Increasing Agricultural Productivity:

Encouraging Foreign Direct Investments in the COMCEC Region

25

administrative assistance. Fiscal incentives in contrast to, for instance, grants (like in the EU),

are often used in emerging and frontier economies as limited funds are available for up front

financial incentives. Where fiscal incentives are used to attract FDI in for instance

OECD

(Organisation for Economic Cooperation and Development) countries they are often rule based

since changes in taxation in most cases require legislative action.

39

Any well-developed incentive policy should be structured and evaluated through in three

different categories:

Structure and targets

: including intended sectors and investors, transparency, time

frame and year of establishment;

Eligibility and benefits

: dealing with the application procedure and processes and the

actual content of the incentive framework (i.e. benefits and payments); and

Monitoring and evaluation

: relating to monitoring and measuring the beneficiaries’

performances and the use of clawback mechanisms.

2.4

Importance of FDI in Agricultural Sector for Host Economies

Before analysing the effect of FDI in the agricultural sector, it is first necessary to examine the

overall inward FDI flows to the COMCEC Member Countries. One obvious trend is that FDI flows

increased from almost US$ 37 billion in 2003 to US$ 173 billion in 2008 after which it dropped

rapidly over the 2009-2011 period and increased slightly again over 2012 to US$139 billion (see

table 8).

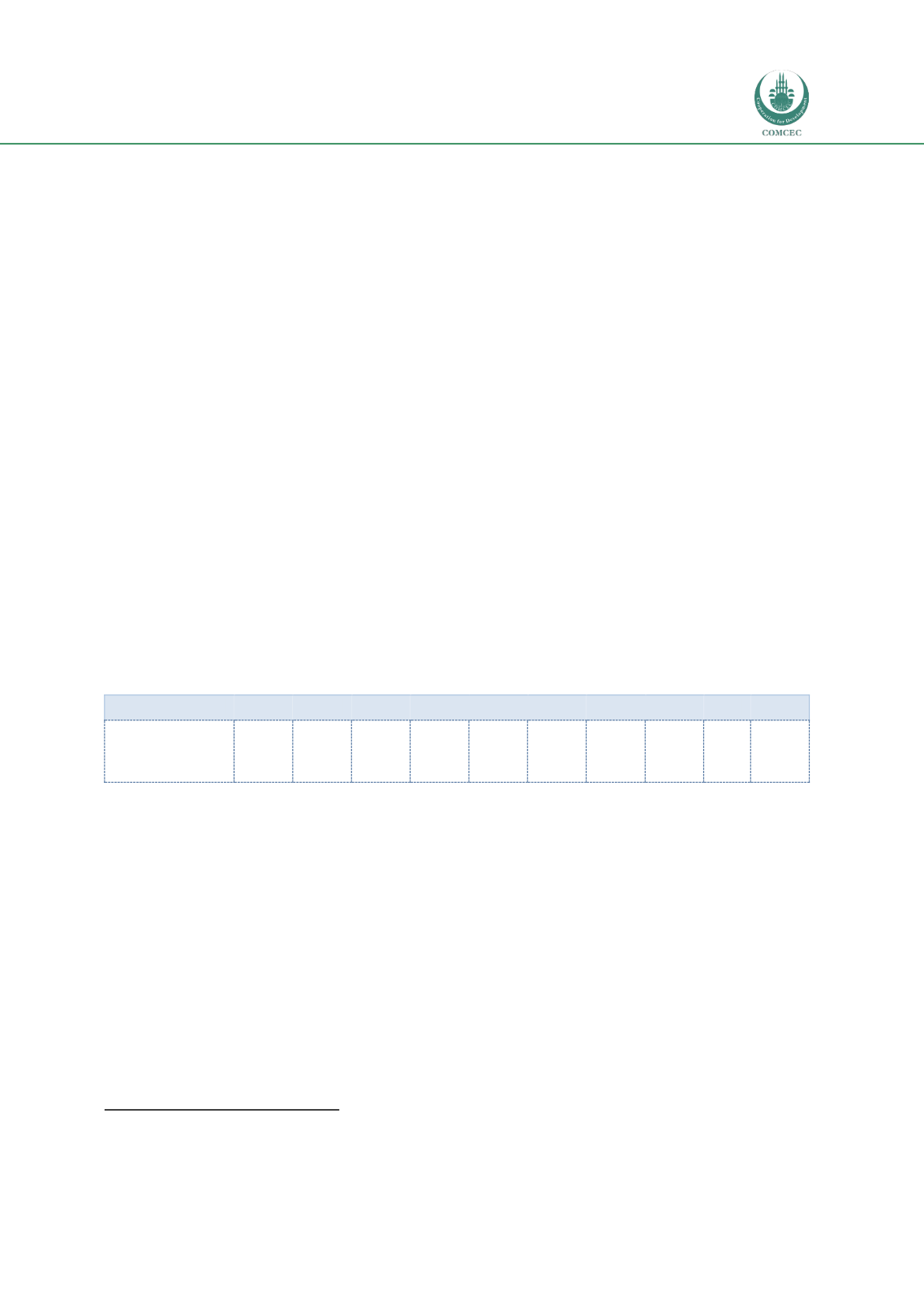

Table 8: Inward FDI Flows for the COMCEC Member Countries

Inward FDI Flows

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

US Dollars at

current prices and

current exchange

rates in billion

36,9

52,8

88,4

124,5

147,0

173,8

138,7

136,4

138,2

139,4

Source: UNCTAD, 2013.

As a percentage of world totals the COMCEC Member Countries together are responsible for just

over 10 percent of inward FDI flows. However, as a share of GDP the percentage is lower

approximately 2 percent, which is presented in Figure 9.

39

OECD, 2003.