Analysis of Agri-Food Trade Structures

To Promote Agri-Food Trade Networks

In the Islamic Countries

32

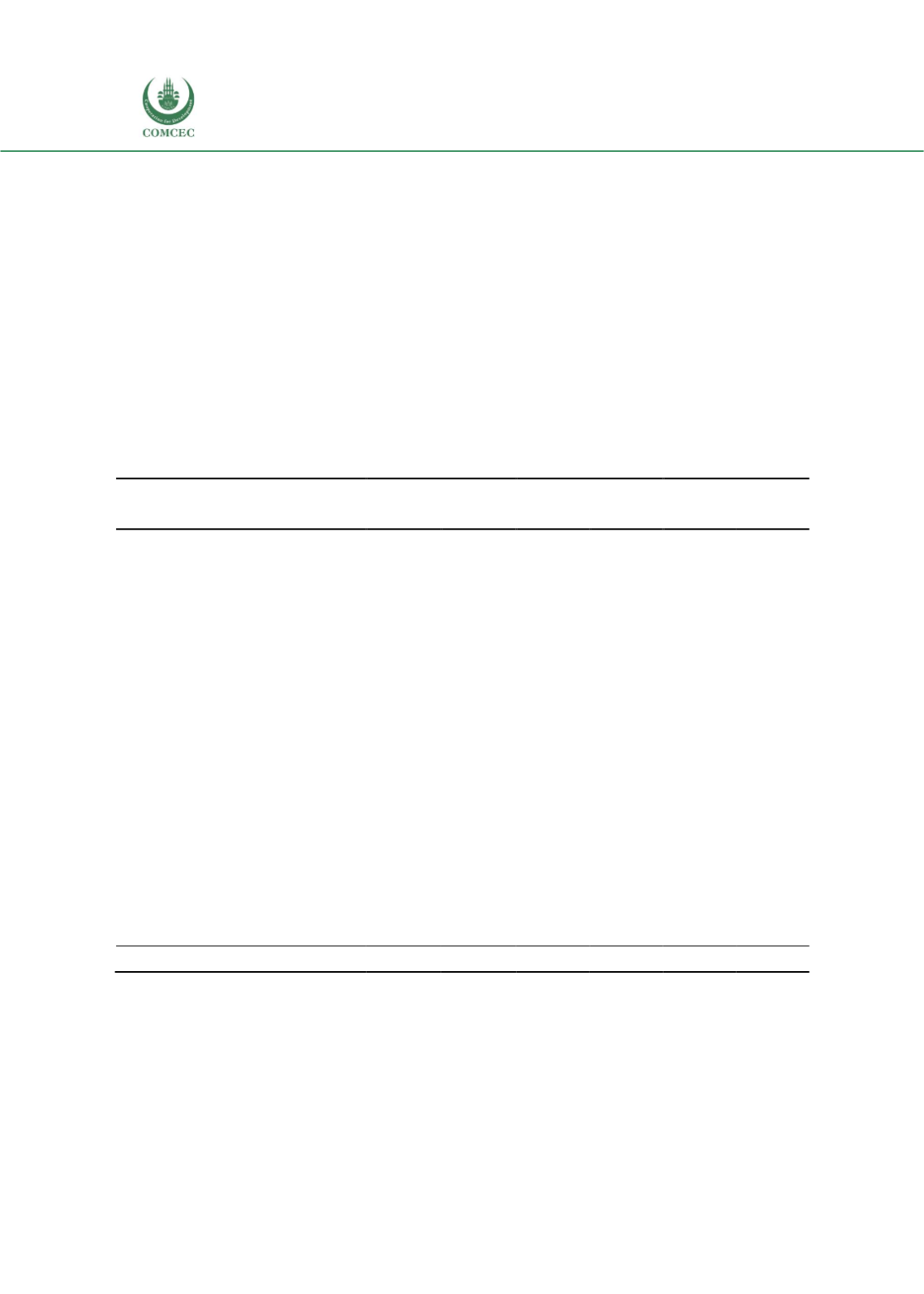

Table 6 shows results for the three OIC regional groups. Moving from left to right, the table

shows that the African Group has seen an overall increase in export diversification within the

agricultural products sector, as the percentage of total exports accounted for by the leading

products has fallen significantly over the last decade. The other two groups, by contrast, have

seen their export bundles become slightly less diversified. However, it started from a very high

level, so it is still appropriate to characterize the group’s export basket as highly concentrated.

The Asian Group has also diversified its export bundle slightly over the last decade, whereas the

Arab Group’s exports have become slightly more concentrated. In all three groups, there are

individual products that account for large amounts of total exports: cotton (15%) and cocoa

(16%) in the case of Africa, vegetables and fruits and nuts (12% in the case of the Arab Group,

and palm oil (29%) for the Asian Group. The implication of this finding is that changes in the

world market prices of a small number of commodities can potentially have large impacts on the

export earnings of countries in all three groups, although the extent of this effect varies

depending on the proportion of agricultural exports in total exports, which is highest for Africa.

Table 6:

Leading Products, Percent of Total Agricultural Exports, by OIC Regional Group, 2005 and 2016

African Group

Arab Group

Asian Group

2005

2016

2005

2016

2005

2016

Live animals

1.72

3.22

3.26

1.63

0.75

0.34

Tobacco

2.45

6.83

2.36

4.49

3.20

3.11

Oil seeds

0.89

5.55

0.90

0.30

0.36

0.89

Crude rubber

3.67

1.19

0.11

0.20

10.77

6.21

Cork and wood

14.04

6.71

0.42

0.24

5.63

3.20

Rice

0.61

2.55

3.18

0.26

3.02

2.44

Vegetables

1.25

2.43

10.33

11.89

2.68

2.04

Fruit and nuts

5.25

5.54

9.78

11.85

11.04

6.86

Coffee

4.94

5.87

0.41

0.48

1.55

2.30

Other edible products

1.35

3.20

2.04

4.85

1.99

3.84

Cotton

15.00

15.00

3.90

0.46

1.36

0.59

Bread products

0.16

0.19

1.94

3.36

1.51

2.59

Palm oil

1.24

2.32

0.50

0.70

20.55

28.64

Fish and crustaceans

7.34

6.58

12.34

10.12

7.44

5.65

Cocoa and chocolate

32.15

15.92

1.51

1.97

3.68

3.83

Rest of 06

0.39

0.40

4.55

7.24

0.75

0.76

Rest of 04

0.57

0.96

0.42

0.45

2.43

3.45

Total (Leading Products)

93.01

84.44

57.96

60.48

78.71

76.75

Source: Authors’ calculations based on UN Comtrade Data.

Patterns of recent export growth at the product level are quite different across the three regional

groups. In the African Group, the fastest growing export product was oil seeds (18.3% per

annum), followed by rice (14.1% per annum) and tobacco (9.9% per annum). For the Arab

Group, export growth was most rapid for other edible products (16.1% per annum), followed by

tobacco (13.8% per annum), and bread and similar products (12.8% per annum). Finally, for the

Asian Group, the three fastest growing export products were oil seeds (16.0%per annum), other

edible products (13.5% per annum), and bread products (12.3% per annum).