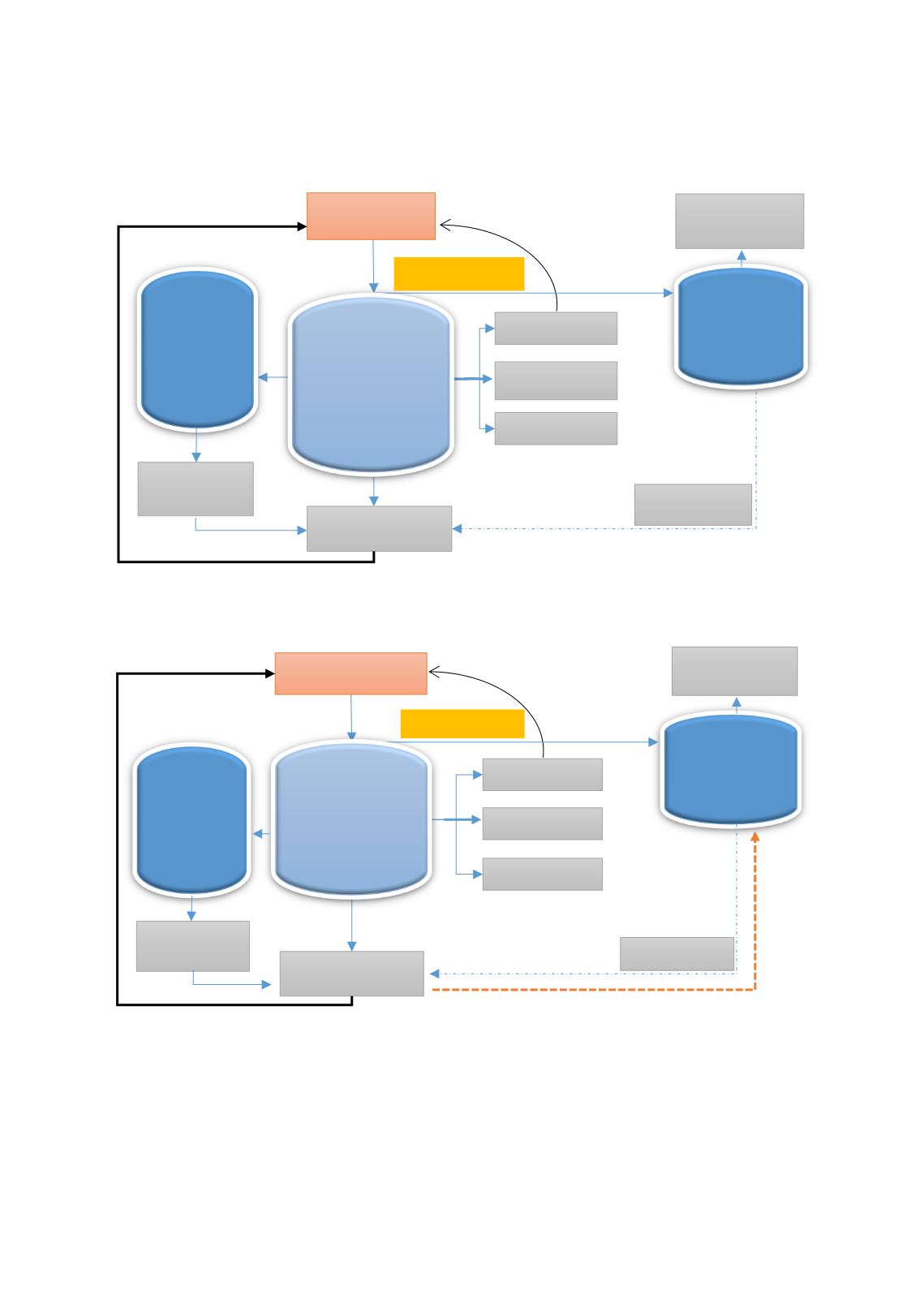

43

F

IGURE

4: P

URE

W

AKALAH

M

ODEL

Notes:

The figure presents two parties – Participants and TO.

Takaful

Fund and Shareholders’ Fund are both

managed by the TO.

Source: Adapted from PwC (2008).

F

IGURE

5: M

ODIFIED

W

AKALAH

M

ODEL

Notes:

The figure presents two parties – Participants and TO.

Takaful

Fund and Shareholders’ Fund are both

managed by the TO.

Source: Adapted from PwC (2008).

In contrast, in the Modified

Wakalah

model, the TO claims a portion of the underwriting surplus

as an additional incentive for efficient performance (see

Figure 5

).

Participants

Surplus/

Deficit

Re-Takaful

Reserves

Shari’ah

-

compliant

Investments

Investment

Profits

Shareholders’

Fund

Qard Hasan

Management

Expenses

Claims

Takaful

Fund

Wakalah Fee

Contribution

Participants

Surplus/

Deficit

Re-Takaful

Reserves

Shari’ah

-

compliant

Investments

Shareholders’

Fund

Qard Hasan

Management

Expenses

Claims

Takaful

Fund

Wakalah Fee

Contribution

Investment

Profits