COMCEC Financial Outlook 2018

10

These figures simply indicate that Low income group of OIC countries need to develop their

markets to increase financial inclusion in order to support their economic growth and poverty

reduction.

Another indicator used to measure financial access is

the number of bank branches per

100,000 adults

that refers to the number of commercial bank branches per 100,000 adults in

an economy.

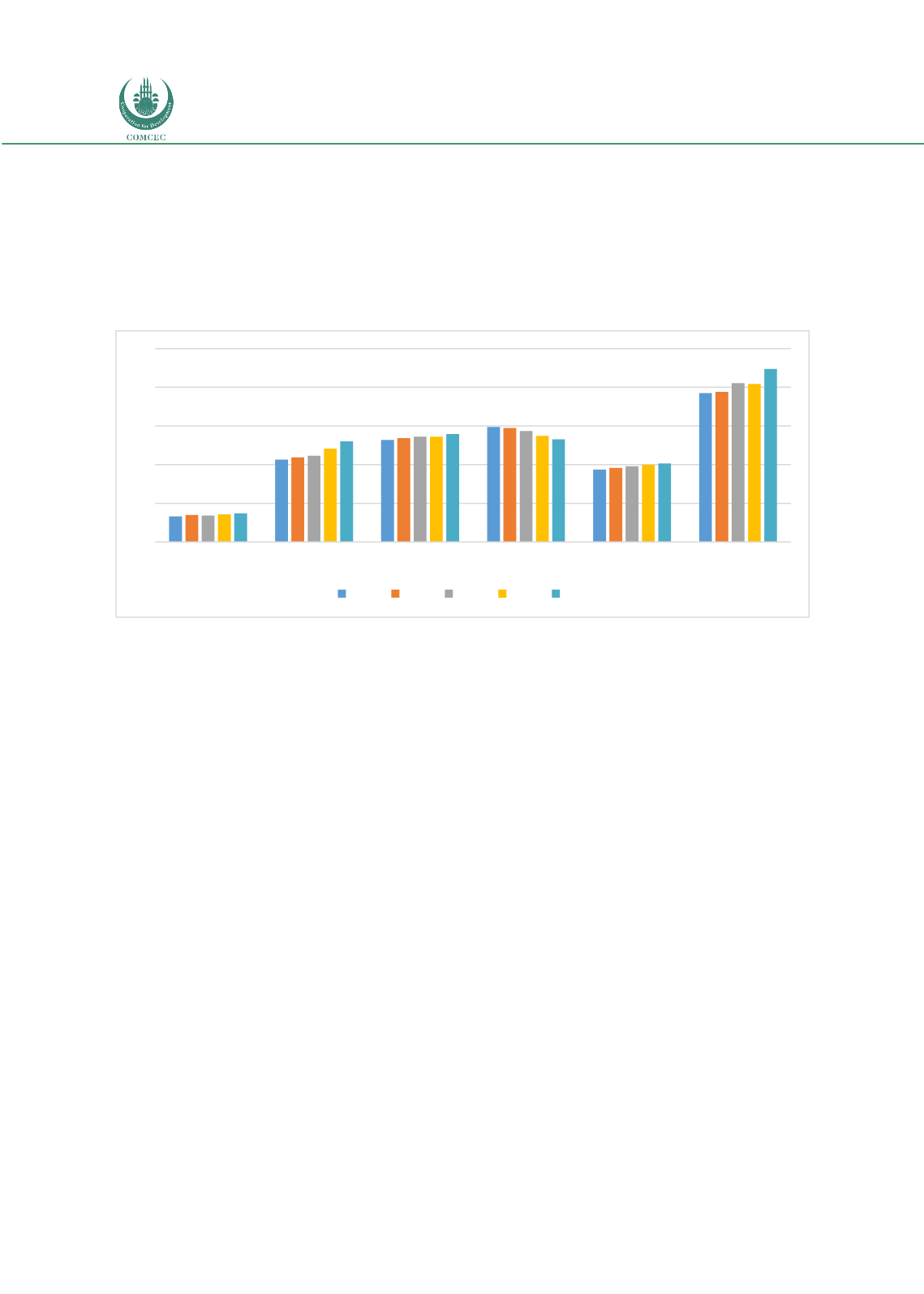

Figure 5: Bank Branches per 100,000 Adults

Source: Authors’ calculation from the World Bank Database

The above Figure on the number of bank branches is consistent with the bank account as both

clearly indicates a low level of financial access recorded for the low income group of OIC

countries which reached to 3.7 branches per 100,000 adults in 2016 while the world average

realized as 22.4 in the same year. Unlike the previous indicator, the UMIG and HIG groups of the

OIC have shown lower performance than the world averages across the selected period. Over

the period of 2012 to 2016, the rate has been realized around 14 branches for both OIC groups

of UMIG and HIG. Although the financial markets and instruments have been recorded

considerable growth and diversified significantly over the years, the branches have not

increased in parallel. Among other factors, this fact can be explained by the widespread usage of

branchless/internet banking.

As a result, the policymakers in the low income group countries should focus on enhancing the

banking activities and access to financial markets by investing on branchless banking initiatives

that have emerged as a cost effective option in recent years.

Data on access to financial markets are more limited. Especially for those countries with low

income level and undeveloped stock exchange markets, the data is very scant. Measures of

market concentration are utilized to have an idea on the level of access to stock and bond

markets. Here we used the

Market capitalization excluding top 10 companies to total

market capitalization (%)

to approximate access to financial markets. This ratio is calculated

as ‘value of listed shares outside of the ten largest companies to the total value of all listed

shares’.

0

5

10

15

20

25

OIC-LIG

OIC-LMIG

OIC-UMIG

OIC-HIG OIC-Average World Average

2012 2013 2014 2015 2016