Improving Public Debt Management

In the OIC Member Countries

88

2016). TBills are mostly bought by banks and other financial institutions, predominantly by

WAEMU commercial banks (IMF 2015a). The secondary bond market is underdeveloped as the

banks pursue mainly a “buy & hold strategy”. Although TBonds can be traded overthecounter (OTC) like TBills, they are predominantly traded at the Regional Bond Exchange

(BRVM) of the West African states (AFMI 2016).

Whereas TBonds and TBills are predominantly used to finance the deficit, Togo also uses

external loans to finance public enterprises and public investments. For instance, in 2012 Togo

signed funding agreements worth $194 million with the Islamic Development Bank (IDB). The

money is supposed to be used for financing road construction, improvements in the

educational system and electrification of rural areas (News Ghana 2016).

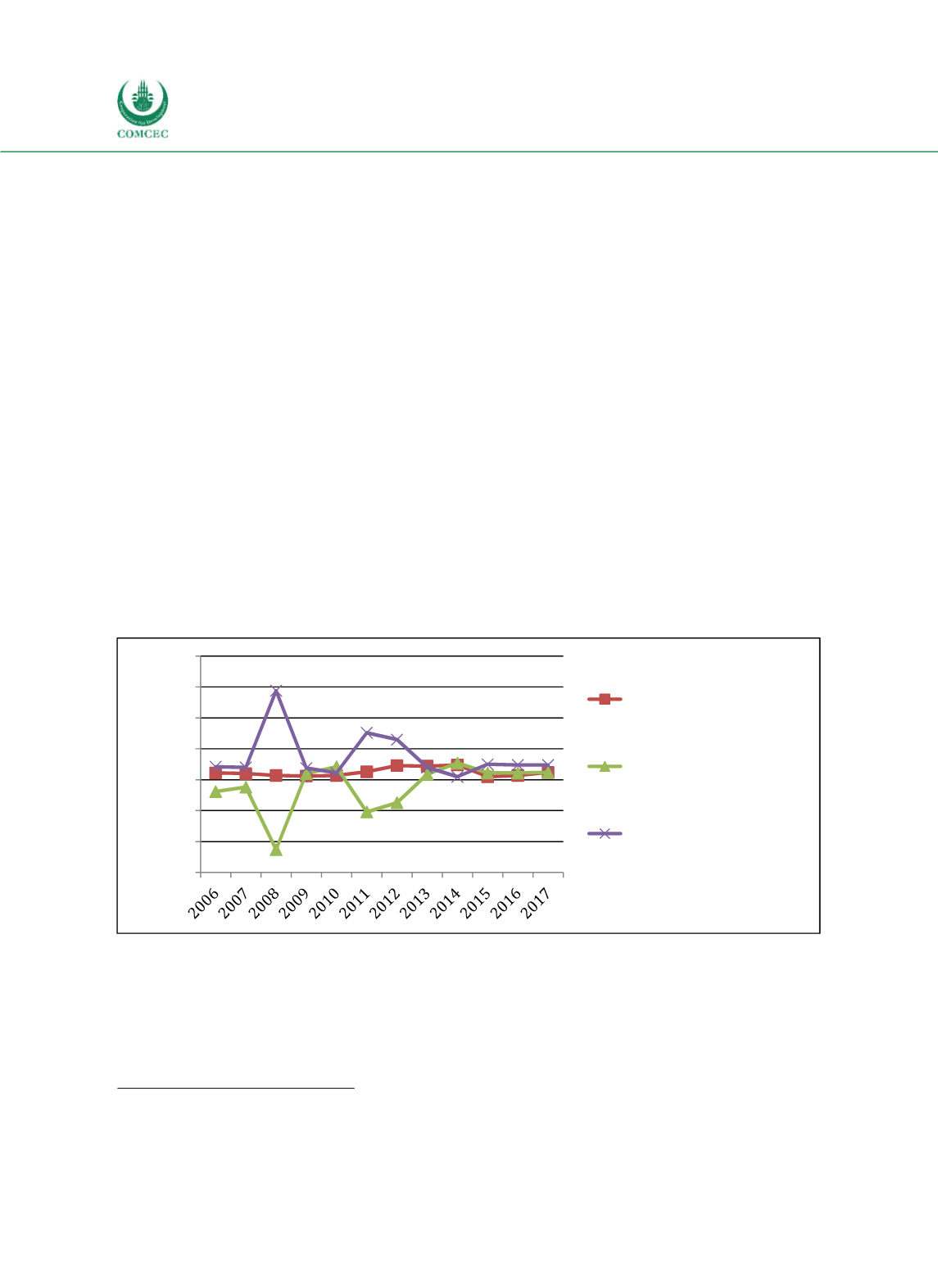

Between 2006 and 2014 nominal interest rates on foreign debt ranged between 0.6% and

2.4% (see Figure 48). Whereas interest rates have been quite low since 2006, they started to

rise after 2010 as a result of the increase in commercial bank’s share in external government

debt (see Figure 49). Debt from official creditors is typically contracted at lower interest rates

than loans from commercial creditors. Due to the strong fluctuations in the inflation rate, real

interest rates were partly negative. Whereas inflation equaled 14.4% in 2008, the inflation rate

declined over the years and is expected to stabilize at around 2.5%.

In 2016, Togo issued its first sovereign

sukuk

bond with a maturity of ten years and a rate of

return of 6.5%. The transaction covered XOF 150 billion, which equals $251.4 million (Zodzi

and Peyton 2016).

19

Figure 4-8: Togo - Interest Rates and Inflation

Sources: IMF (2007, 2009b, 2011, 2013, 2015b), calculations by the Ifo Institute.

Domestic debt market

The structure of Togo’s public debt has changed strongly between 2006 and 2015 because of

the debt reliefs under the HIPC and the MDRI. While in 2006 the share of domestic debt

equaled 18.5%, this share has increased to 53.1% by 2015 (see Figure 47). Togo managed to

19

The issuance was organized by the Islamic Corporation for the Development of the Private Sector (ICD) and the lead

auditor was Deloitte Togo. Togo received management assistance from the Africaine de Bourse, Atlantique Finances,

BOA Capital Securities SA, Coris Bourse, EDC Investment Corporation and SGI Togo (Owermohle 2016).

15 10 5 0 5 10 15 20

%

Average nominal interest

rate on forex debt (in

percent)

Average real interest rate

on domestic debt (in

percent)

Inflation rate (GDP

deflator, in percent)