Improving Public Debt Management

In the OIC Member Countries

81

harmonizing public debt management with internationally recognized standards and

procedures, and improving transparency of public fund and debt management (MoEF 2015).

Borrowing and Related Financial Activities

Operations (incl. Islamic finance)

Mozambique uses TBills and TBonds traded via the domestic financial market. The market

for TBills and repos is restricted to local investors. TBills are issued weekly with maturities of

three, six and twelve months. Maturities for TBonds range between three and ten years. The

Maputo Stock Exchange (

Bolsa de Valores de Moçambique

) also lists one perpetual bond (BVM

2016).

Mozambique has not yet issued Islamic bonds. Officials from the Bank of Mozambique

participated at a workshop about Islamic finance, which was organized by the Islamic

Research and Training Institute (IRTI) and held in February 2016 (IRTI 2016). During the

workshop, Mozambique announced plans to introduce a legal framework for Islamic banking

in the near future (IRTI 2016).

Domestic debt market

Mozambique’s domestic financial market represents a small but growing sector of the

economy. The banking industry is composed of 18 commercial banks, of which four foreign

owned (Standard Bank, Millennium Bim, BCI and Barclays) dominate the market (AFMI 2016).

Investors of TBills and TBonds are predominantly commercial banks, but also insurance

companies and investment management companies. TBills and TBonds represent, however,

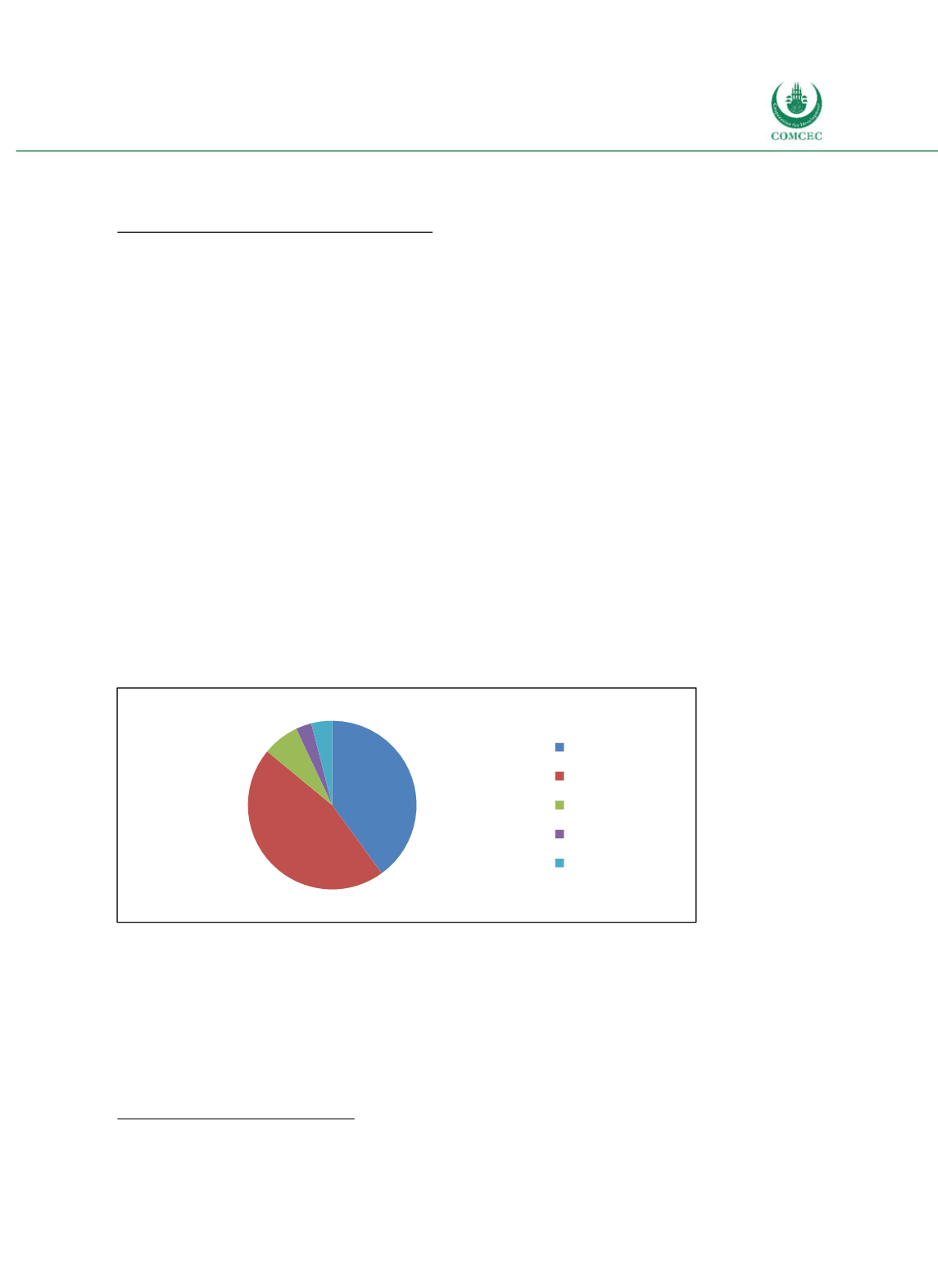

only a small share of total public debt (see Figure 44).

Figure 4-4: Mozambique - Creditor Structure of Public Debt (2014)

Sources: MoEF (2015), calculations by the Ifo Institute.

Foreign borrowing

External debt represented 84.3% of total debt in 2015.

16

The dominance of external debt

indicates a relative underdevelopment of domestic financial markets. As of 2014, 40% of

Mozambique’s public debt was held by multilateral creditors, among others the International

Development Association (IDA), the Arab Bank for Economic Development in Africa (BADEA),

the Islamic Development Bank (IDB), the European Investment Bank (EIB), the International

16

Because of the undisclosed external loans, the share of external public debt is probably even higher.

40%

46%

7% 3% 4%

Multilateral

Bilateral

Treasury Bonds

Treasury Bills

Others