Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

20

unexpected outcomes. Nevertheless, this option allows for a high degree of control and

ownership and secures an immediate access to the local market.

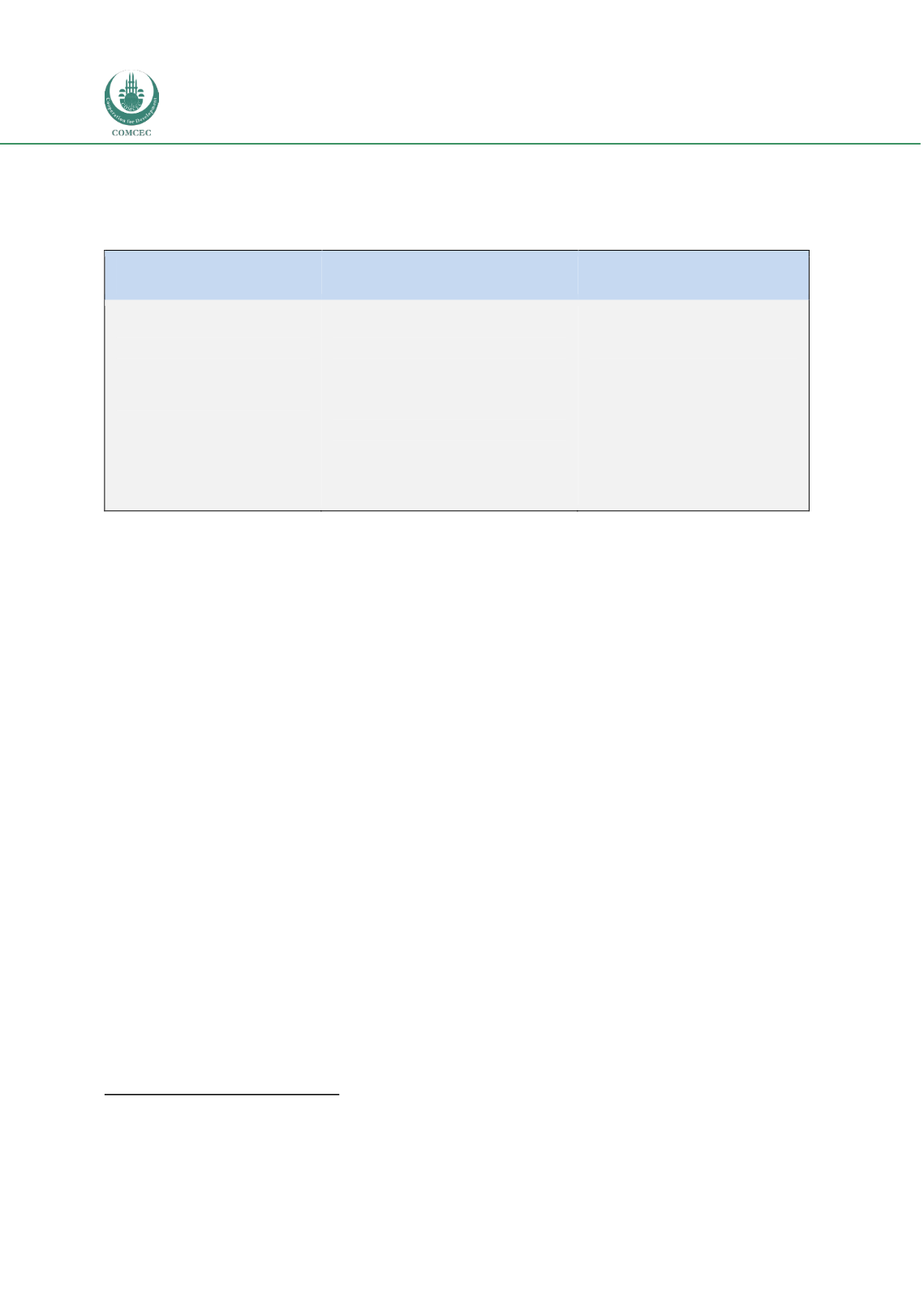

Table 7: Advantages and Disadvantages of Greenfield FDI as FDI Mode

Mode (including definition)

Advantages

Disadvantages

Greenfield FDI:

To establish from scratch an

operation entirely, in a foreign

country

•

Full ownership and control

•

Strong signal to customers

and other stakeholders

•

Incentive potential

•

Circumvent duties and

customers

•

Significant investment

costs

•

Requires time,

resources and

knowledge about local

market

•

Management control

foreign operations

Source: ICA, 2012

If there are significant location advantages in accessing less expensive input factors, such as

labour, raw materials supply, energy, etc. with a high level of proprietary knowledge in

production processes, greenfield FDI may be the preferred mode of entry. There are also

regulatory constraints that paradoxically stimulate FDI, as shown in table 7. Asian textile

companies invested in Africa to circumvent quotas whereas Daimler invested in Russia to avoid

high import duties to serve the Russian market.

2.2

Four Key Drivers of FDI

Given the risks and difficulties in FDI strategies, there are four main drivers why firms

undertake FDI? Based on Behrman

24

(1972), Dunning argued that FDI is

motivated

by four

drivers, either separately or in combination

25

. The categorisation set out below is generally

accepted as the most comprehensive framework capturing all the motives to undertake FDI:

(Natural) resource seeking (supply oriented);

Market seeking (import or export substituting);

Efficiency seeking (rationalized investment);

Strategic asset seeking (supply oriented).

In this context, the study refers to Multinational Enterprises (MNEs) because these types of

firms operate across borders and typically serve multiple foreign markets.

24

Behrman, Jere R., 1972.

25

The explanation of the four motives of international production draws heavily upon Dunning (1993, p. 56-62).