Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

36

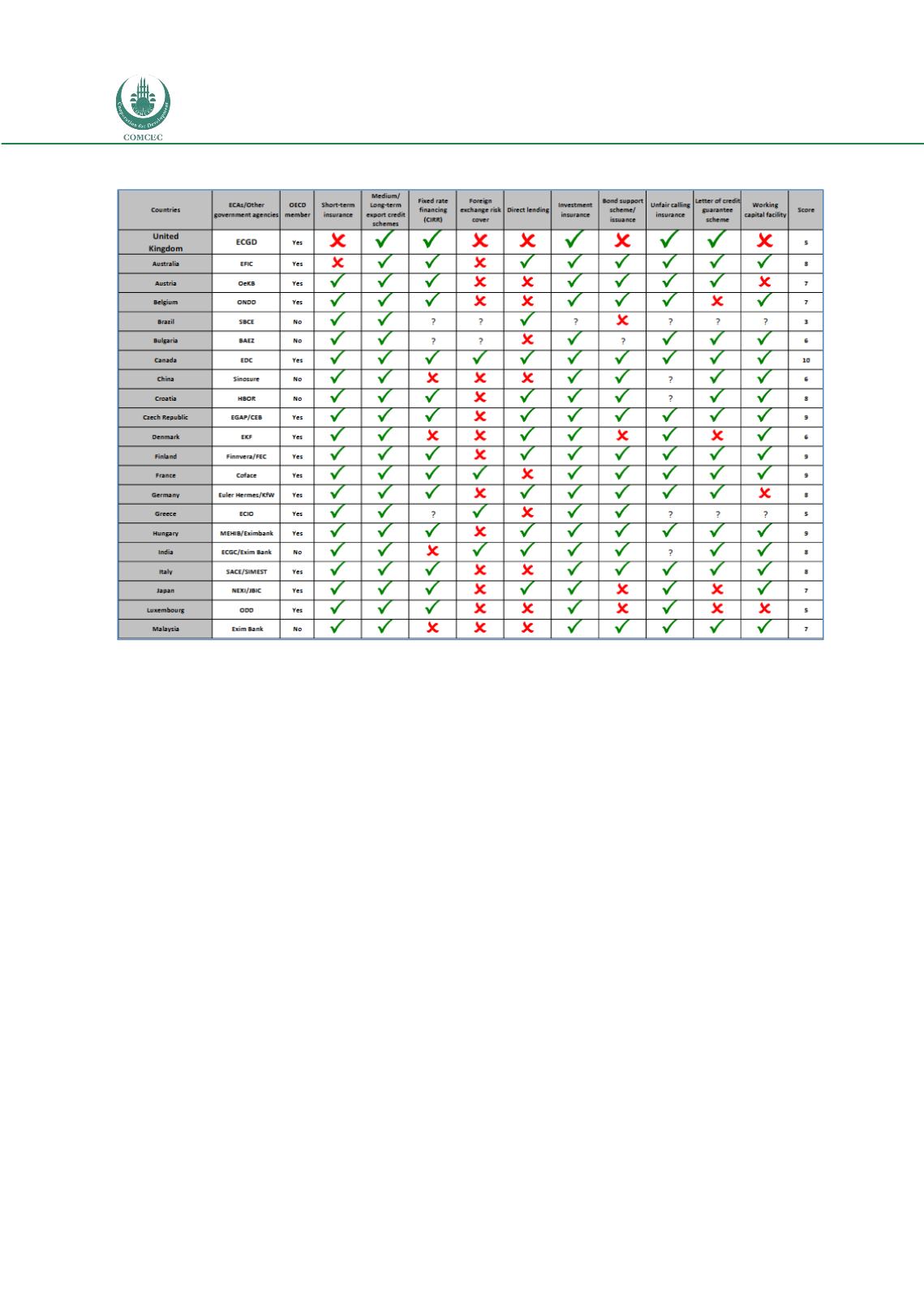

Figure 12: ECA Product and Services Comparison

Source: ECGD (UK Export Finance), 2010

Even an extract of a competitive landscape analysis, as above, illustrates the sometimes

significant differences in the product and solution offerings provided by various export credit

and export insurance agencies.

The breadth and variety of strategic priorities, mandates and product offerings among ECAs is

such that importers and exporters can benefit from the programs of ECAs that may not be

based in their home markets and may not be directly mandated to support those businesses’

objectives.

Importers and exporters seeking trade finance, or some form of risk mitigation associated with

a financing transaction, can look well beyond the offerings of their home country’s ECA and

may even find it useful to explore various ECAs, their mandates and their country or industry

sector level expertise, to determine which ECA might best be suited to provide solutions in

support of a particular transaction or trading relationship.

There is a wide range of product and solution options around export credit and export

insurance linked to ECAs, with many such institutions well-disposed to serving SME clients.

“Traditionally, the purpose of an ECA has been to directly support the financing of

domestic exports. However, for a variety of reasons, an increasing number of ECAs have

broadened the scope of their activity to include untied export credit support. In

addition, many export credit agencies have ramped up their investment insurance

programs. Although untied financing and insurance programs are not required to be