Risk Management in Transport PPP Projects

In the Islamic Countries

241

For airports, commercial ports and touristic marinas PPP contractual documentation excludes

the credit agreement. Financial capacity selection criteria are instead applied and requested at

the tendering stage.

As mentioned in previous sections, a standardized detailed list of risks applicable to PPP projects

in Turkey is not in use at present. According to the Turkish Authorities consulted as part of this

study given the number of PPPs implemented in the country there is a

consolidated experience

of elaboration of contractual documentation

that enabled over the years the refinement and

improvement of the existing documents. PPP contracts regulate in detail the most relevant risks

associated with the development and implementation of PPPs. The following Table summarizes

the usual allocation of risks between the public and the private sector outlining the underlying

rationale.

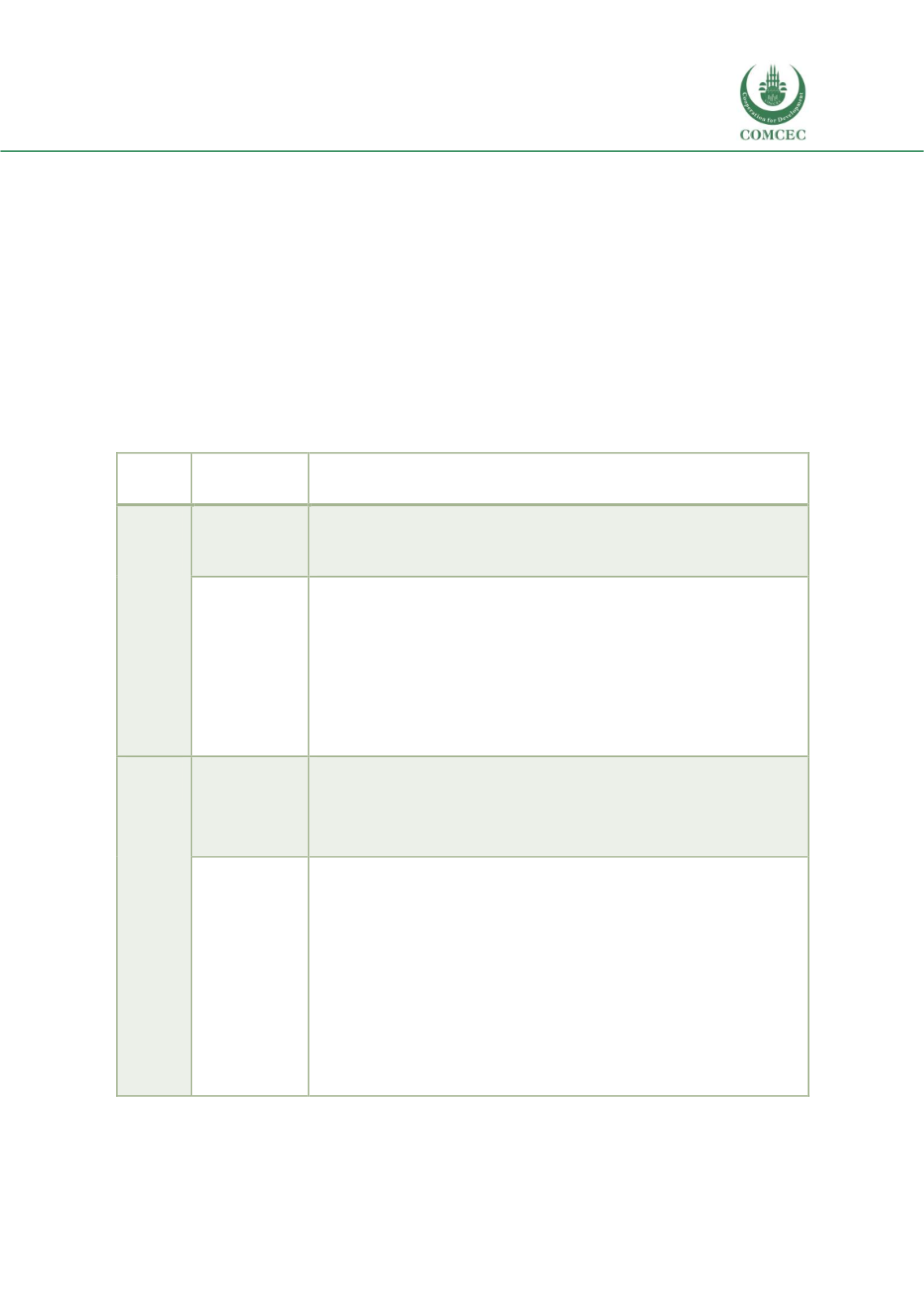

Table 40: Indicative risk matrix in transport PPPs in Turkey (by risk category)

Risk

type

Risk category

Usual allocation of risks (public/private/shared)

Context-

related

risks

Political and

legal risks

In general terms, the

public party

in Turkey bears responsibility for political

events outside the control of the private partner as well as for changes and

the regulatory and legislative system.

Macroeconomic

risks

Macroeconomic risks are

shared

. The public sector retains the risks

associated with the management of the liabilities and fiscal risks i.e. risks

stemming from demand guarantees. Inflation related risks impact on the

concession financial performance of the projects and are particularly

impacting on the private sector, both at the construction stage and operation

stage. Inflation risk is particularly relevant for those contracts regulated

according to the Turkish Lira. The use of the USD currency in the airport

projects partly mitigate the macroeconomic risks on PPPs, specified that

inflation risks still could negatively affect the demand.

Project

risks

Financial credit

risks

Financial credit risks are retained by the

private sector

, who is also

responsible for defining the project financing structure of the PPP initiative

and for timely reaching the financial close. Delays in reaching the financial

close and commercial close may result in early termination of the contract

unless these are attributable to the public sector.

Design,

construction

and operation

risks

Preliminary design and project technical specifications, as well as

Environmental Impact Assessment studies, are generally prepared by the

procuring authorities

, who thus retain the risks associated with these

elements. The public sector also retains the risks related to disruptive

technologies. i.e. those ITS and ICT solutions or special procedures and

protocols not in place at the time of the definition of the project design and

project construction, but required by international or national legislation, to

enhance and enforce security and safety of transport operations. Land

purchase and site risks are also generally borne by the public sector, specified

that the contractor is responsible to submit the applications and accomplish

the administrative procedures to develop and implement the project.

Construction and operation risks are borne by the private party.