104

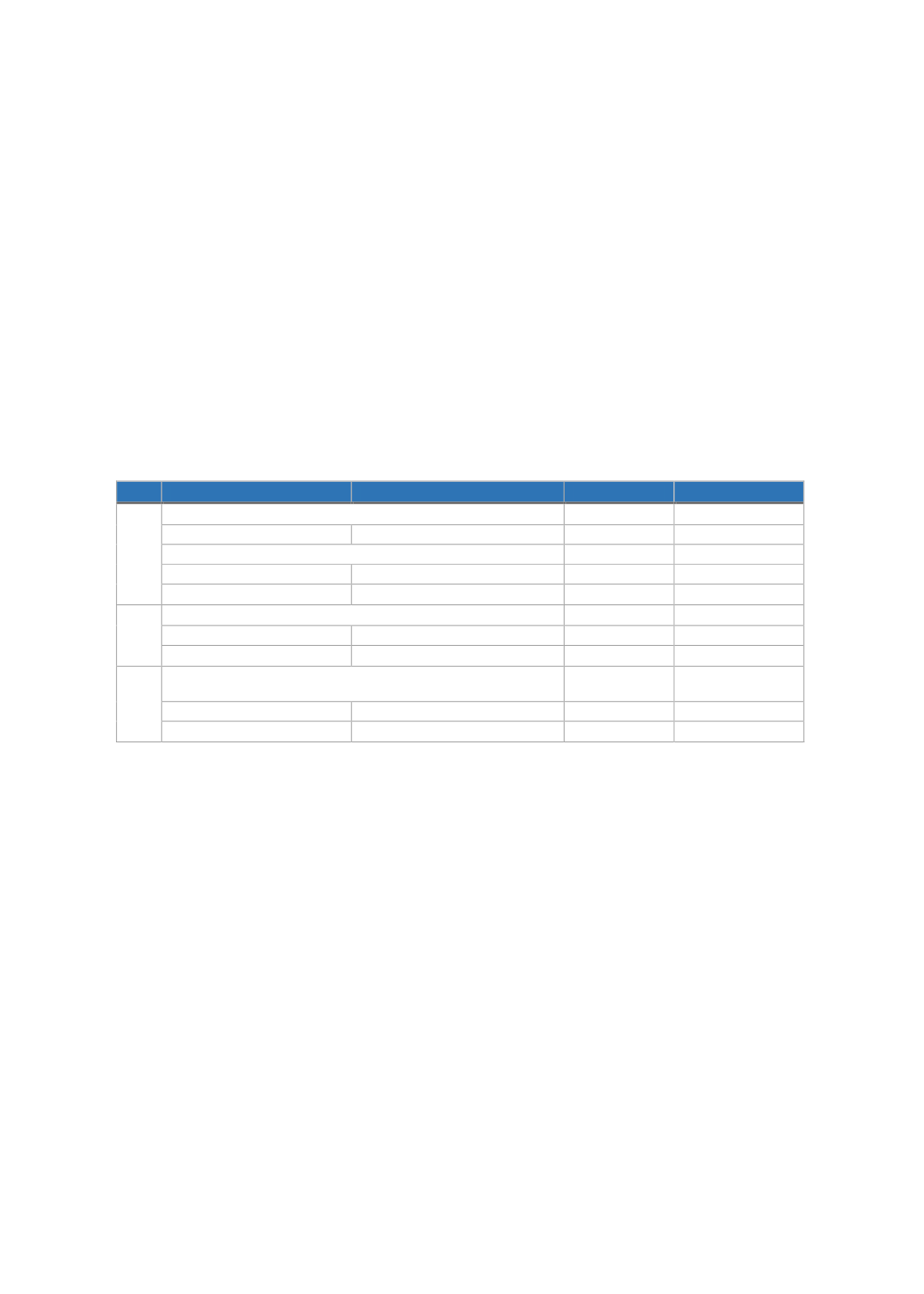

Comparison of Regulatory and Supervisory Frameworks

The legal and regulatory environment is separated into two entities in the dual insurance system

economies. However, the Turkish insurance market may not be considered as a dual system,

since the legal and regulatory environment has one standard insurance act. As can be seen from

Table 16,the main regulators are servicing the conventional and Islamic insurance sectors.

There is one slight difference for the overall Islamic finance sector that the PBAT is serving only

Islamic banking. The most important issue with standard legal and regulatory institutions is the

common pools, which do not separate

Takaful

funds from conventional funds. Even so, the

policies that have to be followed under national level pools (like liabilities for motor vehicles,

agricultural policies) all type of insurance companies are only agents of the pool operator.

T

ABLE

16: C

OMPARISON OF

R

EGULATORY AND

S

UPERVISORY

F

RAMEWORKS

Regulator/Supervisor

Self-Regulatory Organisation Conventional

Islamic

Banking

CBRT

ⱱ

ⱱ

SDIF

ⱱ

ⱱ

BRSA

ⱱ

ⱱ

BAT

ⱱ

-

PBAT

-

ⱱ

Capital

Market

CMB

ⱱ

ⱱ

BIST

ⱱ

ⱱ

Takasbank

ⱱ

ⱱ

Insurance

The Ministry of Treasury

and Finance

ⱱ

ⱱ

Pools

ⱱ

ⱱ

Offices

ⱱ

ⱱ

Source: Authors

6.3.3. Growth Trends

The first General

Takaful

company Neova Insurance was established in the year 2009 and the

first Family

Takaful

company Katilim Pension and Life initiated its operations in Turkey in the

year 2013. However, the first regulations on

Takaful

came into the picture in 2017 in Turkey.

The Regulation on Working Principles and Procedures of Participation Insurance mainly

regulate the operating models and the

Shari'ah

Advisory Committee. With such initiatives, there

is a significant prospect for success in the growth and development of the

Takaful

sector in

Turkey with introduction of new players. Due to the above reasons, the market shares of

Takaful

increased a lot and the

Takaful

sector is picking up momentum. Besides that,

Takaful

is an

important component of Istanbul Finance Centre Plan and it will have a positive effect on

Takaful

industry (SBB, 2019).

Despite the newly established

Takaful

companies, the motor

Takaful

segment is one of the most

successful. This level’s strategies have encouraged the provision of Islamic insurance products.

Turkey has attained a significant level of success in motor insurance. Many firms that did not