Improving Public Debt Management

In the OIC Member Countries

82

Fund for Agricultural Development (IFAD), and the OPEC Fund for International Development

(OFID). Bilateral creditors, which represent 46% of total central government debt, are for

instance the Kuwait Fund, France, Russia, Romania, India, China, Nordea Bank, Libya, Iraq,

Germany and Spain (OECD 2014). Most commercial creditors come from Brazil and China

(OECD 2014).

The largest share of external debt is denominated in U.S. Dollar, which has decreased between

2006 and 2010 and increased again beyond 2010. The share of Eurodenominated debt, SDR

and other currencies, however, decreased after 2010. As of 2014, U.S. Dollar denominated debt

represents 66.3%, followed by other currencies (14.6%), Special Drawing Rights (10.3%) and

Eurodenominated debt (7.7%). The remainder is debt denominated in Japanese Yen (1%).

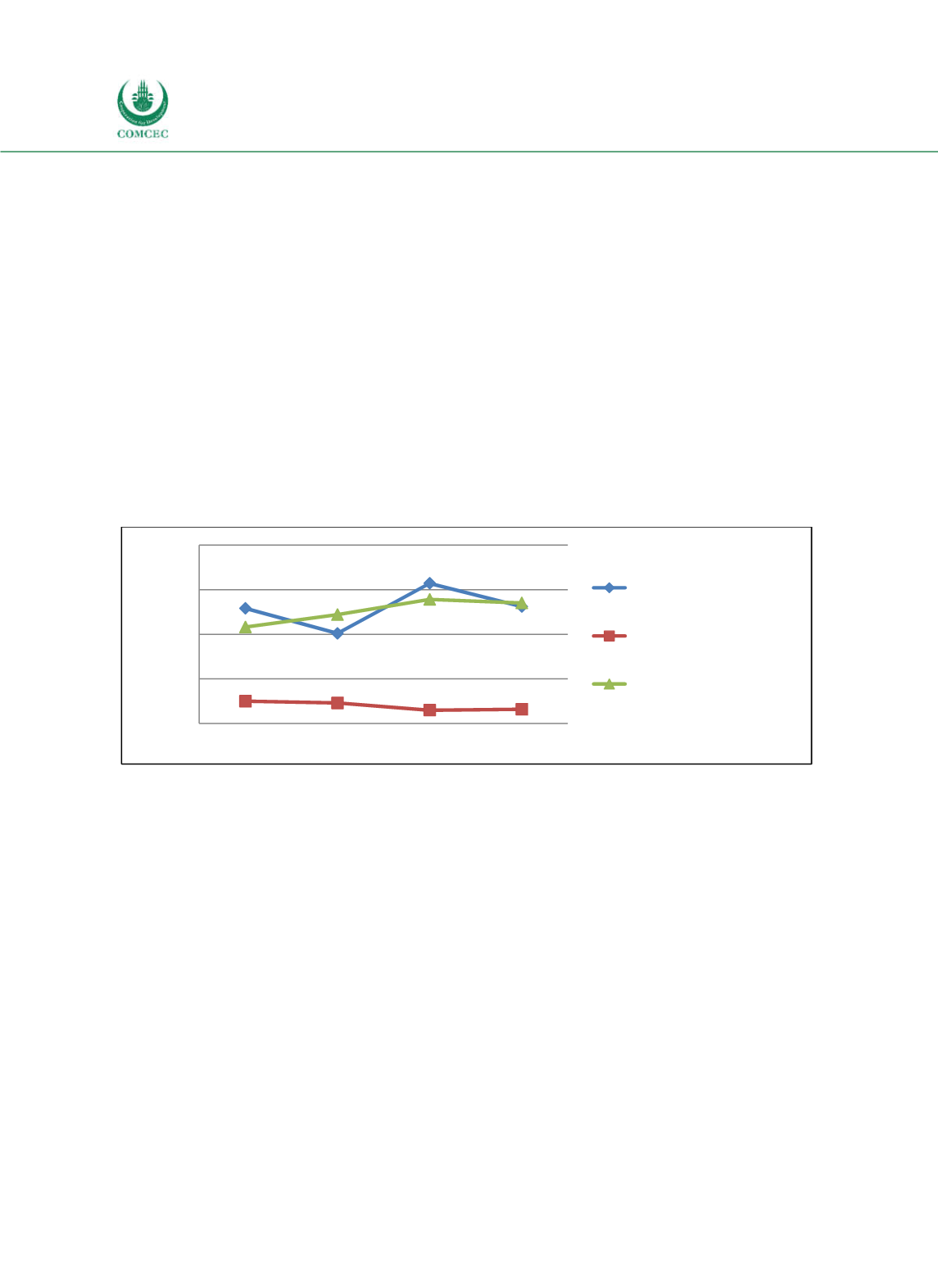

The average maturity of external debt is much higher than the respective maturity of domestic

debt (see Figure 45). Whereas the average maturity of external debt fluctuates between ten

and sixteen years, the average maturity of domestic debt remained relatively stable between

2011 and 2014 ranging from 1.5 years to 2.5 years. With respect to total public debt, a positive

trend in the average maturity can be observed.

Figure 4-5: Mozambique - Average Maturity of Public Debt

Sources: MoEF (2012, 2015), calculations by the Ifo Institute.

The weakness of domestic debt markets is also reflected in interest rate developments.

Whereas the nominal interest rate on forex debt increased slightly from 0.4% in 2006 to 1.5%

in 2016, the average real interest rate on domestic debt increased in the same period from

0.4% to 6% (see Figure 46). The fluctuations in the interest rate can be attributed to the

highly volatile inflation, which ranged from 1.1% to 7.9%, but also to the increasing interest

rates, which the government had to pay on newly issued government securities. While the

yields on government securities with a four year maturity increased from 7.5% in 2013 to

12.75% in 2016, the interest rates on 3 year government securities increased from 8.9% in

2013 to 11% in 2016 (BVM 2016). This increase is predominantly the result of the increased

mistrust following the revelation of the previously undisclosed loans.

0 5 10 15 20

2011

2012

2013

2014

Years

Average Maturity,

External Debt

Average Maturity,

Domestic Debt

Average Maturity, Total

Debt