108

T

ABLE

18: G

ROWTH OF

G

ENERAL AND

F

AMILY

T

AKAFUL

IN

T

URKEY

(%)

Takaful

Plan

2014

2015

2016

2017

2018

General

35.7

97.5

24.5

20.2

70.1

Family

405.5

54.4

77.1

1.1

55.9

Total

39.0

96.1

25.8

17.4

69.6

Source: IAT

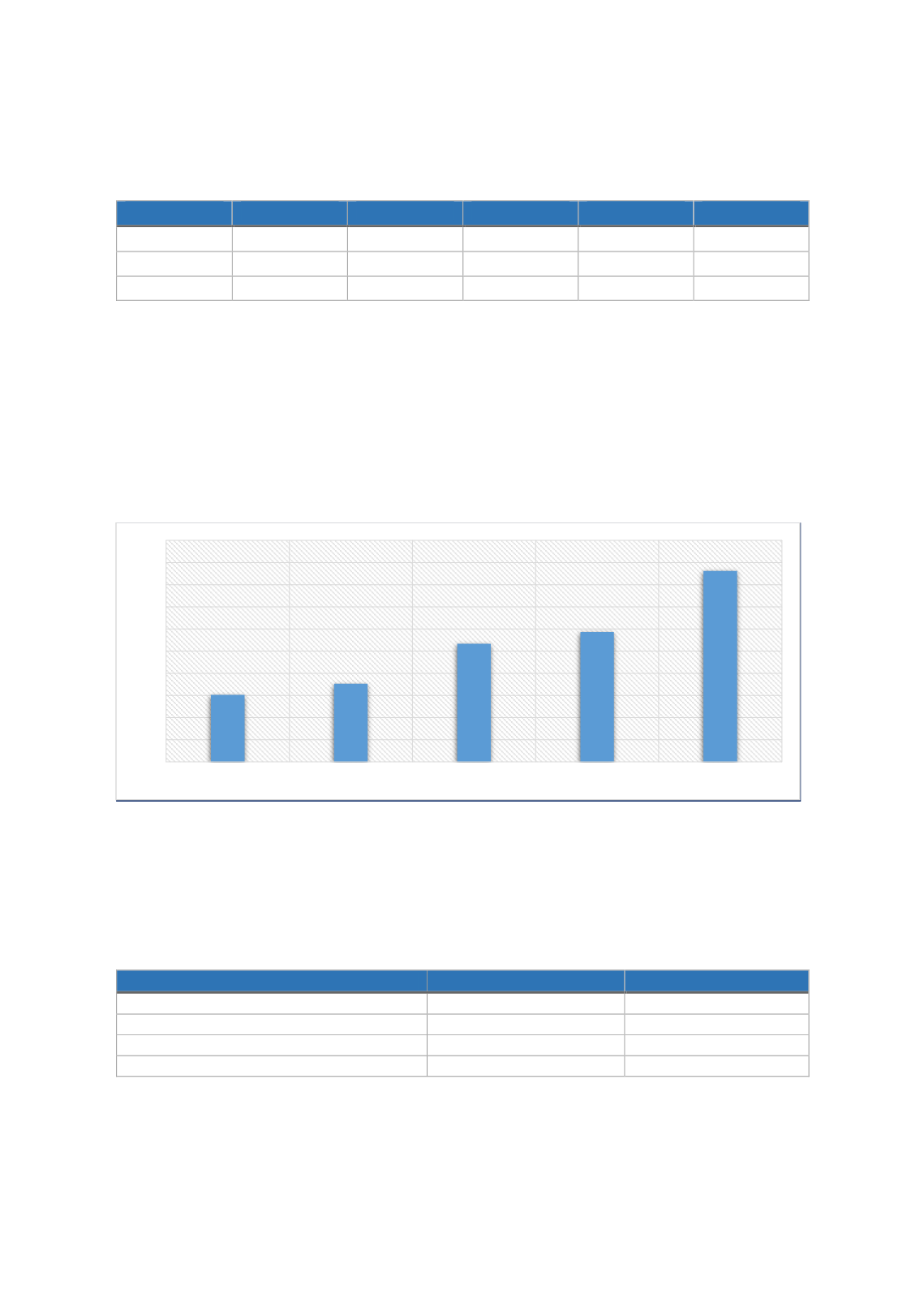

Figure 25shows the total market share of the

Takaful

sector in Turkey. As of 2018, the share of

Takaful

was TRY2.23 billion while it was only around TRY 383 million in the year 2014. In terms

of total market share, it accounted for only 1.51%market share in total insurance sector in year

2014. Then, it substantially increased to 4.31% by year 2018. In a nutshell, these figures indicate

that there is a huge potential for

Takaful

sector of Turkey with market acceptance and

government support.

F

IGURE

25: T

OTAL

T

AKAFUL

M

ARKET

S

HARE IN

T

URKEY

Source: IAT

6.3.4. The Most Preferred

Takaful

Structures

The most preferred

Takaful

structure in Turkey is

wakalah

-

mudarabah

hybrid model (se

e Table 19).

The diagram is represented i

n Figure 8as a hybrid model.

T

ABLE

19: L

IST OF

F

ULL

-F

LEDGED

T

AKAFUL

C

OMPANIES WITH

O

PERATING

M

ODELS

Company Name

Type

Takaful

Model

Neova Insurance

General

Takaful

Hybrid

Katilim Pension and Life

Family

Takaful

Hybrid

Bereket Insurance

General

Takaful

Hybrid

Bereket Pension and Life

Family

Takaful

Hybrid

Source: Authors

As mentioned above, the regulation covers only three main models;

mudarabah

,

wakalah

, and

1,51

1,76

2,67

2,93

4,31

0,00

0,50

1,00

1,50

2,00

2,50

3,00

3,50

4,00

4,50

5,00

2014

2015

2016

2017

2018