Improving Public Debt Management

In the OIC Member Countries

83

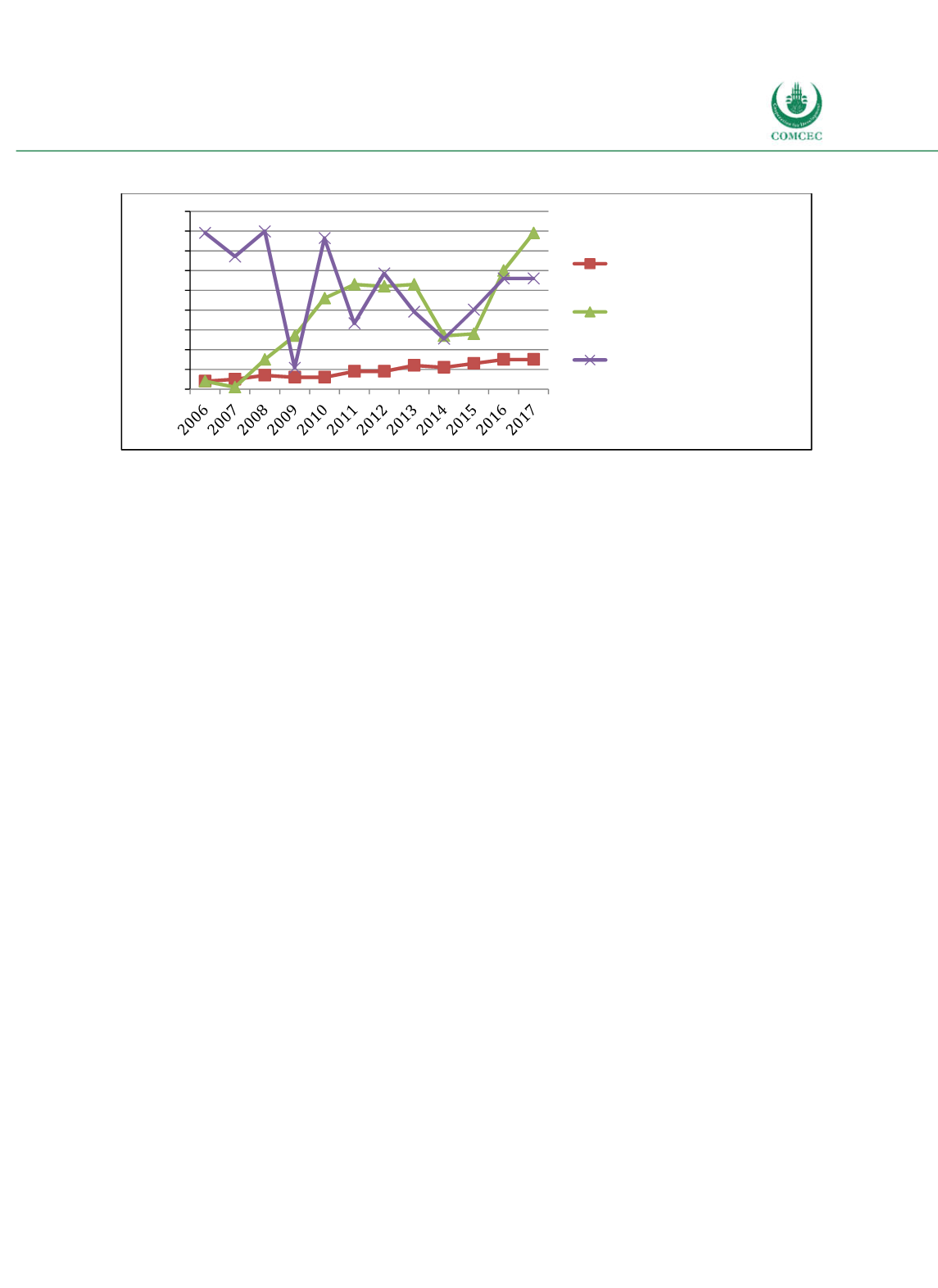

Figure 4-6: Mozambique - Interest Rates and Inflation

Sources: IMF (2009, 2011, 2013, 2015b), calculations by the Ifo Institute.

C) Policy Recommendations

Mozambique has made progress in improving public debt management frameworks in the last

years. The Public Debt Management Unit at the Ministry of Finance is the main institution

responsible for public debt management. The government has developed a mediumterm debt

management strategy that is published online. The targets of the debt management strategy

remain, however, vague. There are no numerical targets regarding the risks the government’s

debt portfolio is facing.

Mozambique is exposed to high exchange rate risks because of the large share of external debt.

Whereas authorities in Mozambique described the country’s external debt as sustainable and

the risk of debt vulnerability with respect to external shocks as moderate at the end of 2015

(IMF 2015b), the adverse effect of the U.S. Dollar appreciation on the debttoGDP ratio poses a

higher risk in the light of the revelation of previously undisclosed loans. Developing a domestic

debt market and increasing domestic borrowing could reduce the exchange rate risk.

Regarding domestic debt, the Mozambique is exposed to refinancing risk because the short

average time to maturity and high share of debt maturing within one year, and interest rate

risk because the average time to refixing is high and the share of debt to be refixed within one

year is high.

Improving public disclosure and accountability is important, in particular following the

revelation of undisclosed loans in 2016. Whereas the local authorities already pushed forward

an investigation about the undisclosed debt through the Attorney General and a Parliamentary

Inquiry Commission, an international independent audit of the affected companies could help

restoring confidence. In the light of the recent revelations, it is even more important to tighten

fiscal and monetary policies substantially and to ensure exchange rate flexibility, which is

needed to restore macroeconomic sustainability and reduce inflationary pressures (IMF

2016c).

It is recommended to modernize the Revenue Authority in order to broaden the tax base and

increase tax revenues, which would give rise to a reduction of the public deficit (IMF 2015b).

Apart from that, Mozambique could create a fiscal risk unit responsible for evaluating all kinds

of risks with respect to potential changes in key underlying macroeconomic assumptions and

related to public and publicly guaranteed debt, PPPs and SOEs (IMF 2015b).

0 1 2 3 4 5 6 7 8 9

%

Average Nominal Interest

Rate on forex debt (%)

Average Real Interest Rate

on Domestic Debt (%)

Inflation (GDP deflator,

annually, %)