COMCEC Financial Outlook 2018

21

Others

46.4

47.1

2%

1.5

16.5

1000%

13.3

13.1

-2%

0.0

0.0

0%

61.3

76.7

25%

Total

1,557.5

1,571.3

1%

399.9

530.4

33%

66.7

61.5

-8%

26.1

27.7

6%

2,050.2

2,190.0

7%

Source: Compiled from IFSB 2019 and IFSB 2018.

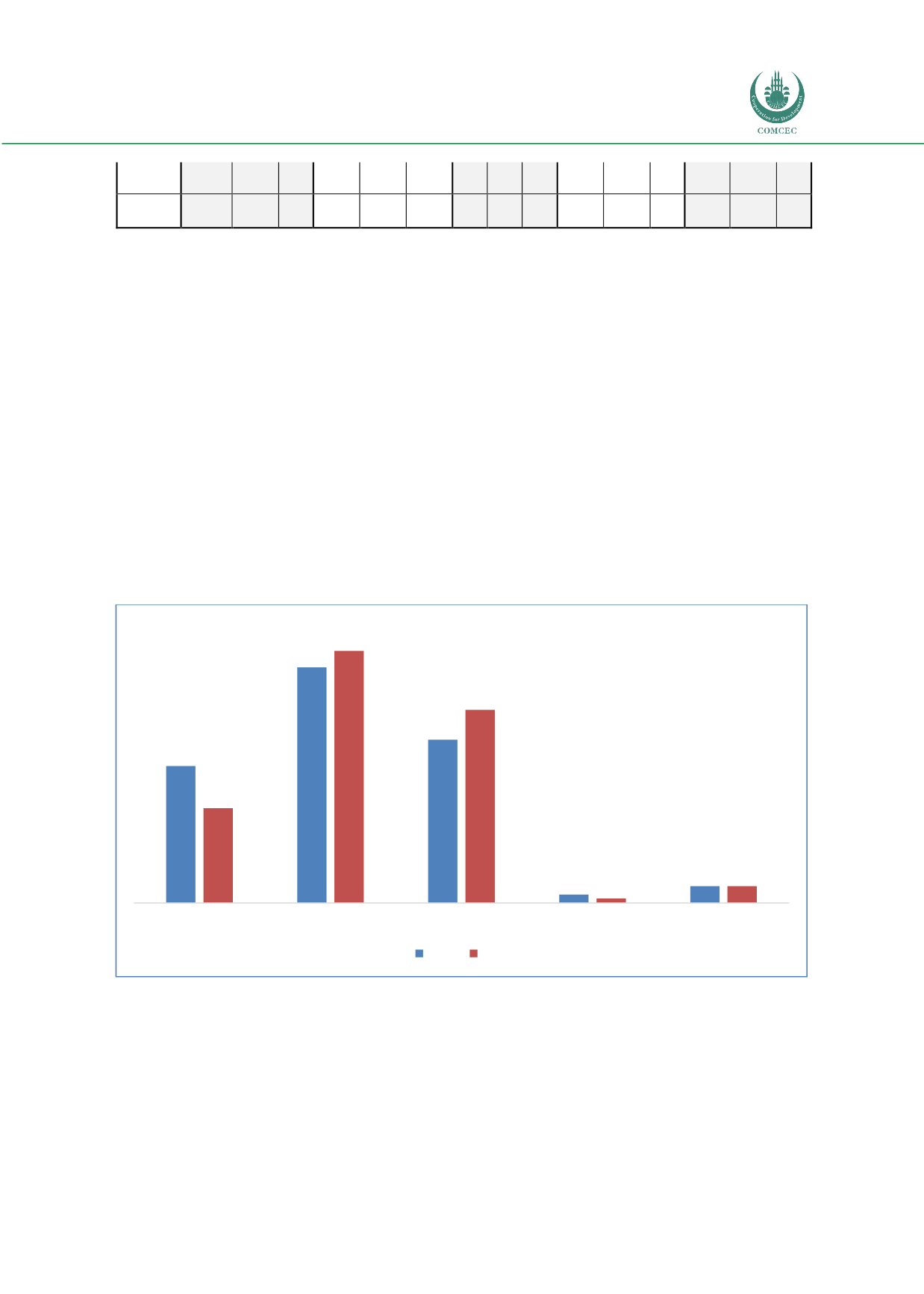

The concentration of Islamic finance in terms of region was not changed in 2018. Total Islamic

finance worth of the GCC region increased by 8% and reached USD 927.1 million [2017: USD

861.6] in 2018 that figures kept the region as being the largest domicile for Islamic finance

assets. In line with the improved asset, the market share of the GCC modestly increased

compared to 2017 [42.0%] and realized as 44.9%.

GCC is followed by the MENA excluding GCC (MENA ex-GCC) in terms of market share that is

moderately rose to 34.4% [2017: 29.1%], although total Islamic finance assets shrank by 8%

from USD 596.4 million [2017] to USD 550.9 million in 2018. Asia is one of the most potential

regions to grow in Islamic financial market with the regional countries such as Malaysia,

Indonesia, Pakistan, and Bangladesh, however only Asia’s market share declined in 2018 to

16.9% [2017: 24.4%], even though total assets of the region significantly increased in the same

period. Total Islamic finance assets of Africa (ex-North) decreased almost half in 2018 to USD

17.2 million [2017: USD 31.4 million], primarily due to the 51% YoY decline in the Islamic

banking assets.

Figure 13: Breakdown of IFSI by Region (%)

Source: Compiled from IFSB 2019 and IFSB 2018.

Islamic financial sector compromises three main sectors: Islamic banking, Islamic capital

markets, and Islamic insurance (takaful). Islamic banking has been still the dominant segment

of the industry in 2018, although its share was slightly decreased to 71.7% as compared to the

76.0% share in 2017. Sukuk market and Islamic funds constitute Islamic capital markets and

represented 24.2%, 2.8%, respectively in 2018. Takaful segment kept its market share at 1.3%

in 2018, although total takaful contributions increased by 6% and recorded USD 27.7 million in

the same period.

24,4

42,0

29,1

1,5

3,0

16,9

44,9

34,4

0,8

3,0

Asia

GCC

MENA (ex-GCC) Africa (ex-North)

Others

2017 2018