COMCEC Financial Outlook 2018

17

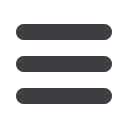

Figure 11: Bank Capital to Total Asset (%)

Source: Authors’ calculation from the World Bank Database

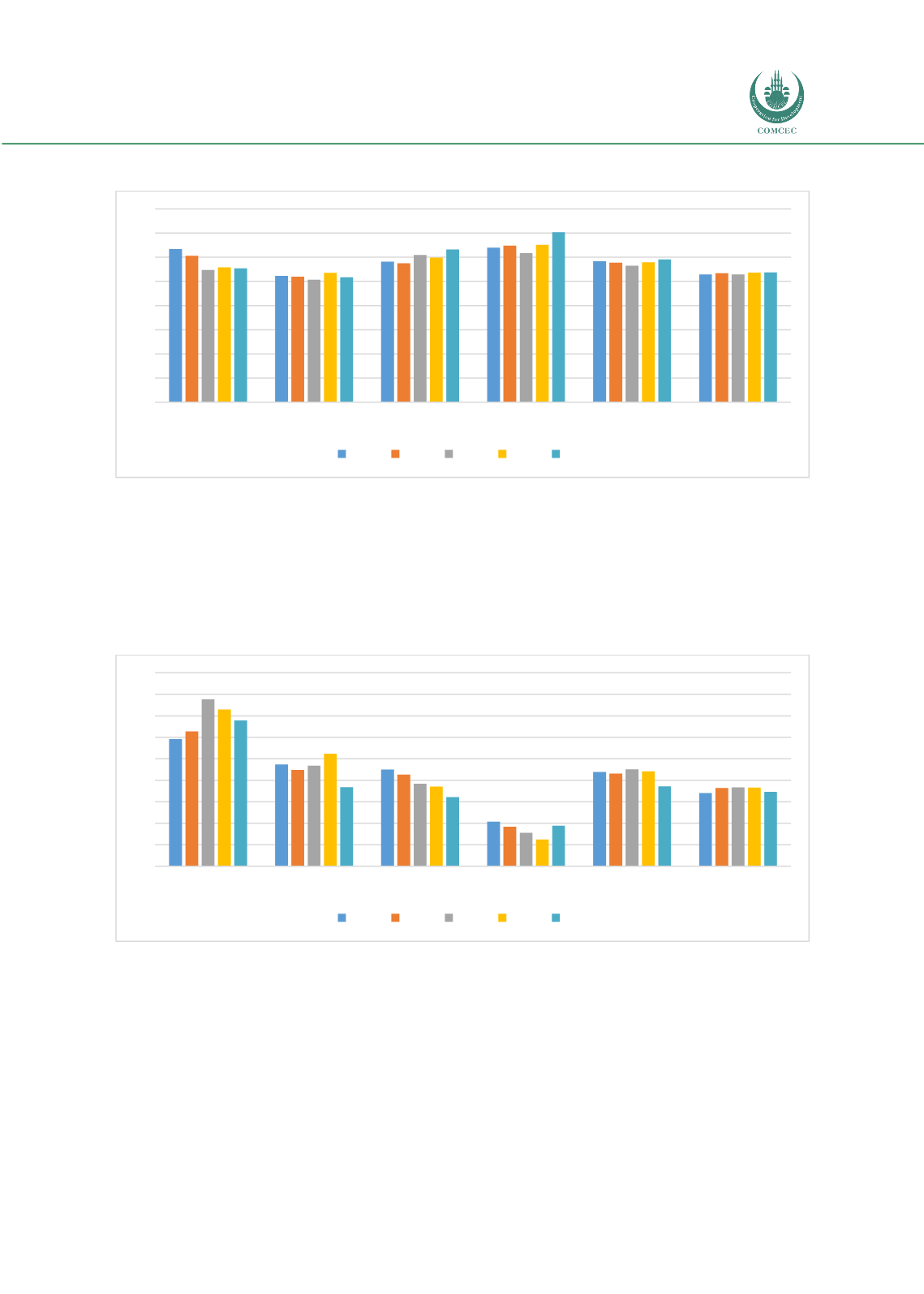

The non-performing bank loans to gross loans (NPL) Ratio

is calculated as defaulting loans

(payments of interest and principal past due by 90 days or more) to total gross loans (total value

of loan portfolio). The loan amount recorded as non-performing includes the gross value of the

loan as recorded on the balance sheet, not just the overdue amount. As this ratio increases, the

possibility of insolvency in the banking sector also increases.

Figure 12: Bank Non-performing Loans to Gross Loans (%)

Source: Authors’ calculation from the World Bank Database

The Figure shows that NPL ratios of OIC-LIG, OIC LMIG, and OIC UMIC were higher than the OIC

HIGH. OIC-LIG score, for example, increased significantly in 2014 and as accounted for 15.5

percent. The ratio for OIC-LIG has slightly decreased to 13.6 percent in 2016, but it was still

higher than the OIC country groups and world average. The OIC-UMIG group performance

improved since 2012 and dropped to 6.4 percent in 2016. OIC-HIG has shown outstanding

performance over the years, and the ratio declined to 2.5 percent in 2015 and increased to 3.8

in 2016, that was much better than the world average as well.

0

2

4

6

8

10

12

14

16

OIC-LIG

OIC-LMIG

OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015 2016

0

2

4

6

8

10

12

14

16

18

OIC-LIG

OIC-LMIG

OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015 2016