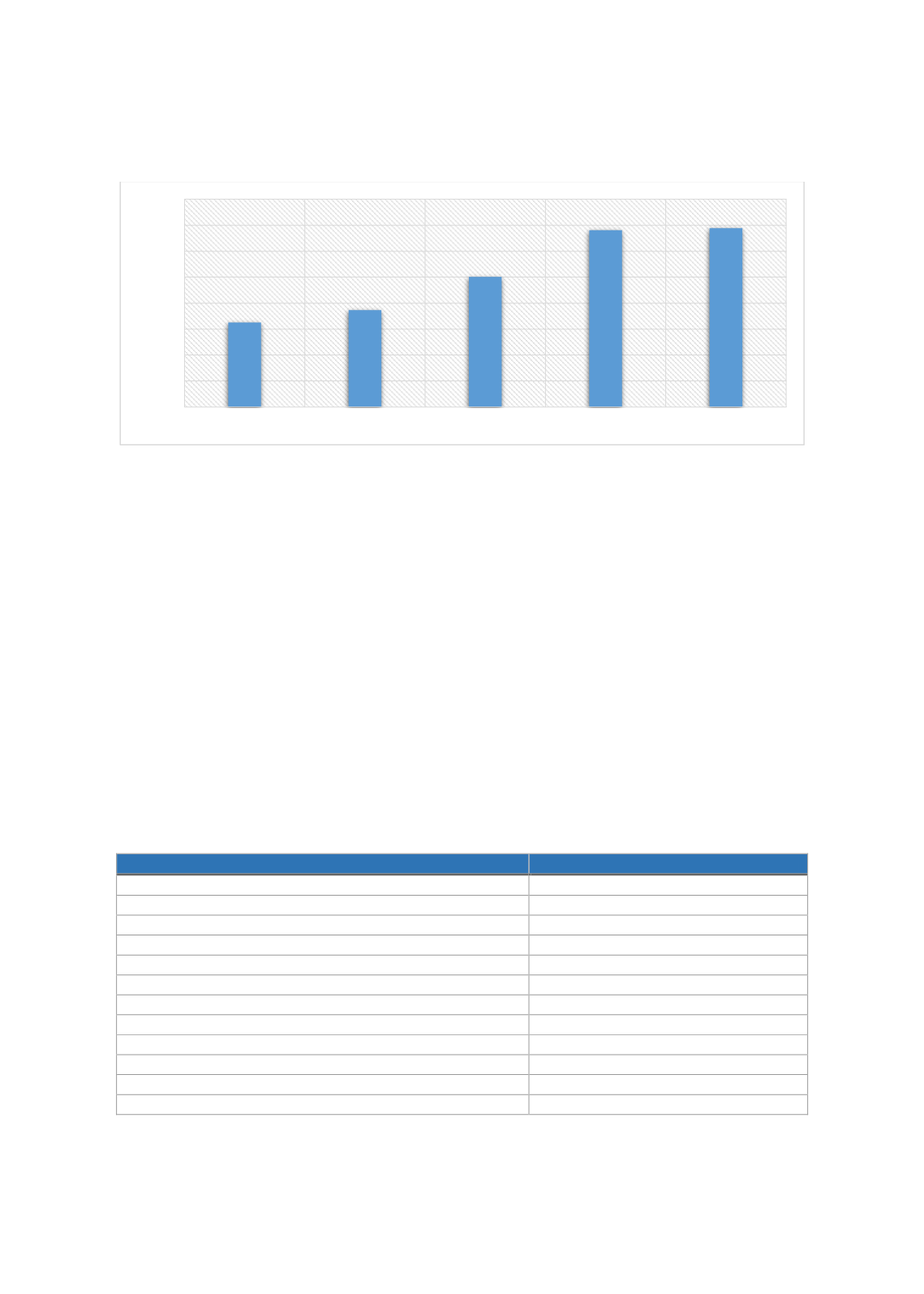

106

F

IGURE

22: T

HE

L

IFE

I

NSURANCE IN

T

URKEY

Source: IAT

It is believed that such tremendous success is driven by the

Takaful

Sector. Thus, the Turkish

economy’s share in the world

Takaful

sector is growing fast. The IAT reveals that the total

contributions realised from the

Takaful

or Participation Insurance Sector amounted to US$414

million as of end 2018, with four full-fledged

Takaful

companies out of 82 operating in Turkey.

TOs are the key actors in ensuring the sustainability of the overall interest-free financial system

in Turkey. It is the most critical pillar to collateralise the financial risks and the necessity of

integrating the interest-free financial system. Also, Family TOs with their pension plans feed

both the Islamic banking, Sukuk market, Islamic index stock companies, and Islamic portfolio

management companies. In the conventional system, the insurance mechanism is intertwined

with the whole of the financial system at every point and drive economies with their volume as

financial actors. Similarly,

Takaful

is developing parallel to the Islamic financial industry, and

overall Islamic finance is growing with

Takaful

in Turkey

. Table 17shows the list of full-fledged

Takaful

companies and windows in the Islamic insurance sector of Turkey.

T

ABLE

17: F

ULL

-F

LEDGED

T

AKAFUL

C

OMPANIES AND

W

INDOWS IN

T

URKEY AS OF

E

ND

2018

Company Name

Takaful

Type

Neova Insurance

General

Takaful

Katilim Pension and Life

Family

Takaful

Bereket Insurance

General

Takaful

Bereket Pension and Life

Family

Takaful

Gunes Insurance

Window

Unico Insurance

Window

Groupama Insurance

Window

Vakıf Pension and Life

Window

HDI Insurance

Window

Ziraat Insurance

Window

Ziraat Pension and Life

Window

Doga Insurance

Window

Source: Authors

0

1

2

3

4

5

6

7

8

2014

2015

2016

2017

2018

TYR Billions