105

exist few years back are now major players in the Turkish motor insurance market. According

to the Turkish Insurance Association, motor insurance premiums rose by nearly 33% from July

1, 2016, to June 30, 2018 – a rise largely attributed to

Takaful

(Newton, 2019).

Currently, Turkey accounts for four full-fledged insurance companies and eight windows

providing

Takaful

coverage for a large section of the population. Experts are expecting that the

Islamic insurance (

Takaful

) to reach a 10% share of the Turkish Insurance Market by 2023.

There is already confusion over the validity of different

Takaful

contracts, and it is likely that a

Turkish option will only further cloud the field. However, Turkey is betting that its solutions,

namely growing and empowering a middle class through strong moves with religious backing,

could be the key to set it apart from the competitors. By that time, Turkey Takaful practices will

likely be considered as best practices. (Atlas Magazine, 2017).

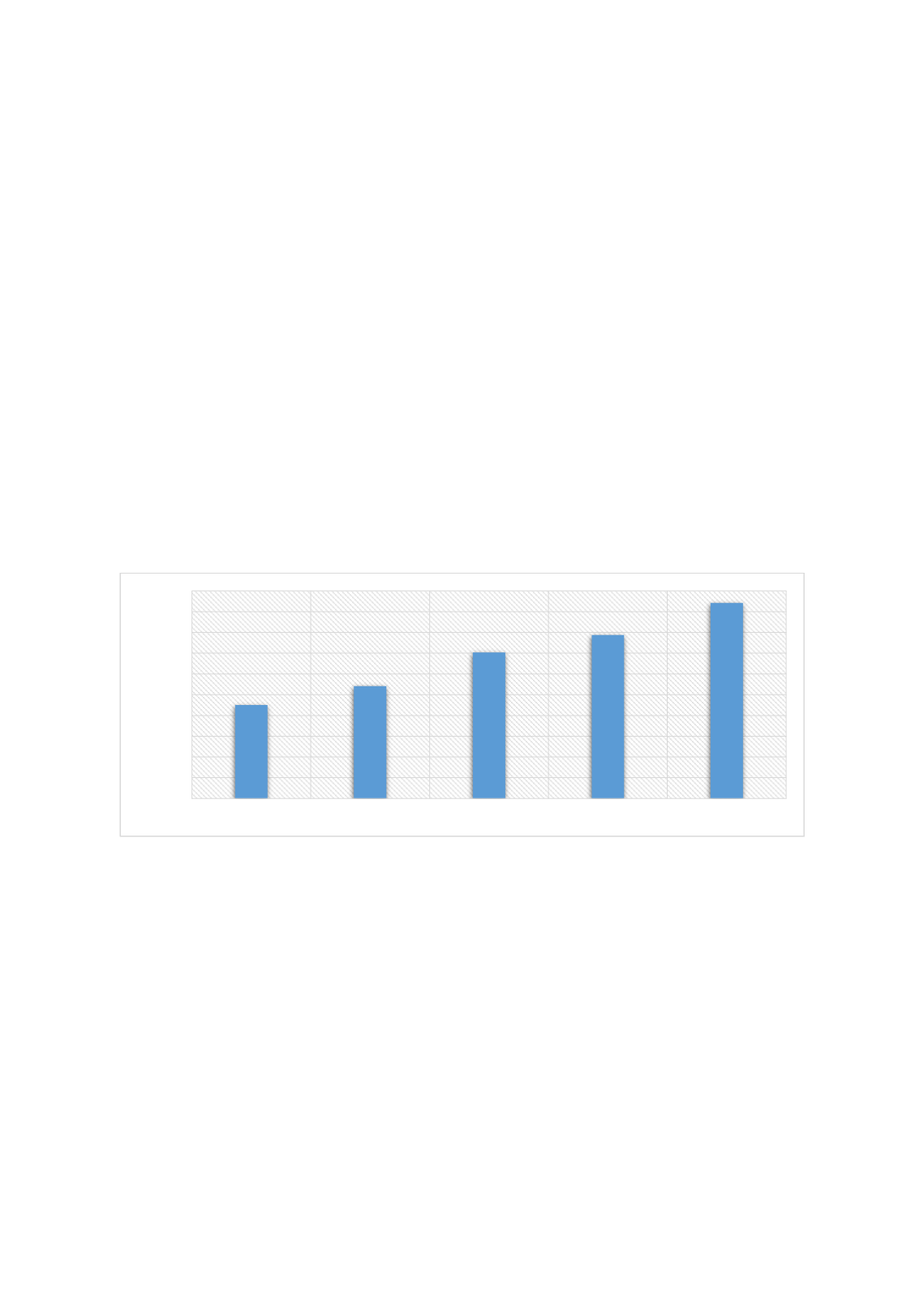

Recent data released by the Insurance Association of Turkey (IAT) (2018) reveals that motor

insurance premiums increased significantly by 33%over two years since the mid of 2016

. Figure 21and

Figure 22present the growth and size of non-life and life insurance in Turkey.

F

IGURE

21: T

HE

N

ON

-L

IFE

I

NSURANCE OF

T

URKEY

Source: IAT

Both figures show that there is uptrend growth in both cases. The non-life insurance was only

around TRY 22.5 billion in the year 2014, and it was more than TRY 47 billion in year 2018. In

the case of life insurance, it was TRY 3.25 billion in year 2014, and it was TRY 6.89 billion in year

2018. It means that both insurance sectors were doubled in year 2018 compared to year 2014.

0

5

10

15

20

25

30

35

40

45

50

2014

2015

2016

2017

2018

TYR Billions