DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

37

tied to domestic procurement and exports, Market Window financing (at least from

EDC of Canada) is tied to domestic procurement and exports. Moreover, such programs

may often be priced on commercial terms even if the parameters of the financing may

be more attractive than standard OECD Arrangement terms (e.g., no 15% cash payment

requirement or tenor restrictions).”

Source: US Exim Bank ECA Competitiveness Report 2012

1.6.4. Hedge Funds, Platforms and Other Providers and Sources

Numerous other potential sources of trade and supply chain finance can be identified in the

global marketplace. Some are technology-based, platform type providers that offer a basis on

which trade financing and liquidity can be brought to the market by banks, or platforms where

importers and exporters can engage directly in the buying and selling of trade-related

receivables, thus accessing financing in non-traditional ways, and perhaps at competitive cost.

Several UK and US-based hedge funds demonstrated interest, particularly pre-crisis, in

providing liquidity in support of high-margin trade flows involving Africa, and there are efforts

underway to design and deploy various forms of capital pools in support of trade activity,

including around commodity trade.

It is worth noting that emerging models of e-commerce and electronic trade are paying more

attention to the need for and opportunity in providing financing. While such online

marketplaces initially focused on facilitating a transaction and enabling simple payment,

advanced approaches now consider various forms of financing, including the use of letters of

credit, and support for trade on open account terms, to be core elements of their overall value

proposition.

One example of such a model is China-based One Touch (APTFF, Beijing, 2013), which is an

affiliate of online marketplace Alibaba.com. This Chinese company has perceived a need to

complement its global trading platform with broader capabilities aimed at facilitating more

efficient conduct of trade, including the ability to provide trade financing support for

customers.

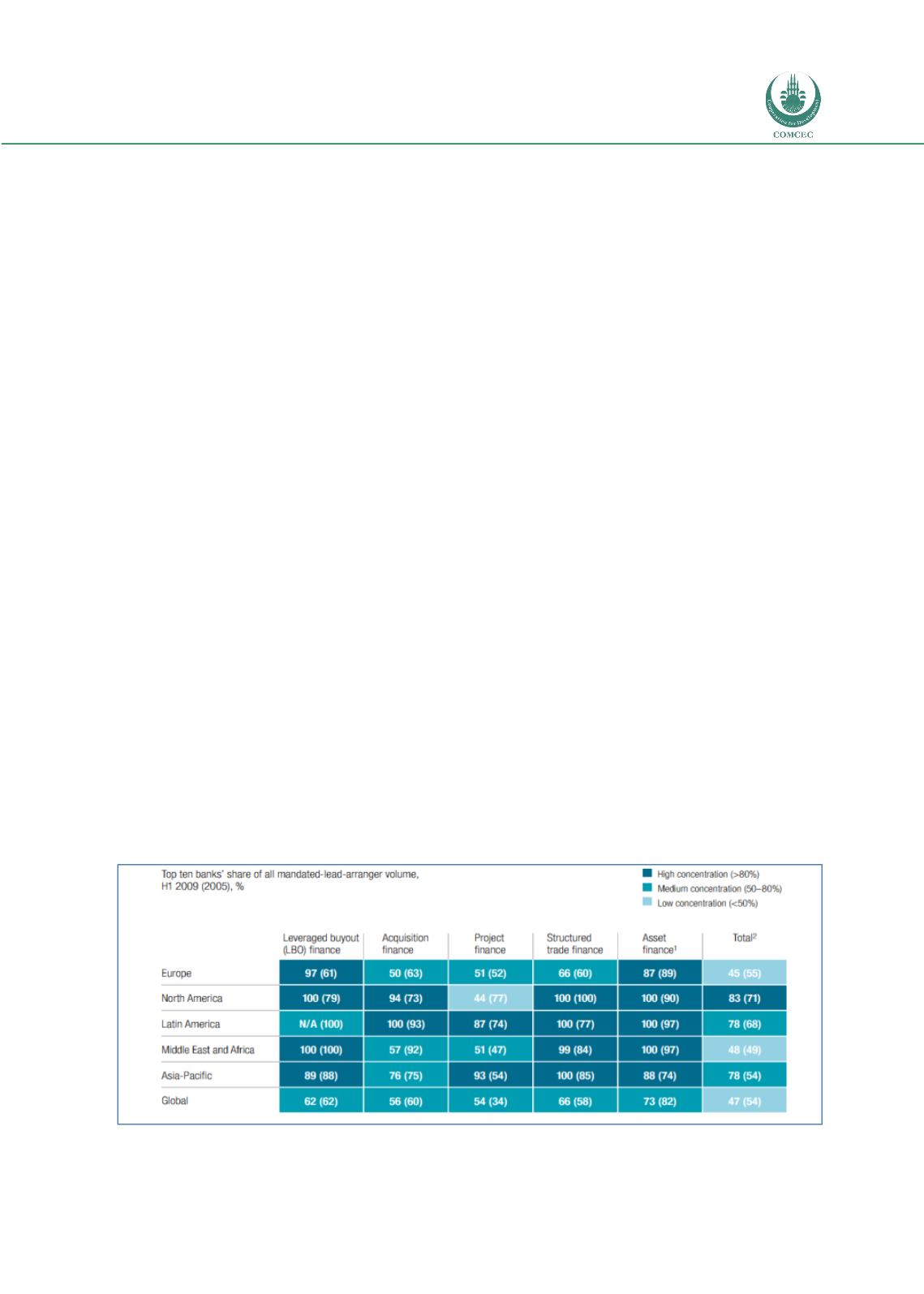

Figure 13: Global Concentration of Finance Activity

Source: Turning the Crisis to Advantage in Structured Finance, McKinsey 2010