Improving Public Debt Management

In the OIC Member Countries

80

Contributing to the maintenance of stability and development of the financial sector;

Promoting balanced and efficient functioning of financial markets;

Contributing to poverty reduction.

In November 2015, Mozambique revised its public debt management strategy with technical

assistance from the World Bank and the IMF. Key issue was the development of the domestic

capital market (IMF 2015b). In order to provide a more efficient and transparent debt portfolio

and minimize its costs, Mozambique developed a MTDS for the years 20152018, including the

following objectives (MoEF 2015, p. 4):

Identification of the type and size of contracted debt;

Define priorities which should be considered when deciding on new financing;

Identification and analysis of borrowing limits and indicators of debt sustainability;

Minimizing the costs and risks of the debt portfolio;

Establishing clear rules for new borrowings;

Establishing institutional coordination mechanisms for the management of public debt.

Public debt management faces several challenges (see Table 42):

Cost of debt: the weighted average interest rate was high at 9.5%, caused mainly by the high

interest rates on domestic debt;

Refinancing risk: more than 40% of domestic debt matures within one year;

Interest rate risk: more than 70% of domestic debt has to be refixed within one year;

Exchange rate risk: about 95% of Mozambique’s debt is external.

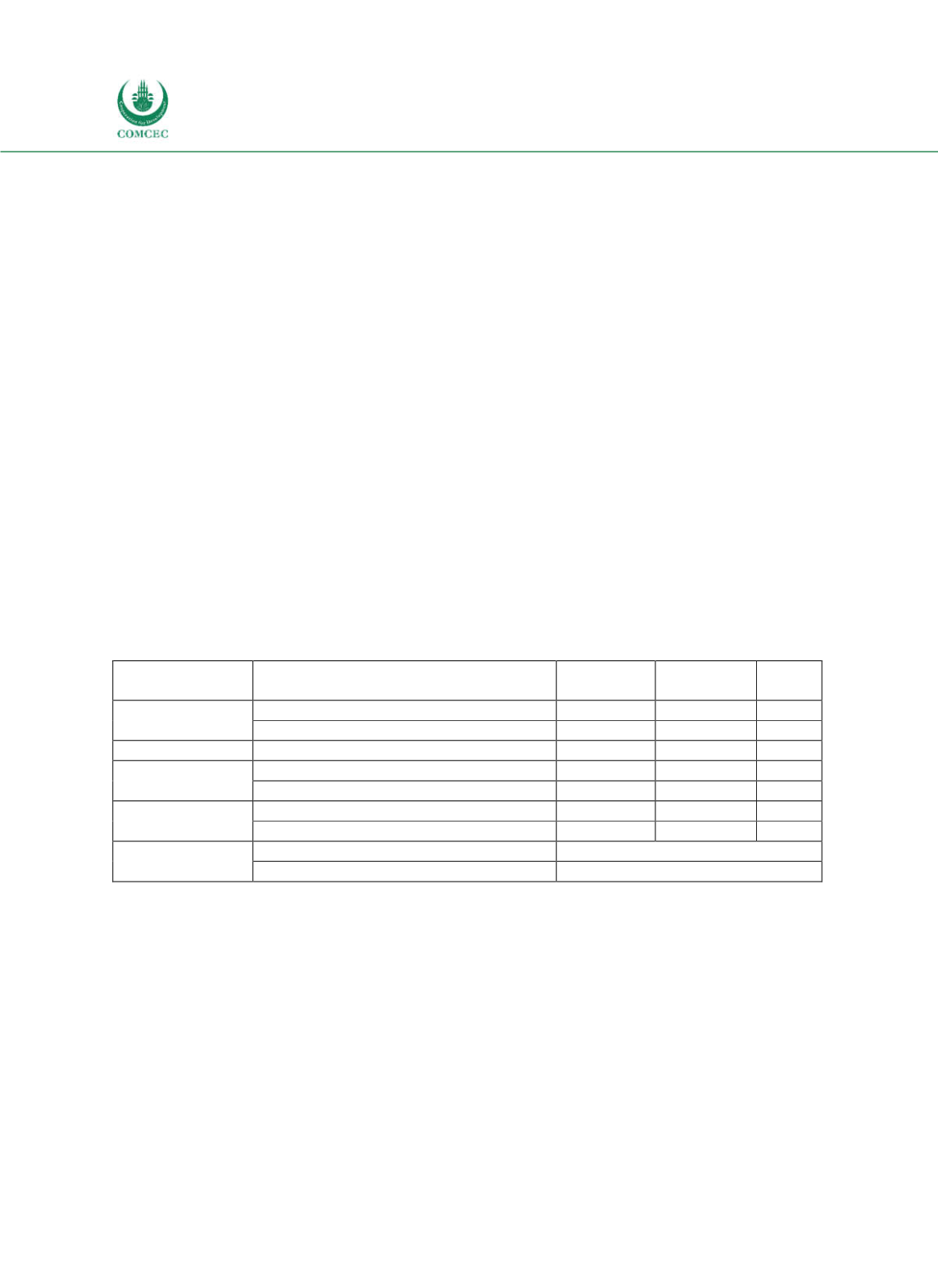

Table 4-2: Mozambique - Cost and Risk Indicators for the Govt.'s Debt Portfolio (2014)

Type of risk

Risk indicator

Domestic

debt

External

debt

Total

debt

Solvency

Nominal stock of public debt (Mio. $)

1102

7067 8173

Nominal stock of public debt (% of GDP)

7

42

49

Cost of debt

Weighted average interest rate (in %)

9.5

1.8 2.9

Refinancing

risk

ATM (years)

1.6

13.1 13.5

Debt maturing in 1 year (% of total)

43.3

2.7 8.3

Interest rate

risk

ATR (years)

1.1

13 12.6

Debt refixing in 1 Year (% of total)

70.7

4.7 13.8

Exchange rate

risk

FX debt (% of total debt)

94.5

ST FX debt (% of reserves)

6.7

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing; FX = Foreign exchange; ST = Short-term.

Source: MoEF (2015).

In order to ensure the mediumterm debt sustainability, the strategy highlights the alignment

of the available fiscal space with the project prioritization according to the Integrated

Investment Plan (IIP), the State Budget and the Economic and Social Plan (PES). In particular,

infrastructure projects under Public Private Partnerships (PPP) should be prioritized. Apart

from that, foreign direct investment and the sale of public assets would strengthen private

investment. Connected to debt management, the strategy considers the revenue side to be very

important. By broadening the tax base, intensifying audit and inspection measures and by

pushing forward the computerization of tax collection, greater efficiency in revenue collection

could translate into revenue growth and smaller budget deficits (MoEF 2015). The strategy

identifies various challenges regarding the implementation of the objectives, including