DRAFT

Improving the SMEs Access to Trade Finance

in the OIC Member States

31

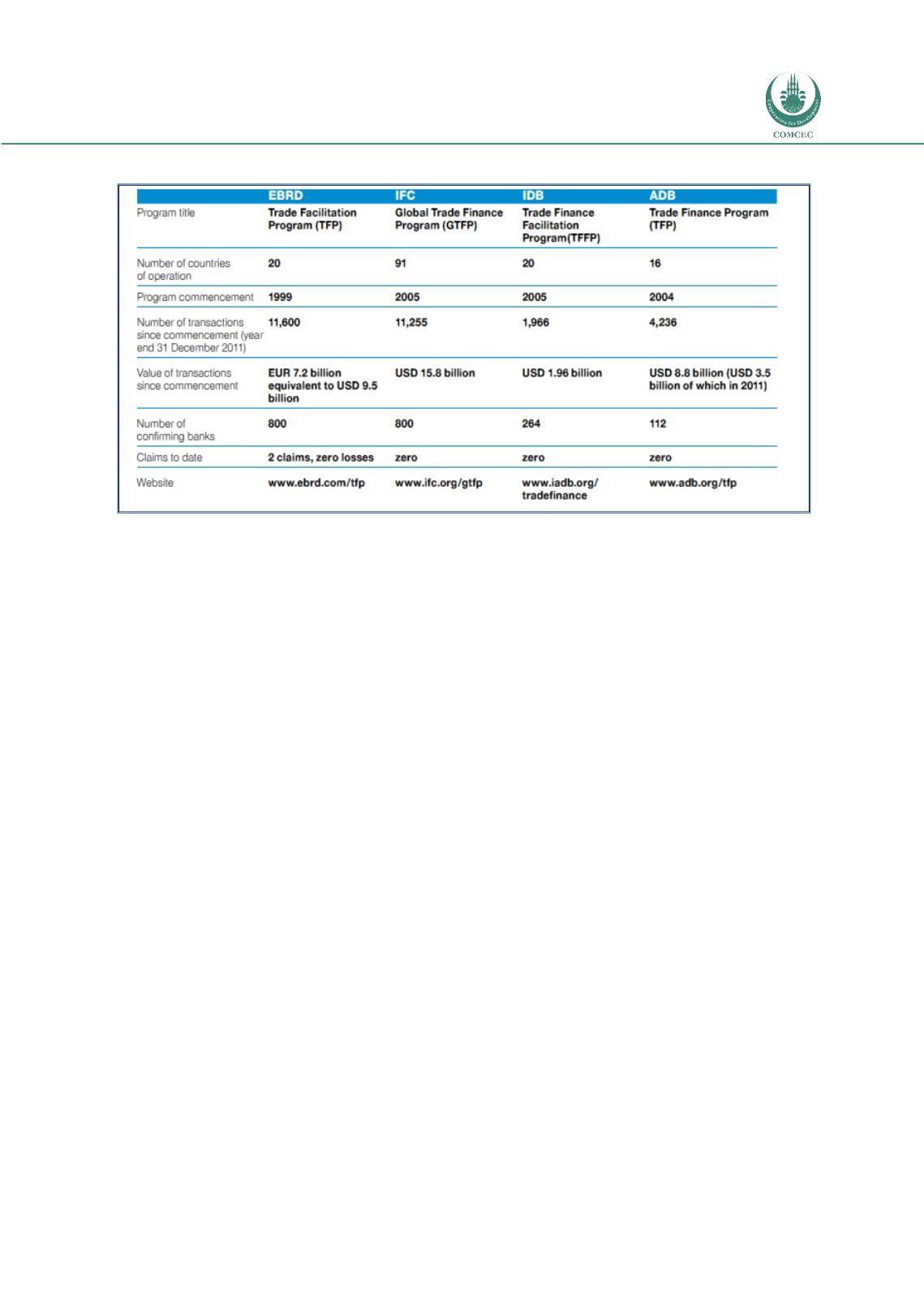

Figure 9: IFI Trade Finance Programs

Source: ICC Rethinking Trade and Finance

The role of such programs and organizations and the fundamental importance of their

contributions to the facilitation of trade, and the support of developing economies was brought

sharply and clearly into focus at the peak of the global crisis. The lack of liquidity in global

markets directly impacted availability of trade finance, and resulted in a precipitous drop in

trade flows from Asia to Europe and the Americas, and the lack of trade-focused liquidity was

deemed sufficiently serious for the World Bank’s International Finance Corporation to be

mandated by the G20 and the WTO to manage the injection of $250 billion in new capital into

global trade finance markets.

The IFC Global Trade Finance Program is comprehensive in nature, including both traditional

and emerging supply chain finance solutions, as well as solutions targeted to meet the needs of

specific types of trade flow, deemed strategic from a development perspective. The scope of

the program, from a solutions perspective, and from the perspective of supporting technical

assistance and advisory capabilities, is notable.