35

2.3. Comparison of

Takaful

with Conventional Insurance

This section presents a comparative analysis of the

Takaful

insurance in comparison with

conventional insurance, emphasising on the concepts, features and nature of risks. The concept

of

Takaful

is quite like cooperative insurance (called

ta’min ta’awuni

) where the participants

mutually agree to help one another. The participants undertake to contribute a certain amount

of money as

tabarruʻ

(donation) to the

Takaful

fund, and they are also entitled to receive

Takaful

benefits payable from the fund on the occurrence of certain events covered under the scheme.

Therefore, under a

Takaful

arrangement, the

Takaful

participants play in the same time the roles

of insured (policyholders) and the insurer (

Takaful

benefits provider). Unlike the conventional

insurance companies which undertake to provide compensation to the policyholders, the TO’s

duty is only to manage the

Takaful

fund and administer

Takaful

certificates (policies)

adequately.

Thus, the main features of

Takaful

can be summarised as follows:

Policyholders (

Takaful

participants) jointly protect their common interest.

The participants pay their contributions to assist those of them who need assistance.

The payment of

Takaful

contributions is made based on

tabarru’

to share the burden of

losses and spread liability as per the community pooling system.

Based on the contract of

tabarru’

, the element of uncertainty in the payment of

contribution and compensation is tolerated.

Takaful

is not aimed at taking the advantage at the cost of others.

The

Takaful

company is not an insurer which is obliged to pay indemnification or

Takaful

benefits to the participants, but it is only a manager or administrator

responsible for managing the fund and administering its operations.

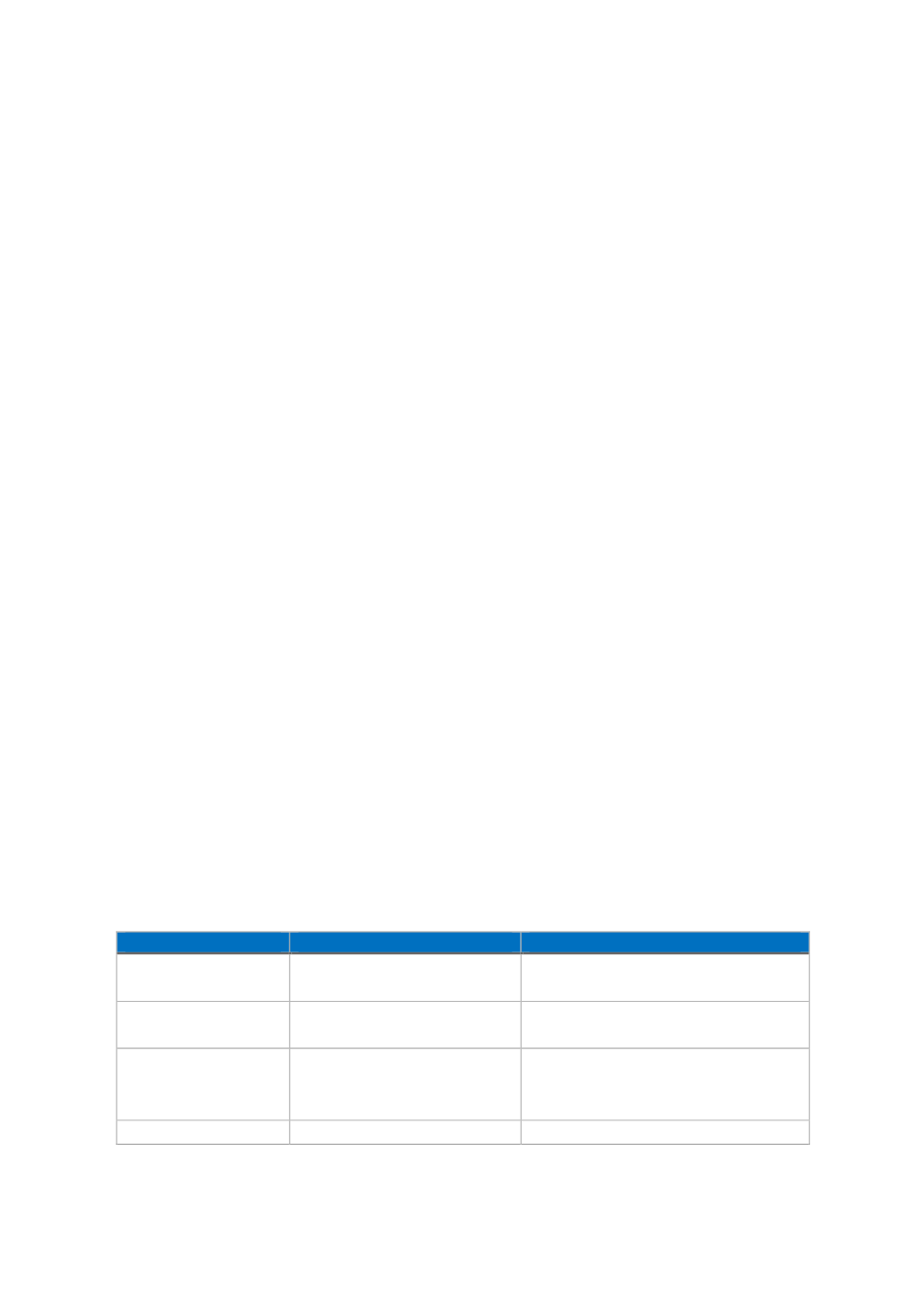

As discussed above, there are debatable issues among Muslim jurists about the concept of

insurance. This makes a case for the need to examine the differences between

Takaful

and

conventional insurance based on a number of themes

. Table 3below provides a snapshot of the

differences between

Takaful

and conventional insurance.

T

ABLE

3:

T

AKAFUL

VS

C

ONVENTIONAL

I

NSURANCE

Themes

Conventional Insurance

Takaful

Concept

Based on the Contract of

Bottomry

Based on

Aqilah

Principle

The Contract of

Bottomry

was founded on interest

Aqilah

was practised based on

cooperation among the tribes

Contractual

relationship

Interest-based contract

Bilateral contract

Shari'ah

-compliant

Takaful

models

Multilateral contract

Motive

Profit based

Mutual help and

tabarru’