Reviewing Agricultural Trade Policies

To Promote Intra-OIC Agricultural Trade

21

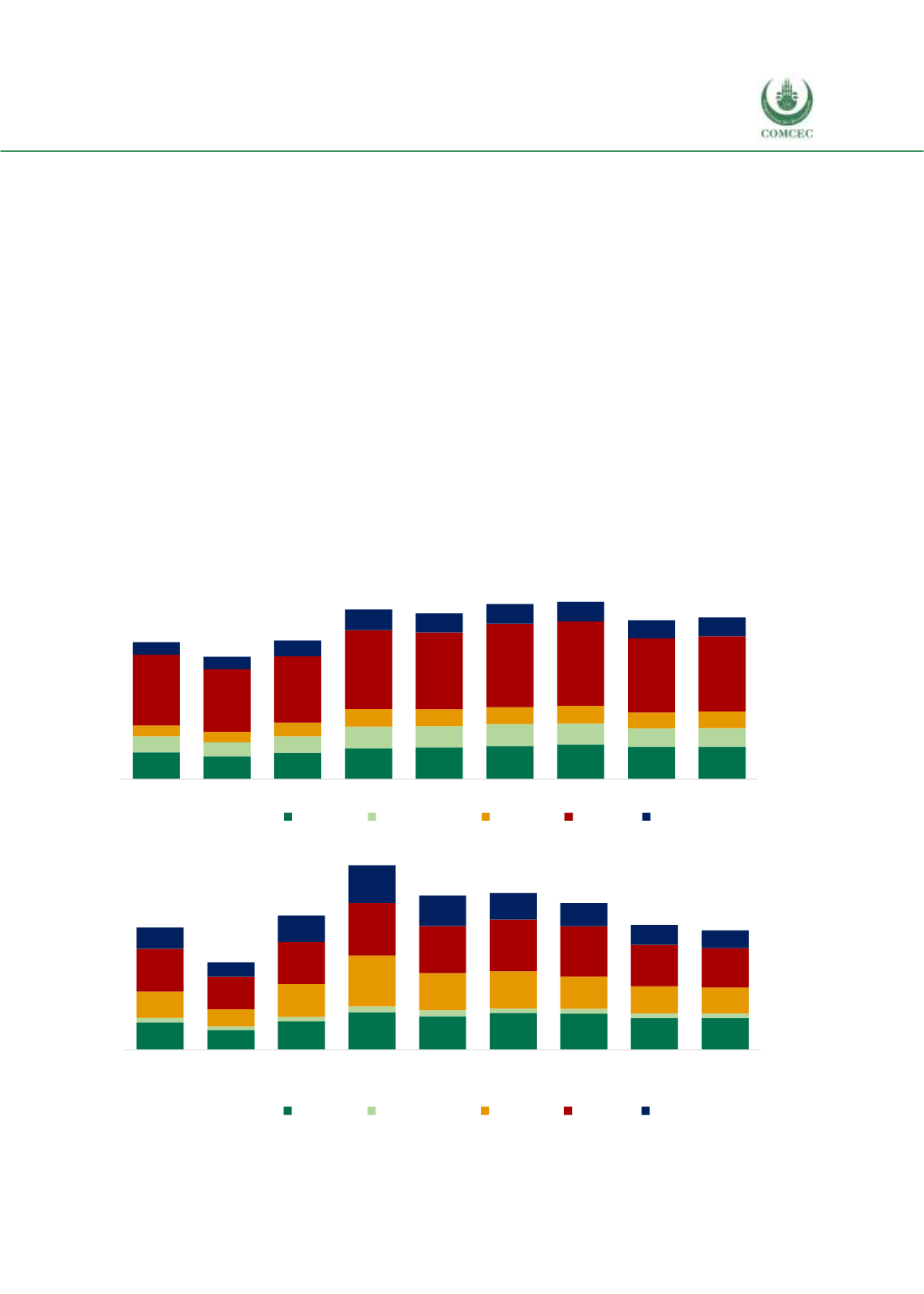

Since agricultural food products are more value-added than the agricultural raw materials, all

agricultural countries aim to increase their exports of the former category while decreasing the

latter. This trend can be observed on the agricultural rawmaterials exports for all the compared

groups except NAFTA and the Rest of the World (second graph of Figure 2. 4). However, for this

last group of countries there is a very rapid decrease since 2011, showing a clear decisiveness

of policy change in those countries towards more value-added agricultural exports. The group

whose reduction has been the most rapid in this category is OIC with 2.2% annual decrease in

the exports of the agricultural raw materials during the period. However, the highest export

volume of agricultural raw material was still realized by the Rest of the World in 2016, despite

the negative trend mentioned above.

Trading blocs have a tendency to leave the raw material exports to the Rest of the World while

continuing increasingly to export processed and higher value added agricultural food products.

A similar tendency is visible for Fish products. The leading group is the Rest of the World and

has increased its exports to reach 118 billion USD in 2011, while the latest figure available in

2016 is almost halved, down to 63 billion USD compared to a steady increase by the EU-28. Table

2.1 shows that average annual growth rate of exports from the Rest of the World in low value-

added agricultural rawmaterials has been 15.04%, while it diminished for the rest of the trading

blocs other than NAFTA.

Figure 2. 4 Agricultural Exports by Major Trading Blocs, Billion USD, 2008-2016

165

141

161

190

196

204

215

199

200

100

87

104

133

131

137

129

116

115

66

66

84

110

106

103

110

98

102

440

387

411

490

476

519

524

459

469

77

79

98

126

120

122

121

113

116

2008

2009

2010

2011

2012

2013

2014

2015

2016

Agri-food Products

NAFTA MERCOSUR ASEAN EU-28 OIC

22

16

23

31

27

30

30

26

26

4

3

4

5

5

4

4

4

4

22

14

27

42

31

31

27

22

21

35

27

35

43

39

42

41

34

32

18

12

22

31

25

22

19

16

15

2008

2009

2010

2011

2012

2013

2014

2015

2016

Agricultural Raw Materials

NAFTA MERCOSUR ASEAN EU-28 OIC