37

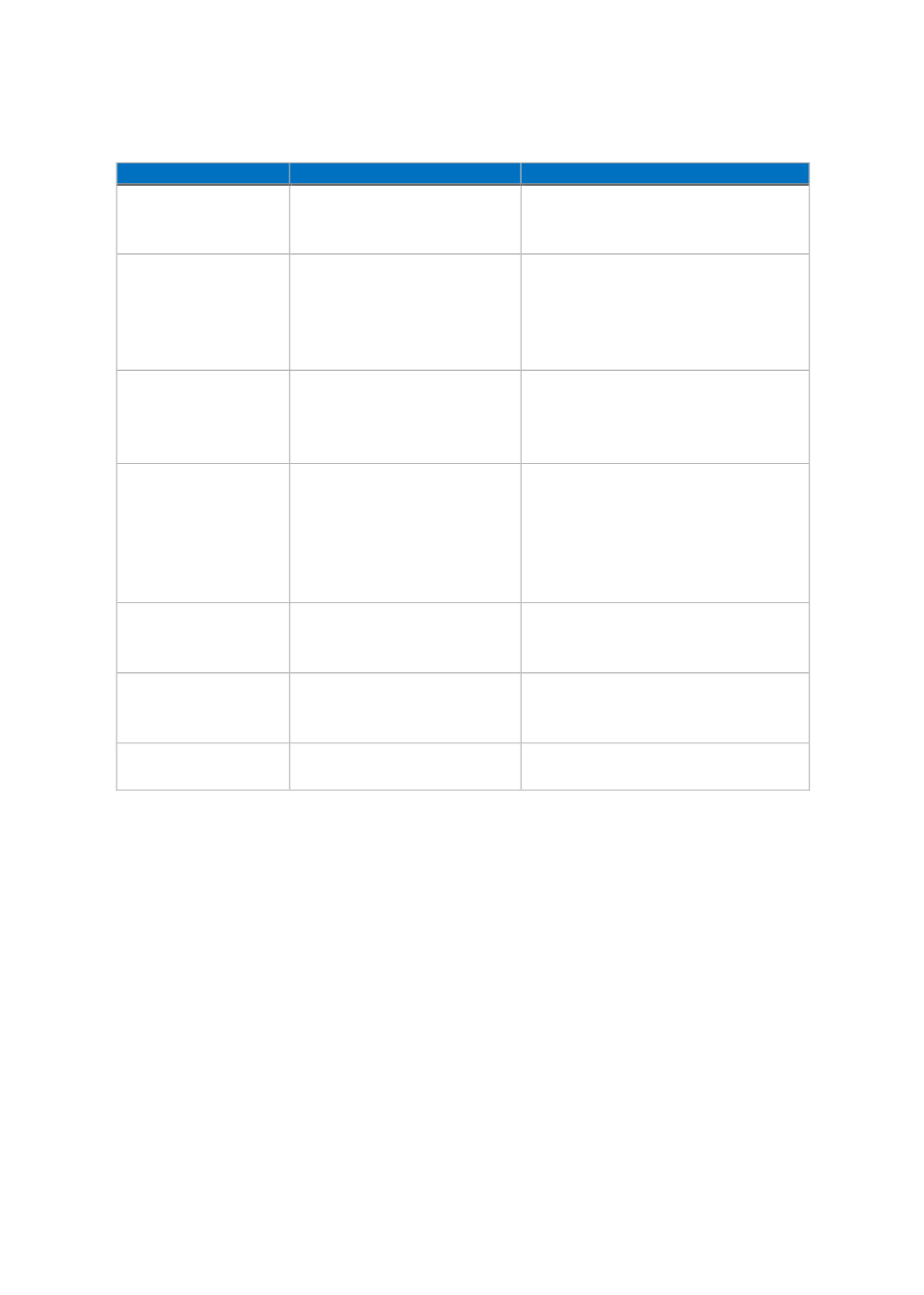

Themes

Conventional Insurance

Takaful

fund

profits and underwriting

surplus, belong to the

insurance company

surplus belong to the participants

collectively

Receivable upon

maturity

The amount agreed upon in

the contract (dividends,

bonus, and interest)

Participant’s share from the

investment account and profit (if

any) from investment and the

maturity value of the participant’s

risk fund

Receivable upon

surrender

The amount agreed upon in

the contract (interest,

dividend and bonus (if any)

Participant’s share from the

investment account and profit (if

any) and the surrender value of the

participant’s risk fund

Liability to pay

claims

The company is liable to pay

the claims from its assets

(the insurance funds and the

shareholders’ fund) even

though the claims exceed the

amount of the paid premium.

All claims are paid from the

Takaful

fund. If the number of claims

exceeds the amount collected in the

fund, the participants should

increase their contributions

Investment of the

insurance/

Takaful

fund

The premiums might be

invested in interest-bearing

securities

The funds must be invested in

Shari'ah

-compliant instruments and

halal

businesses

Sources of ruling

Purely based on “man-made”

laws such as Acts, Case laws

and age-long trade practices

Qur’an, Sunnah, and Fiqh rulings

based on revelations

Agency commission

Paid from the premium

Depending on the

Takaful

model

adopted

Source: Rusni Hassan, 2011