Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

19

Source: ICA, 2013.

Finally, at the top end of the spectrum, a foreign direct investment either through

an acquisition or greenfield investment can be used to strengthen the foreign market position.

This is a strategic company decision, requiring substantial investments and a dedicated long-

term involvement. The advantages are full ownership and control, a strong signal to customers

and other stakeholders, circumvention of duties and other barriers, and possible incentive

benefits.

An acquisition shortens the time cycle and the company can benefit from existing sales channels

and organizational capabilities (see table 6). But cultural risks and difficulties in managing

change can lead to frustrated processes and hidden costs.

Table 6 Advantages and Disadvantages of Cross-Border Merger & Acquisition as FDI Mode

Mode (including

definition)

Advantages

Disadvantages

Cross-border M&A

To establish a wholly

owned affiliate by acquiring

(or merging with) an

existing firm in a foreign

market

•

Quick access to the

market

•

Benefit from existing

clients and sales

channels

•

Difficult to find the

right target

•

Possible

governmental

intervention /

politics

•

Management

challenge – high risk

of conflicts

Source: ICA, 2012.

Contrary to greenfield FDI, this type of entry mode is preferred when time is of the essence.

However finding the right acquisition partner requires an in-depth due diligence, with sometime

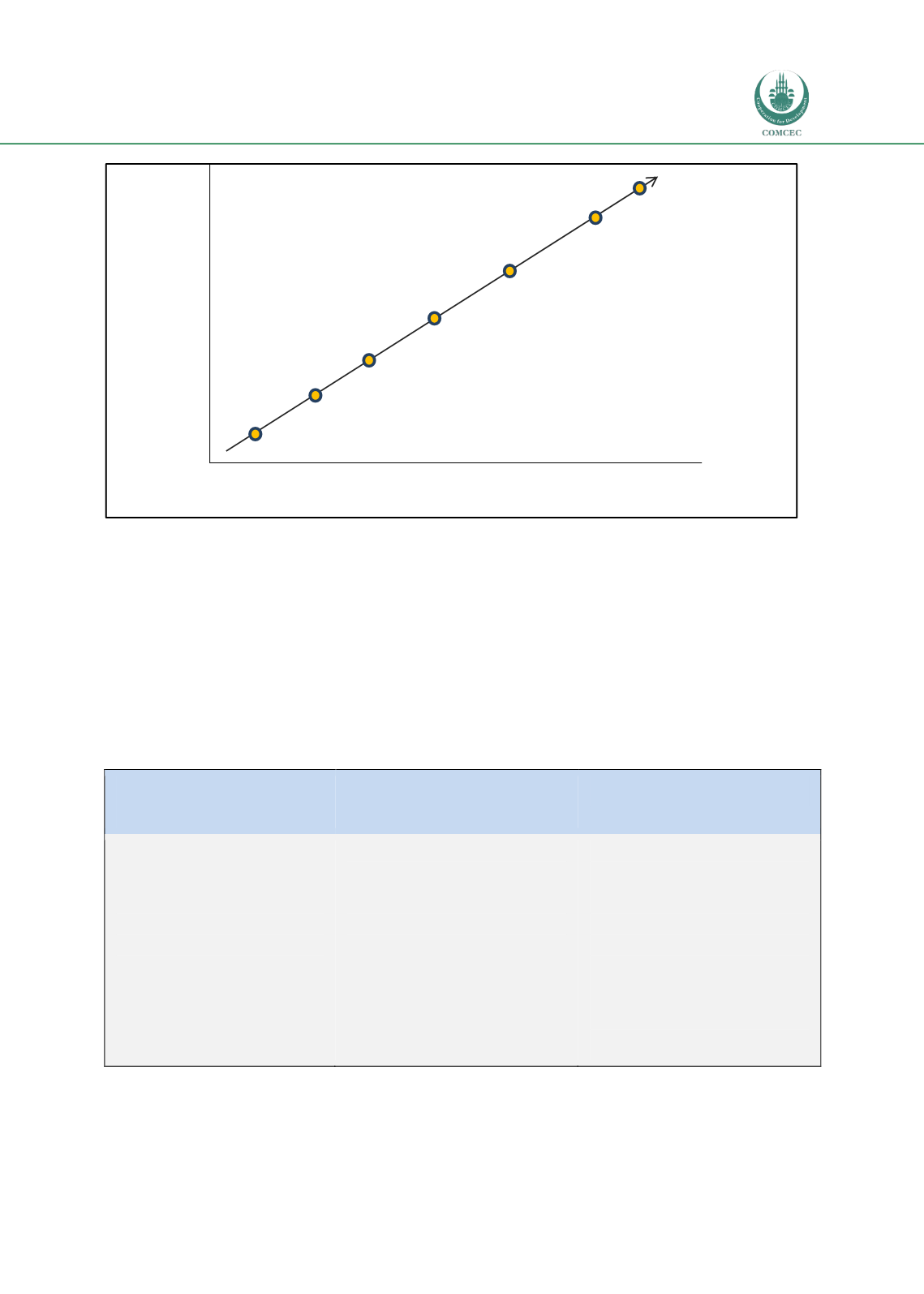

Representation office

Export and sales agents

Depth of

involvement

in foreign

markets

Investment

volume

Licensing / franchising

Export

Cross border M&A

JV / Contract Manufacturing

Greenfield FDI

High

Low

Low

High