Improving the SMEs Access to Trade Finance

DRAFT

in the OIC Member States

26

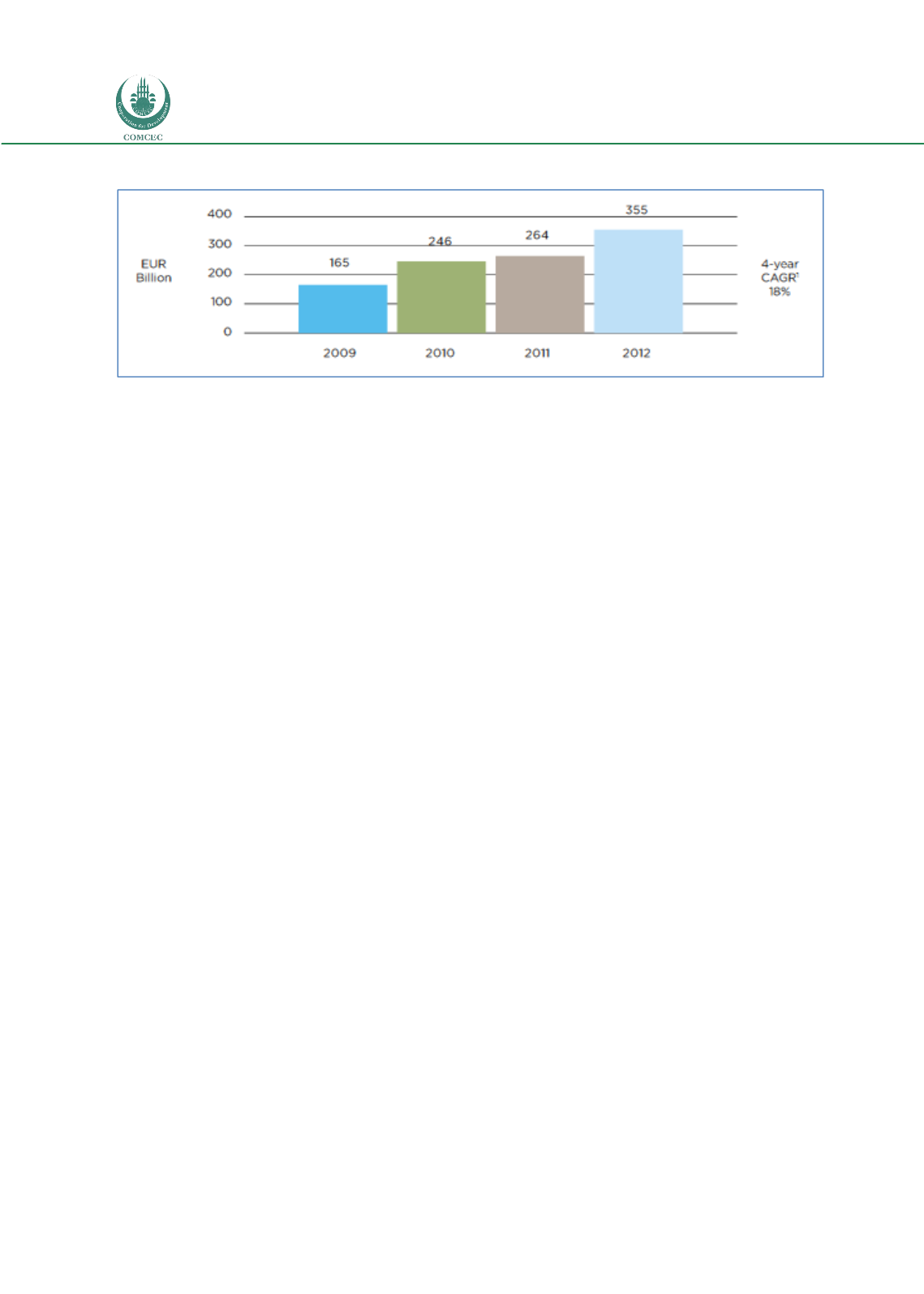

Figure 8: Growth of International Factoring Volumes

Source: Factors’ Chain International/ICC, 2013

With global factoring volumes approaching €1 trillion, about a third of this activity relates to

cross-border factoring, as shown below in an illustration of total international cross-border

factoring volumes from 2009 to 2012.

The Export Credit Guarantee Company of Egypt (ECGE) includes both international and

domestic factoring among its service offerings. On the international front, ECGE leverages its

membership in Factors Chain International to provide both import and export factoring

services:

1 - Export Factoring:

ECGE provides export factoring service which is a package of financial services

including finance, protection and collection through the purchase of export sales

invoices without recourse.

2- Import Factoring:

ECGE offers “Import Factoring” service including issuing guarantees on Egyptian

importers to the export factor, in order to facilitate importation from foreign suppliers

through open account transactions without cash collateral or bank guarantees.

Source: Export Credit Guarantee Company of Egypt, 2013

Even emerging solutions in the trade finance space are being acknowledged as important to

the conduct of global trade. Supply chain finance, through programs aimed at granting access

to finance for SME suppliers on the back of the borrowing capacity of large buyers, is

enhancing the overall health and viability of key international supply chains, arguably reducing

the overall cost of financing and enhancing the ability of buyers to manage strategic suppliers.

“…the credit differential among investment grade buyers and their SME suppliers is

wide enough in the current funding market to make the credit arbitrage of reverse

factoring an attractive way to improve liquidity for both buyers and suppliers. For

example, SCF programs allow buyers to extend payment terms from 60 to 120 days

while providing suppliers access to better financing rates (e.g., 120 days at 100 bps

instead of 60 days at 500 bps). According to industry sources, SCF could unlock $100