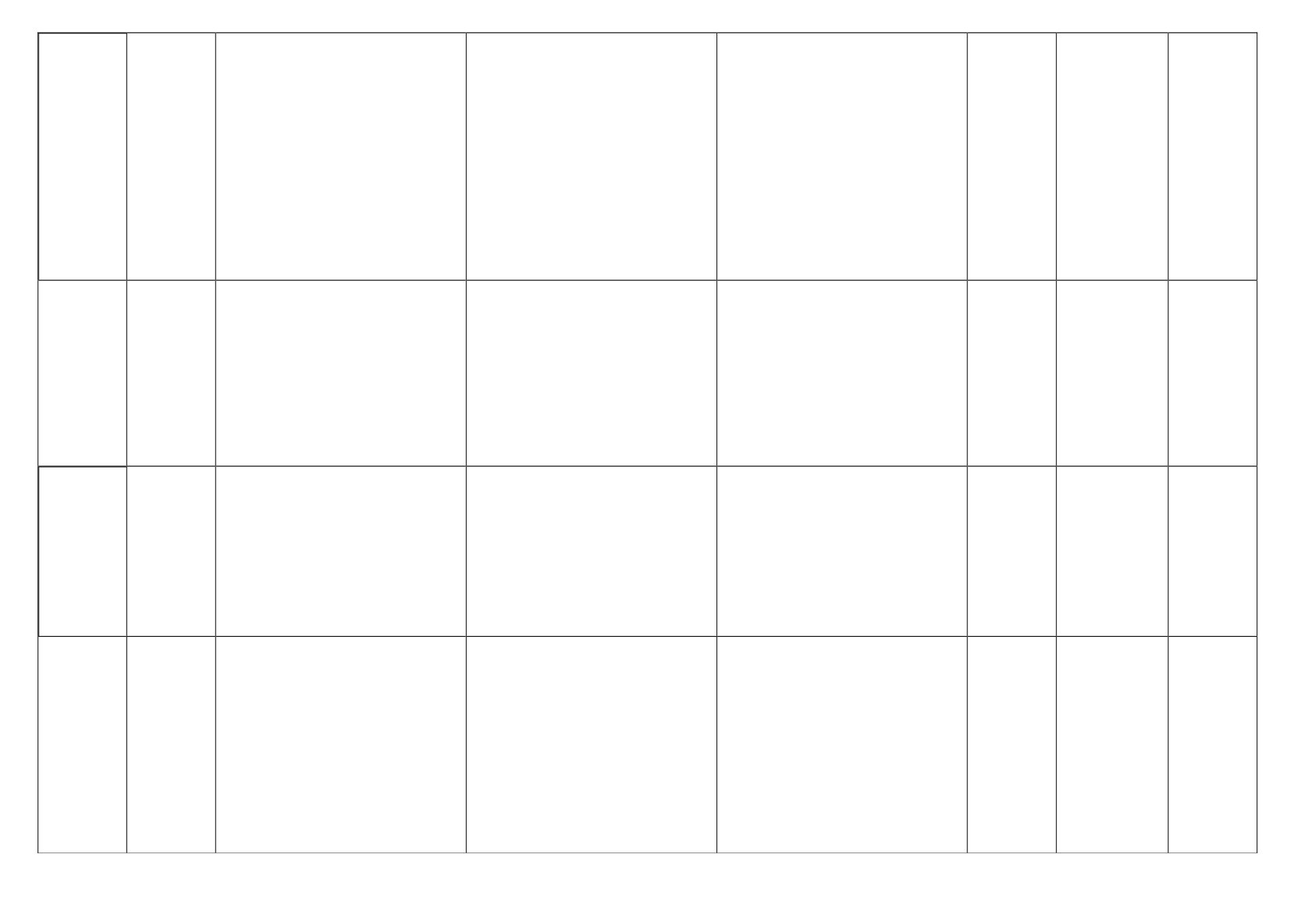

India - Sri

Lanka

15-Dec-01

Signed on 28.12.98. Un-

der this Agreement, both

countries are committed to

the elimination of tariffs in

a phased manner.

3-8 years

INDIA: Granted duty free access to all ex-

ports from Sri Lanka in respect of items

freely importable except on items listed in

Annex D of the Agreement. Upon entry

into force of the Agreement :- a). Zero duty

access for the items in Annexure

’

E

’

b).

50% margin of preference on the remain-

ing items except on items listed in Annex-

ure D. Concessions on items in Chapters 51

to 56, 58 to 60 and 63 shall be restricted to

25%. SRI LANKA: Tariff concessions on

exports from India to Sri Lanka: a). Zero

duty for the items in Annex ?F? ? I, upon

entering into force of the Agreement.

b).50% margin of preference for the items

in Annex ?F? ? II, upon coming into force

of the Agreement.

India, Sri

Lanka

No

Latin

American

Integration

Associatio

n (LAIA)

18-Mar-81

The current signatories

stated below are "as no-

tified by the Parties".

However, please note that

Panama is now a Party of

LAIA.

For each of the member countries, the Con-

solidated preferences given and received in

the agreements signed in the under the

Treaty of Montevideo 1980 (TM80).

Argentina,

Bolivia, Brasil,

Chile, Colom-

bia, Cuba,

Ecuador, Mex-

ico, Paraguay,

Panama, Peru,

Uruguay,

Venezuela

No

MERCOSU

R

- India

01-Jun-09

The aim of this Framework

Agreement was to create

conditions and

mechanisms for

negotiations in the first

stage, by granting recipro-

cal tariff preferences and in

the second stage, to nego-

tiate a free trade area be-

tween the two parties in

conformity with the rules

of the World Trade Orga-

nization.

The India-MERCOSUR PTA provides for

five Annexes. These five Annexes had been

finalized during six rounds of negotiations

in order to operationalise the PTA. These

have been signed between the two sides on

March 19, 2005.

Tariff concession on Indian products in

MERCOSUR contains 452 products: Tar-

iff concession on MERCOSUR

’

s products

in India contains 450 products. The ma-

jor products covered in Indian offer list are

meat and meat products, organic & in-

organic chemicals, dyes & pigments, raw

hides and skins, leather articles, wool, cot-

ton yarn, glass and glassware, articles of

iron and steel, machinery items, electrical

machinery and equipments, optical, pho-

tographic & cinematographic apparatus.

The major product groups covered in the

offer list of MERCOSUR are food prepa-

rations, organic chemicals, pharmaceuti-

cals, essential oils, plastics & articles, rub-

ber and rubber products, tools and imple-

ments, machinery items, electrical machin-

ery and equipments

Brazil,Ar-

gentina,

Uruguay

and

Paraguay,

India

No

Common

Market for

Eastern

and South-

ern Africa

(COMESA)

08-Dec-94

The current signatories stated be-

low are "as notified by the Parties".

However, please note that the real

membership is: Burundi; Comoros;

DR Congo; Djibouti; Egypt; Er-

itrea; Ethiopia; Kenya; Libyan Arab

Jamahiriya; Madagascar; Malawi;

Mauritius; Rwanda; Seychelles; Sudan;

Swaziland; Uganda; Zambia; Zim-

babwe.

The agreement provided that member

states shall reduce and ultimately elim-

inate by the year 2000, customs duties

and other charges of equivalent effect

imposed on or in connection with the

importation of goods which are eligible

for Common

The Member States agree to the grad-

ual establishment of a CET in respect

of all goods imported into the Mem-

ber States from third countries within

a period of ten years from the entry

into forc of this Treaty and in accor-

dance with a schedule to be adopted

by the Council.

None

Angola,

Bu-

rundi, Congo,

Eritrea,

Ethiopia,

Kenya, Mada-

gascar, Malawi,

Mauritius,

Namibia,

Rwanda, Sey-

chelles, Sudan,

Swaziland,

Tanzania,

Zambia, Zim-

babwe, Egypt,

Comoros, Dji-

bouti, Uganda

No

Ec nomic

and Mon-

et ry

Comm -

nity of

entral

Africa

(CEMAC)

24-Jun-99

Treaty Establishing the Economic

Community of Central African States

(ECCAS), Protocol Establishing the

Network of Parliamentarians of EC-

CAS (REPAC), Mutual Assistance

Pact Between Member States of EC-

CAS, Protocol Relating to the Estab-

lishment of a Mutual Security Pact in

Central Africa (COPAX)

The customs union still does not func-

tion efficiently. Trade within the re-

gion amounts to: Imports 2% of to-

tal imports; exports 1% of total ex-

ports. Absence of economic comple-

mentarity and administrative hurdles

continue to hinder the flow of goods,

services, and people in the sub-region.

Intra-regional trade still remains con-

siderably low at below 10%, even in

comparison to its West African coun-

terpart.

Cameroon,

Central Afrian

Rep, Chad,

Eq.

Guinea,

Gabon, Congo-

Republic of

No

Economic

Com-

munity

Egypt

-

Turkey

01-Mar-07

Products in List 1 on 1 January 2007, each

duty and charge shall be reduced to 25%

of the basic duty; on 1 January 2008, the

remaining duties shall be abolished.For the

produ ts listed in List 2 on 1 January 2008,

each duty and charge shall be reduced to

90% of the basic duty; on 1 January 2009,

reduced to 75%, on 1 January 2010, re-

duced to 60%. on 1 January 2011, each

duty and charge shall be reduced to 45%,

on 1 January 2012 reduced to 30%, on 1

January 2013 reduced to 15% of the ba-

sic duty; on 1 January 2014 the remaining

duties shall be abolished. List 3 and 4.

The two parties will establish a free trade

area between them over a transitional pe-

riod of no more than twelve years of FTA’s

date of entry into force, according to the

provisio s of the FTA and in li e with Ar-

ticle 24 of the GATT 1994 and other mul-

tilateral agreements for trade in go ds an-

nexed to the convention establishing the

WTO

Products

in List 1 on

the date of

entry into

force of this

Agreement,

each duty

and charge

shall

be

reduced to

50% of the

basic duty;

No

El Salvador

- Cuba

01-Aug-12

Partial Scope Agreement

(PSA) between El Salvador

and Cuba.

433 Salvador products will enter Cuba

with discounted import taxes. Within the

new tariff list, 71 percent of Salvadoran

products can now be imported into Cuba

without paying duties. Products included

in the agreement are poultry, seafood,

tropical fruit, oil seeds, fats and cooking

oil, chocolate, bread, juices, rum, vodka,

tobacco, cement, pharmaceuticals, hygiene

products, plastic products, and paper and

carton

No

India

-

Afghanistan

13-May-03

A Preferential Trade

Agreement was signed

between

India

and

Afghanistan on March

The Agreement remains in force till ei-

ther party gives to the other a notice

for the Agreement’s termination. By this

Agreement, preferential tariff is granted

India,

Afghanistan

No

of

West

Afric n

States

(ECOWAS)

24 Jul-93

objectives: (i) the removal of customs

duties for intra-ECOWAS trade and

taxes having equivalent effect, (ii) the

establishme t of a CET; (iii) the har-

monization of econom c and financial

policies; and (iv) th creation of a sin-

glemonetary zone.

Marginal Intra-regional trade

Benin; Burk-

ina

Faso;

Cape

Verde;

Côte d’Ivoire;

Guinea;

Guinea-Bissau;

Gambia, Niger;

Nigeria; Sene-

gal;

Ghana,

Liberia, Togo,

Sierra Leone

No

op-

eration

Org ni-

zation

(ECO)

17-Feb-92

The current signatories stated below

are " s notified by the Parties". How-

ever, please note that the real m m-

be ship is: Afghanistan; Azerbaijan;

Islamic Republic of Ir n; Kazakhstan;

Kyrgyz Republic; Pakistan; Tajik-

istan; Turkey; Turkmenistan; Uzbek-

istan.

Th positive list of goods sh ll be ex-

panded gradually on proportionate ba-

sis in 8 equal annual stages so as to

cover at least 80 percent of the goods

on lines. Each Contracting Party shall,

keeping in view the extent of tariff re-

duction required, notify a schedule f

concessions to all member states for

gradual and progressive reduction of

applied tariffs to bring the highest tar-

iff slab of each item to a maximum of

15 percent at the end of 8 years, but

reduction shall not be less than 10 er-

cent per annum of the existing tariff.

To reduce tariffs, within a maximum

period f 15 years for Afghanis an and

8 years for other Contracting Parties,

to a maximum of 15 percent as the

highest tariff slab. All goods being ac-

tual y traded among the Cont cting

Parties till th date of entry into force

of the Agreement shall co stitute the

positive list, exce t fo the g s re-

flected n the negative list n tified by

a Contracting Party. The applied tar-

iff schedule of the positive list shall be

notified by each Contracting P rty:

Afghanistan;

Azerbaijan;

Iran;

Kaza-

khstan; Kyrgyz

Republic; Pak-

istan;

Tajik-

istan; Turkey;

Turkmenistan;

Uzbekistan.

No