Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

38

While sources of trade finance remain concentrated on a global basis, it is evident that there is

increasing interest in the financing of international commerce, and that the sources of liquidity

and financing targeted at trade activity will increase in the medium term.

1.7. Importance and Common Challenges for SMEs in Accessing

Financing and Trade Finance

The critical role of small businesses creating economic value and in generating employment is

well-known among development practitioners and within international institutions, and has

gained increasing profile and priority in the political context, even as small businesses

continue to report challenges in accessing affordable and timely financing, including trade

finance.

Small and medium-sized enterprises, globally, face challenges in accessing timely and

affordable financing: a systemic reality that may be showing signs of favourable shift as a

direct result of the global crisis, the redesign of global trade flows and the increasing

realization of the importance of SMEs to economic growth and value creation.

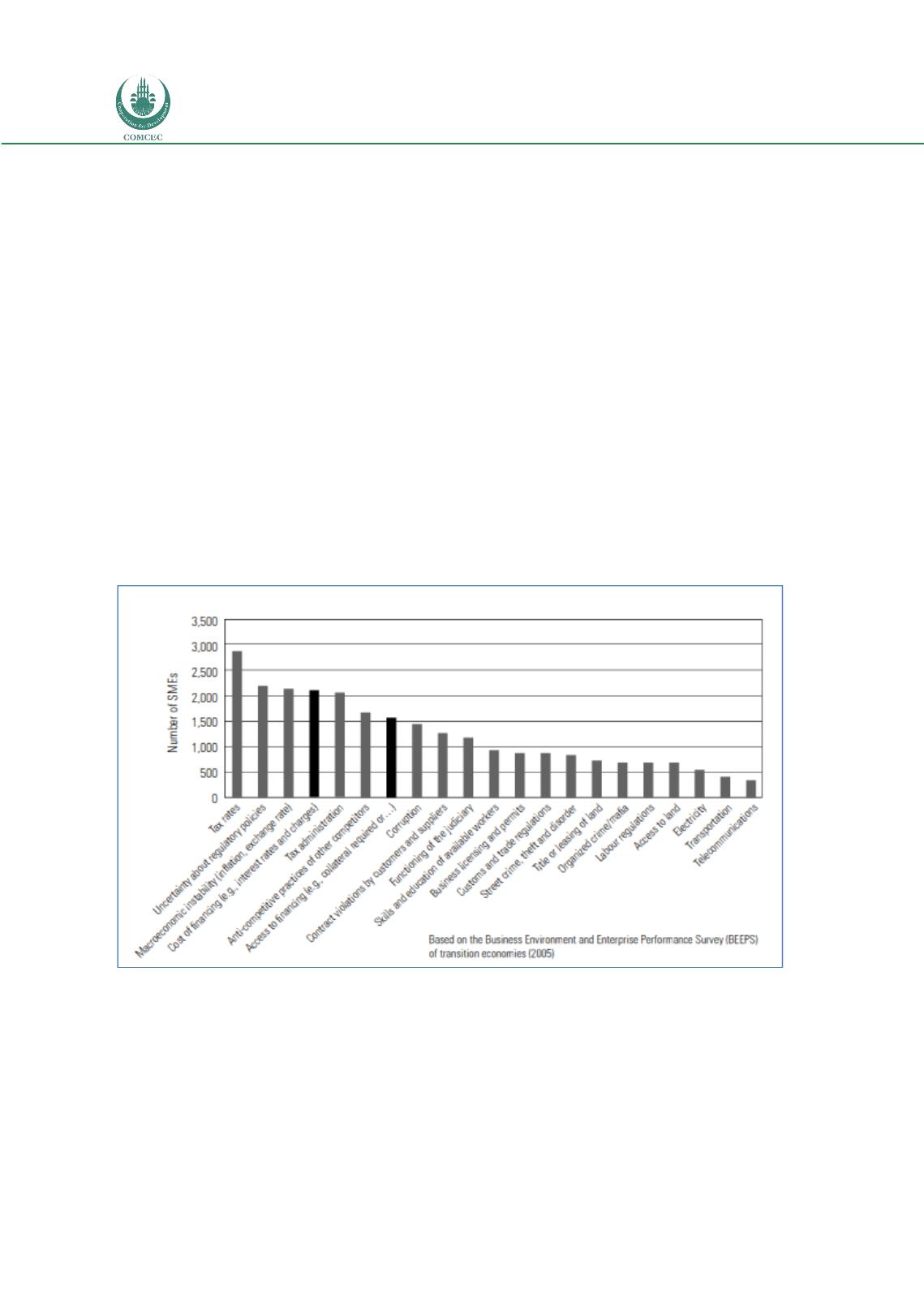

Figure 14: SME Obstacles to Growth

Source: How to Access Trade Finance, UN ITC, 2009

At the same time, SMEs, and particularly those in developing and emerging markets, continue

to report difficulty in accessing financing and consistently report that financing costs are high

relative to other customer segments. The graphic above illustrates that SMEs are concerned

about both the high cost of financing (fourth item from left) and inadequate access to financing

(sixth item from left). Limitations on access to finance are consistently identified as a

significant obstacle to growth and long-term sustainability of small businesses.