Risk Management in Transport PPP Projects

In the Islamic Countries

242

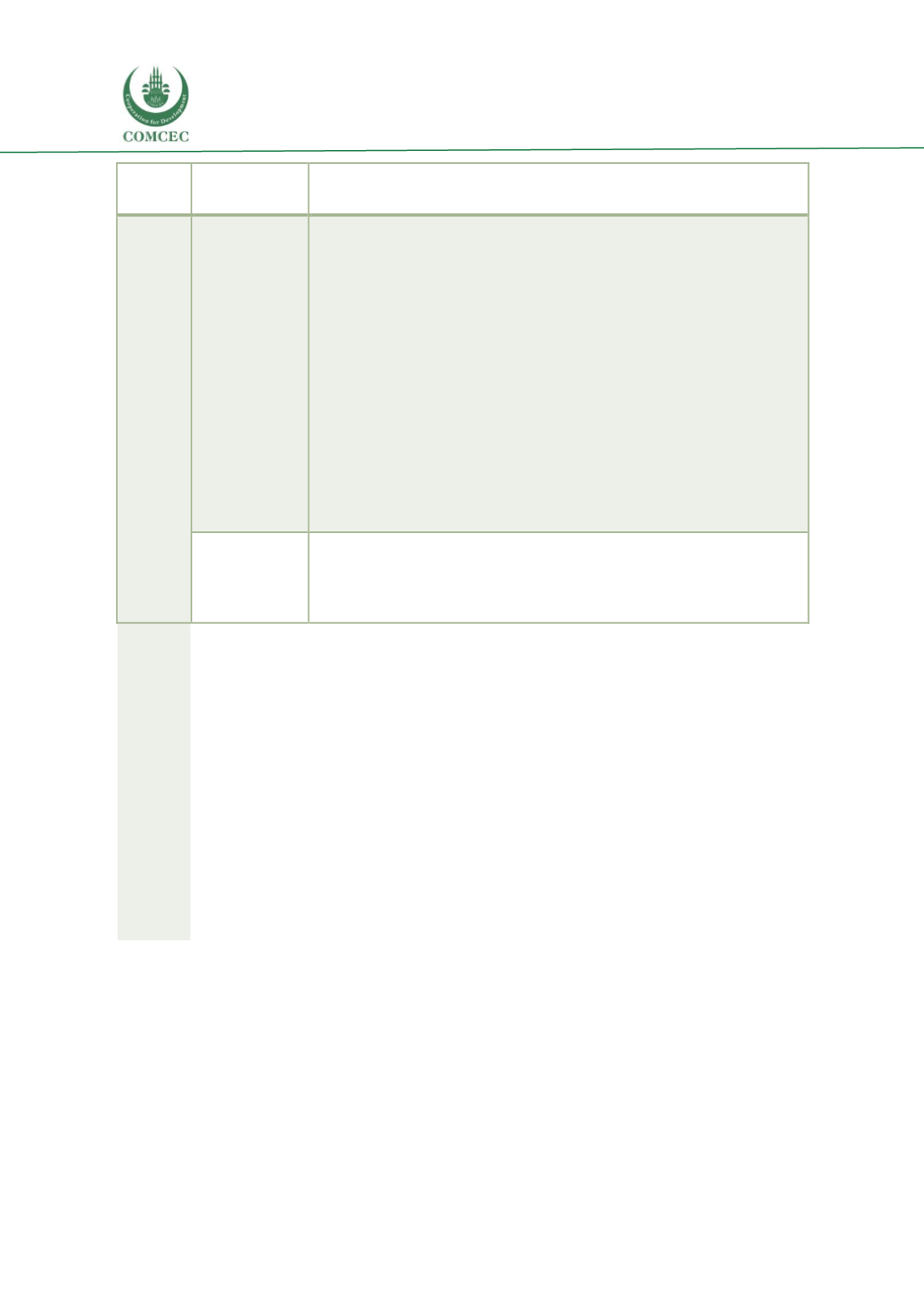

Risk

type

Risk category

Usual allocation of risks (public/private/shared)

Financial

sustainability

risks

Given that the private sector is responsible for the operation and maintenance

of the infrastructure, the financial sustainability of the concession contract

falls generally under the responsibility of the

private sector

. This is

particularly the case of BOT projects in the commercial ports and touristic

marinas and BOT/TOR airport projects. In BOT projects related to road

transport operations, demand guarantees are adopted, which results in the

allocation of demand risks to the

public sector

. However, it is worth to notice

that the concession period is offered by the contractors, hence there is a

degree of shared demand risk on the profitability of the project between the

public and private sector. Bonus/malus schemes could also be adopted which

could relate to the concession time-schedule or revenues, resulting in an

extension of the operation period in case of savings of time at the construction

stage or reduction of the concession period in case of delays; or the sharing of

revenues in excess to demand guarantee or revenue thresholds. These

mechanisms imply a r

isk/opportunity sharing

of the financial sustainability

risks between the private and public in certain BOT and LOT projects.

Other risks

(force majeure

and early

termination)

Force majeure and early termination risks are

shared

. Cases of force

majeure and early termination are specifically referred to in the PPP

contracts.

Source: Authors.

The analysis of the

risk management practices

and processes in Turkey reveals specific

attention to the identification, allocation and treatment of projects risks that concentrates at the

stage of the contractual elaboration and finalization. This “

legal attitude”

to risk management

should be strengthened with an economic approach aimed at integrating risk management

related analysis and monitoring activities with risk appraisal (ex-ante), monitoring and

evaluation (ex-post), concerning all steps of the project life-cycle.

Performance metrics

According to the Turkish legislation regulating the implementation of BOT PPP projects,

auditing and monitoring mechanisms of the implementation of the projects shall be performed,

which is under the direct responsibility of the procuring authority and shall be regulated by the

implementation contracts. Accordingly, provisions are included in the contracts which relate to

the monitoring of the implementation of the works during the construction stage. The

performance of the contract is also monitored at the operation stage (WB, 2018).

In general terms, the current practice concerning auditing and monitoring of PPPs in the

transport sector consists of

periodic reporting by the contractors

to the procuring

authorities. In order to manage and supervise PPPs, each of the procuring authorities in Turkey

has established a PPP contract management team. Monitoring activities are performed either

independently (by the PPP dedicated team or involving personnel from specialized central or

regional departments in the case of KGM), or by hiring consultancy firms. Finally,

lending

institutions

also perform auditing and monitoring procedures, especially during construction.