Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

34

more closely linked dynamic between these two dimensions of international engagement

(Integrative Trade, EDC and Conference Board of Canada). The notion is that companies

engaged in export trade are now often also importers due to the need to sources inputs to

production, and that companies engaging in trade activity are increasingly likely to become

investors in the markets in which they trade. This view, referred to as “Integrative Trade” has

seen some exposure in academic circles as well as among practitioners.

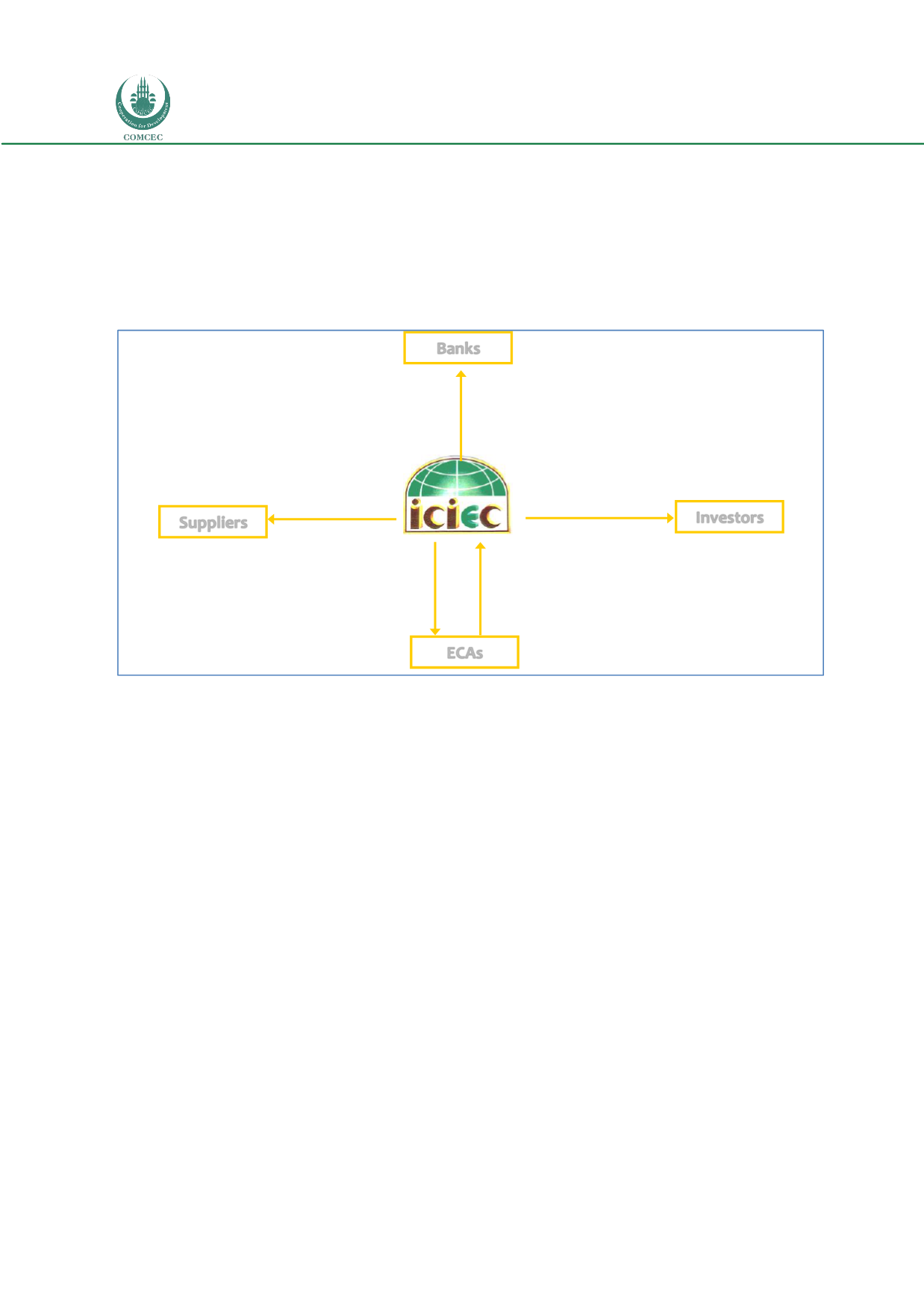

Figure 11: Trade Finance and Investment Insurance

Source: ICIEC 2013

The offerings of ICIEC are both comprehensive and strategically defined, and provide a clear

complement to the value proposition of the ITFC, while encompassing international activities

(trade and investment) that are both complementary and directly linked to the broader

objectives of OIC Member States.

The differentiated focus of ICIEC on Shari’ah compliant products and solutions is notable

however, it is also clear that the ICIEC is actively working to develop partnerships, alliances

and collaborations with selected partners, including Canada’s EDC.

b.

Export Credit Agencies (ECAs)

In addition to the critical contributions of international financial institutions, particularly in

the context of ongoing crisis and economic challenge, the role of export credit and insurance

agencies has also been shown to be of critical importance in responding to the trade financing

needs of companies of all sizes.

Export credit agencies (ECA) were originally public sector entities mandated to enable

economic recovery through support for export trade. ECAs provided financing and various

forms of guarantees, insurance and other forms of risk mitigation, linked directly to the export

aspirations of their sponsoring national governments.

Banks

Investors

ECAs

Suppliers

Credit

Insurance

Political Risk

Insurance

Trade Credit

Insurance

Reinsurance

Foreign Investment Insurance :

•

Equity Investments

•

Non Equity Investments

Inward Reinsurance :

•

Quota Share Treaty

•

Facultative Reinsurance

•

Excess of Loss Treaty

Trade Finance and Investment Insurance

•

Bank Master Policy

•

Documentary Credit Policy

•

Loss Payee Assignment for CSTP/STP

•

PRI for Financing Facilities

•

Non-Honoring of Sovereign Financial Obligations