36

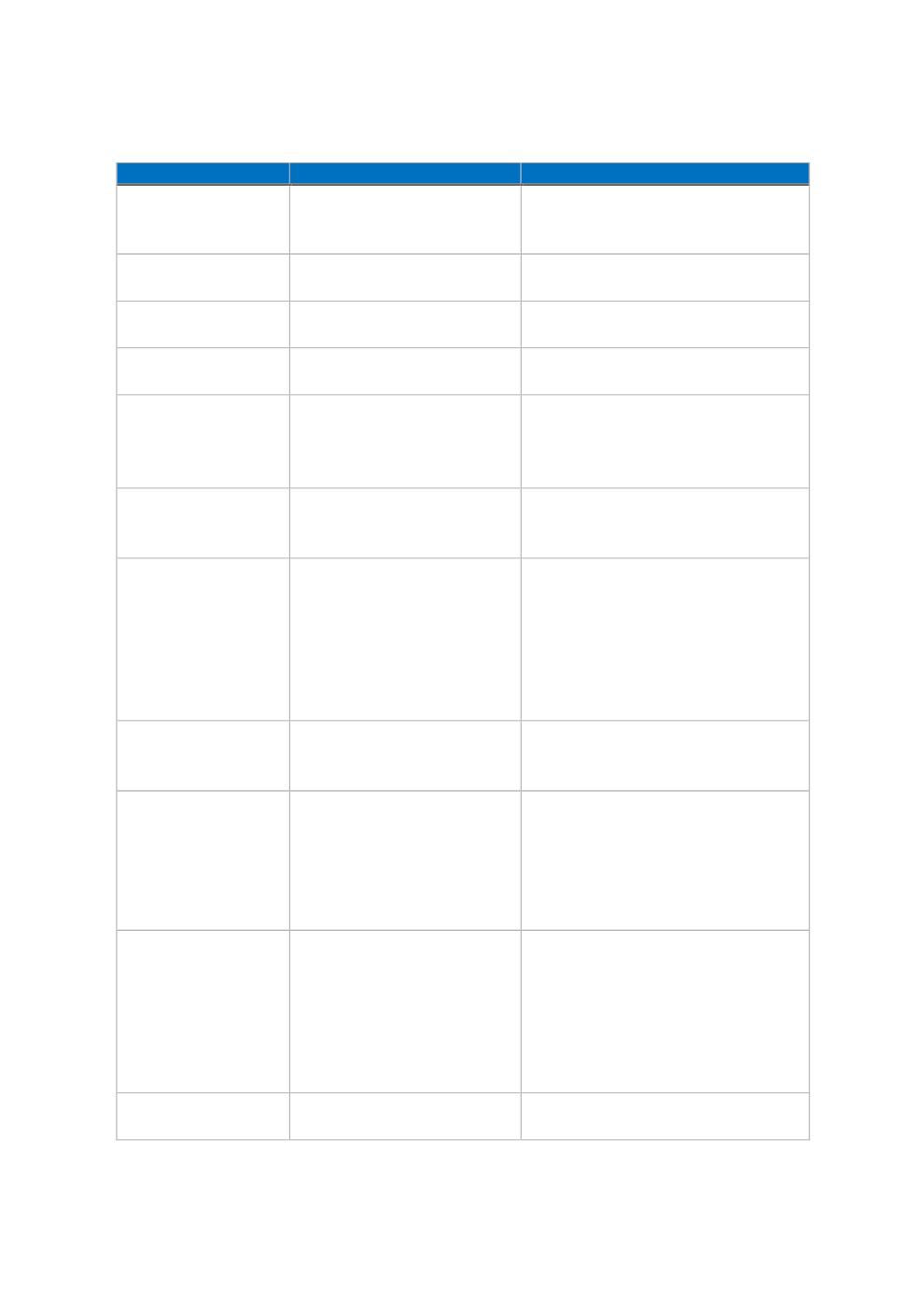

Themes

Conventional Insurance

Takaful

Payment

Premium belongs to the

insurance companies

Contribution belongs to the

participants and TOs, depending on

the

Takaful

model adopted

Standard-setting

bodies

IAIS, Local standard-setting

bodies

AAOIFI, IFSB, Local standard-setting

bodies

Choice of

investment

No restriction

Shari'ah

-compliant investment

Risk mitigation

approach

Risk transfer

Risk sharing

Method of

managing risks

Risks are transferred from

the insured to the insurer.

Risks are distributed to the whole

group of participants, and the

burden of losses is shared equitably

among them

Surplus from

participant risk

fund

It belongs to the insurance

company

It can be shared depending on the

Takaful

models adopted

Profit motive

Commercial insurance

companies make profits for

their shareholders by

protecting the policyholders

against risks in return of

fixed premiums

Takaful

companies make profits for

their shareholders by managing and

investing the

Takaful

fund on behalf

of the participants.

Takaful

coverage

against risks is provided by the

participants on a mutual or

cooperative basis

Profit from

investment

It belongs to the insurance

company only

It can be shared between

participants and TOs according to

the

Takaful

model adopted

The nature of the

contract

The contract of commercial

insurance is a sale and

purchase of insurance policy

between the insurer and the

insured

Takaful

is a contract of

ta’awun

which combines the elements of

musharakah

and

tabarruʿ

. The

contract of

muʻawadah

only relates

to the management of the

Takaful

funds

The obligation of

the parties of the

contract

The policyholder is obliged

to pay the premiums while

the insurer is obliged to pay

the compensation to the

policyholder upon the

occurrence of losses

specified in the policy

The participant is obliged to pay the

contributions as a commitment to

provide indemnity to other

participants on a mutual basis while

the TO is obliged to manage and

invest the

Takaful

contributions

The ownership of

insurance/

Takaful

The paid premiums, together

with all the investment

The

Takaful

contributions, profits

from their investment and the