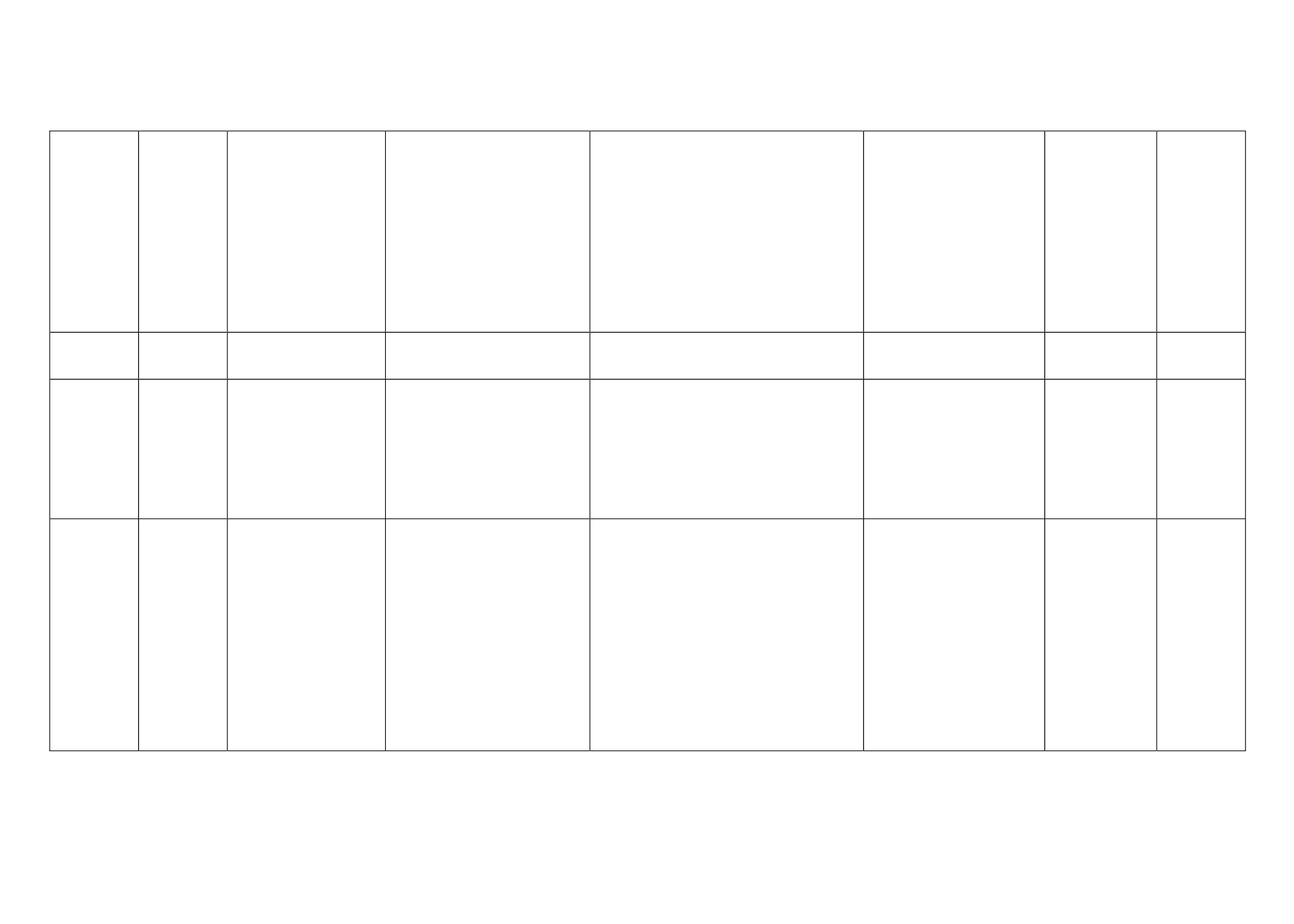

East

African

Commu-

nity (EAC)

07-Jul-

2000(G)

The tariff reduced gradually by

2% every year. At the in-

ception of the EAC Customs

Union, the highest rate was

10% duty on Kenyan goods im-

ported into Uganda. by Jan-

uary 2010, this had reduced to

0%.Tanzania’s offer to Kenya

at the inception of the EAC

Customs Union was a 6 band

tariff pegged at a high of 25%

and a low of 2%. By 2012, the

rates gradually reduced to 0%

Since coming into force of the Protocol,

goods to and from Uganda and the Tan-

zania have been duty free; and goods from

the Uganda and the Tanzania into the

Kenya have also been duty free. Category B

goods are eligible for gradual tariff reduc-

tion from maximum 25% (Tanzania) and

10% (Uganda) during the first year with a

phase out tariff reduction period of 5 years

for all products to 0%.

Goods from the Kenya into

the Uganda and the Tan-

zania categorized as Cate-

gory A are eligible for im-

mediate duty free treat-

ment

Burundi,

Kenya,

Rwanda,

the

United

Republic

of

Tanzania, and

the Republic of

Uganda

Yes

India

-

Malaysia

01-Jul-11

Comprehensive Eco-

nomic

Cooperation

Agreement (CECA)

India, Malaysia

Yes

Pakistan -

Malaysia

01-Jan-08

1st bilateral FTA be-

tween members of OIC

Normal Track: Tariff lines

placed by each Party in the

Normal Track respective base

rates reduced in accordance

with the schedule as shown

(pg2). Sensitive Track: Con-

sists of exclusion List. Tariff

lines placed by each Party in

the

Pakistan eliminate tariff on 43.2% of the

imports from Malaysia by 2012. On the

other hand Malaysia eliminate tariff on

78% of imports from Pakistan.

Pakistan,

Malaysia

Yes

Southern

Common

Market

(MERCO-

SUR)

29-Nov-

1991(G)

LAIA Reference:

AAP.CE N

◦

18. The

current

signatories

stated below are

"as notified by the

Parties".

However,

please note that the

Bolivarian Republic

of Venezuela is now a

Party of MERCOSUR.

Targeted the end of duty and

other non-tariff restrictions on

trading betweenArgentina and

Brazil by December 31, 1994,

and by December 31, 1995

for trade with Uruguay and

Paraguay. A programme of

gradual, linear and automatic

tariff reductions.

Products being adapted will be subject to

tariffs for domestic imports, and not in-

cluded in the free-trade zone, whose tariffs

are 0% for all member states. This adapta-

tion period will end in four years. (2)The

Brazil/Argentina exception lists contain

232 items; Paraguay, 253; and Uruguay,

212. The member nations can supplement

their national exception lists until April 30,

1995 (for Argentina, Brazil and Uruguay

the limit is 300, and for Paraguay, 399).

(3)With implementation of a CET (TEC),

it was initially possible to set a 0% TEC

for only 20% of the products, within the

flat 85% product tariff rate

Argentina,

Brazil,

Paraguay,

Uruguay,

Venezuela,

Bolivia

Yes