COMCEC Financial Outlook 2018

11

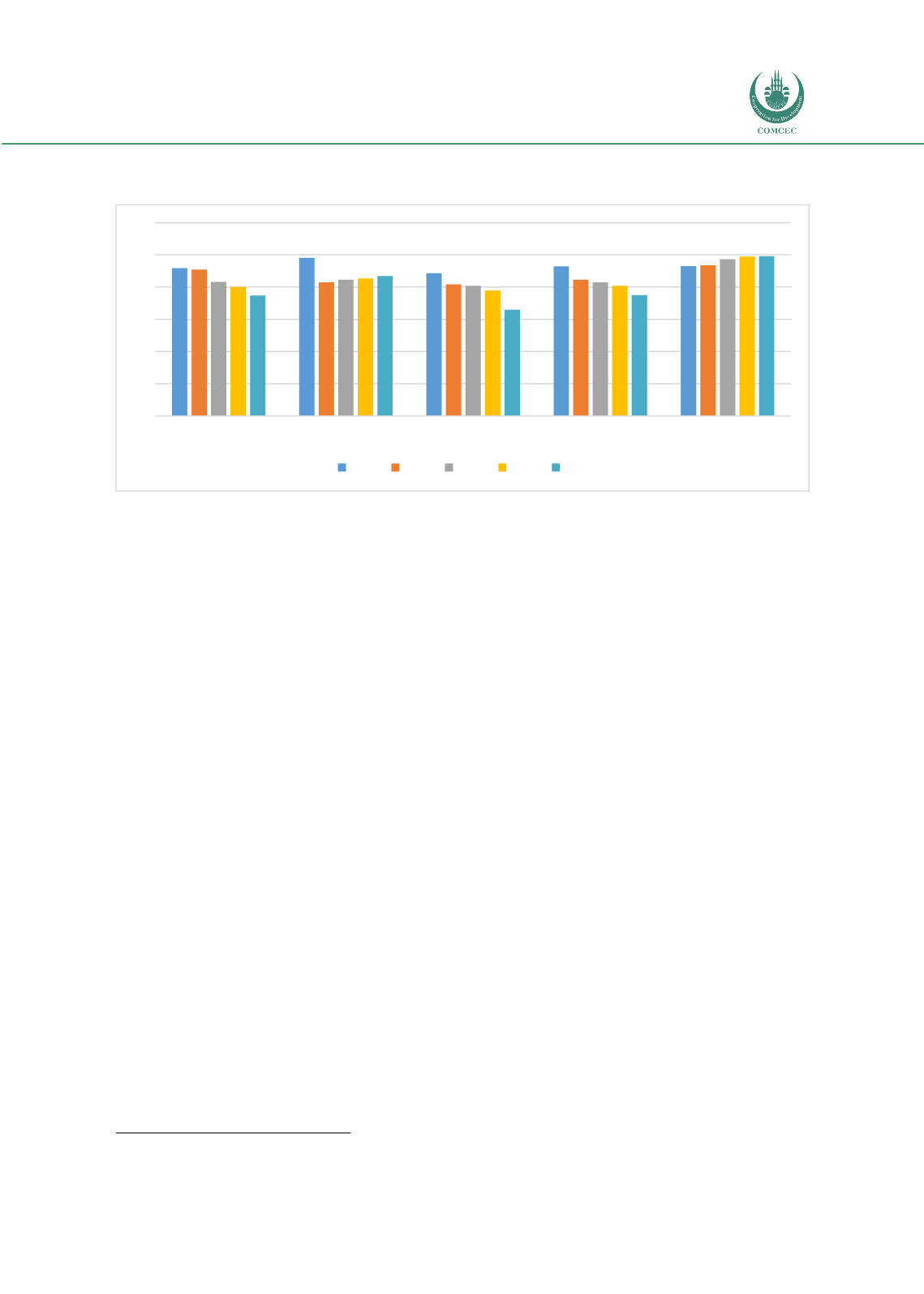

Figure 6: Market Capitalization Excluding Top 10 Companies to Total Market Capitalization

(%)

Source: Authors’ calculation from the World Bank Database

The world average just hovers around 50 percent over the years from 2012 to 2016. As for the

OIC countries, the ratios for all groups are fluctuating around 38 percent during the same period.

As this ratio increases across the countries and country groups, it should be interpreted that the

value of outstanding shares of comparatively smaller companies is increasing in the market and

meaning access to the market is affected positively. Considering the fact that the data is available

only for those countries that their markets have the maturity as well as the undeveloped nature

of stock exchanges in the OIC countries, it is understandable to have smaller shares in OIC states

compared to the world averages.

As a result, in terms of financial efficiency, the OIC averages for the selected indicators have been

found around the world averages over the selected years. As mentioned earlier, there is a close

correlation between economic development, income level and financial access. Therefore, the

findings of the indicators under this characteristic clearly signs that as the economies develop

financial access increases in parallel. The high and upper middle income groups of OIC countries

have performed much better than the other groups. In this regard, the policies towards

promoting financial access should focus on the low income group countries as well as on the

groups of financially deprived segments of other group countries.

1.3 Financial Efficiency

The structure and operation of the financial system have undergone remarkable changes in the

past couple of decades due to the significant improvements in technology, product innovation,

and integration in the global financial system, competition in financial services, and policy,

regulatory and trade reforms. These developments have led to a dynamic and sophisticated

global financial markets and fostered economic growth; at the same time, however, specific

problems and issues have plagued the financial system.

14

In this regard, among other

characteristics, the efficiency of the financial intermediaries and markets have emerged as an

important tool to understand the financial system.

14

Policy Framework for Effective and Efficient Financial Regulation, OECD 2010

0

10

20

30

40

50

60

OIC-LMIG

OIC-UMIG

OIC-HIG

OIC-Average

World Average

2012 2013 2014 2015 2016