering bank and non-bank financial institutions,

capital markets, money markets and insurance (“Takaful”). In many majority Muslim countries,

Islamic banking assets have been growing faster than conventional banking assets. There has

also been a surge of interest in Islamic finance from non-Muslim countries such as the UK,

Luxembourg, Germany, South Africa, and Hong Kong. Islamic finance is equity-based, asset-

backed, ethical, sustainable, environmentally- and socially-responsible finance. It promotes risk

sharing, connects the financial sector with the real economy, and emphasizes financial inclusion

and social welfare.

20

The growing market shares and rising domestic systemic importance of Islamic finance

underscore the importance of developing robust regulatory frameworks for prudential

regulation and supervision in Islamic finance jurisdictions.

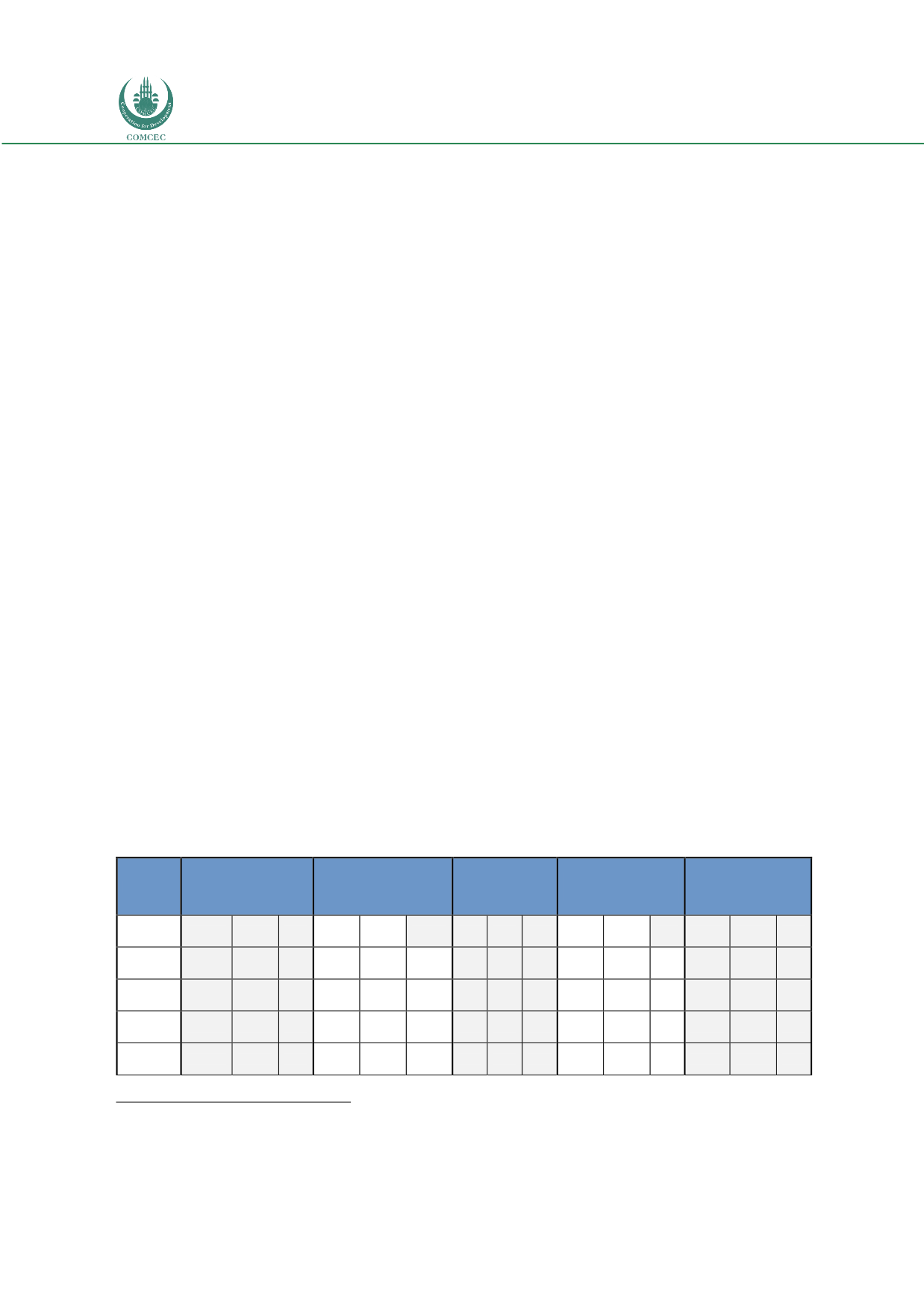

2.2 Islamic Finance Outlook

Islamic financial sector has continued its growth performance in 2018 but at a steady pace

(Table 3). According to latest data, the total asset size of the Islamic finance sector has slightly

increased from USD 2.05 trillion [2017] (that was the first time the sector recorded USD 2

trillion) to USD 2.2 trillion in 2018 with 7.0% YoY growth rate [2017: 8.5%]. Relatively low

growth performance can be attributed to the depreciation in the local currencies of some

emerging economies against the dollar, which induces to decline in the dollar values of the

industry assets. Apart from the effect of the weak local currencies, economic and geopolitical

issues led to the slight growth performance of the industry

21

.

Table 3. Breakdown of IFSI by Sector and by Region

22

(USD billion)

Islamic Banking

Outstanding Sukuk

Islamic Funds

Assets

Takaful

Contributions

Total

Region

2017

2018

YoY

2017

2018

YoY

2017 2018

YoY

2017

2018

YoY

2017

2018

YoY

Asia

232.0

266.1

15%

239.5

323.2

35%

24.8

24.2

-2%

3.3

4.1

24%

499.6

617.6

24%

GCC

683.0

704.8

3%

139.2

187.9

35%

26.8

22.7

-15%

12.6

11.7

-7%

861.6

927.1

8%

MENA (ex-

GCC)

569.0

540.2

-5%

17.8

0.3

-98%

0.1

0.1

0%

9.5

10.3

8%

596.4

550.9

-8%

Africa (ex-

North)

27.1

13.2

-51%

2.0

2.5

25%

1.6

1.5

-6%

0.7

0.0

-99%

31.4

17.2

-45%

20

World Bank, Islamic Finance Brief

21

Islamic Financial Services Industry Stability Report 2019

22

For purposes of regional classification, Iran is included in “MENA (ex. GCC)”, while Turkey is included in “Others”