Improving Public Debt Management

In the OIC Member Countries

75

41). The external debt portfolio has higher ATM due to financing mostly from multilateral and

bilateral creditors. The refinancing risk of the external debt portfolio is therefore lower than

that of the domestic debt portfolio. The domestic debt portfolio with mostly one year

maturities poses a high rollover risk (MoFEA 2014). The interest rate exposure, which is

indicated by the average time for refixing (ATR), is 2.6 years for the domestic debt and 10.7

years for the external debt portfolio (MoFEA 2014). In the domestic debt market variable

interest rates hardly exist.

While the implied interest rate on external debt is quite low at around 1.7% (MoFEA 2014),

domestic interest rates remain high in Gambia, which is the result of a constant crowding out

of credit by the public sector (IMF 2015). Legal and institutional difficulties contribute to the

elevated domestic interest rates. Currently, the yields of TBills are equal to 15.73% (91day),

16.98% (182day) and 20.17% (364day). The rates of return on TBills and SAS bills follow

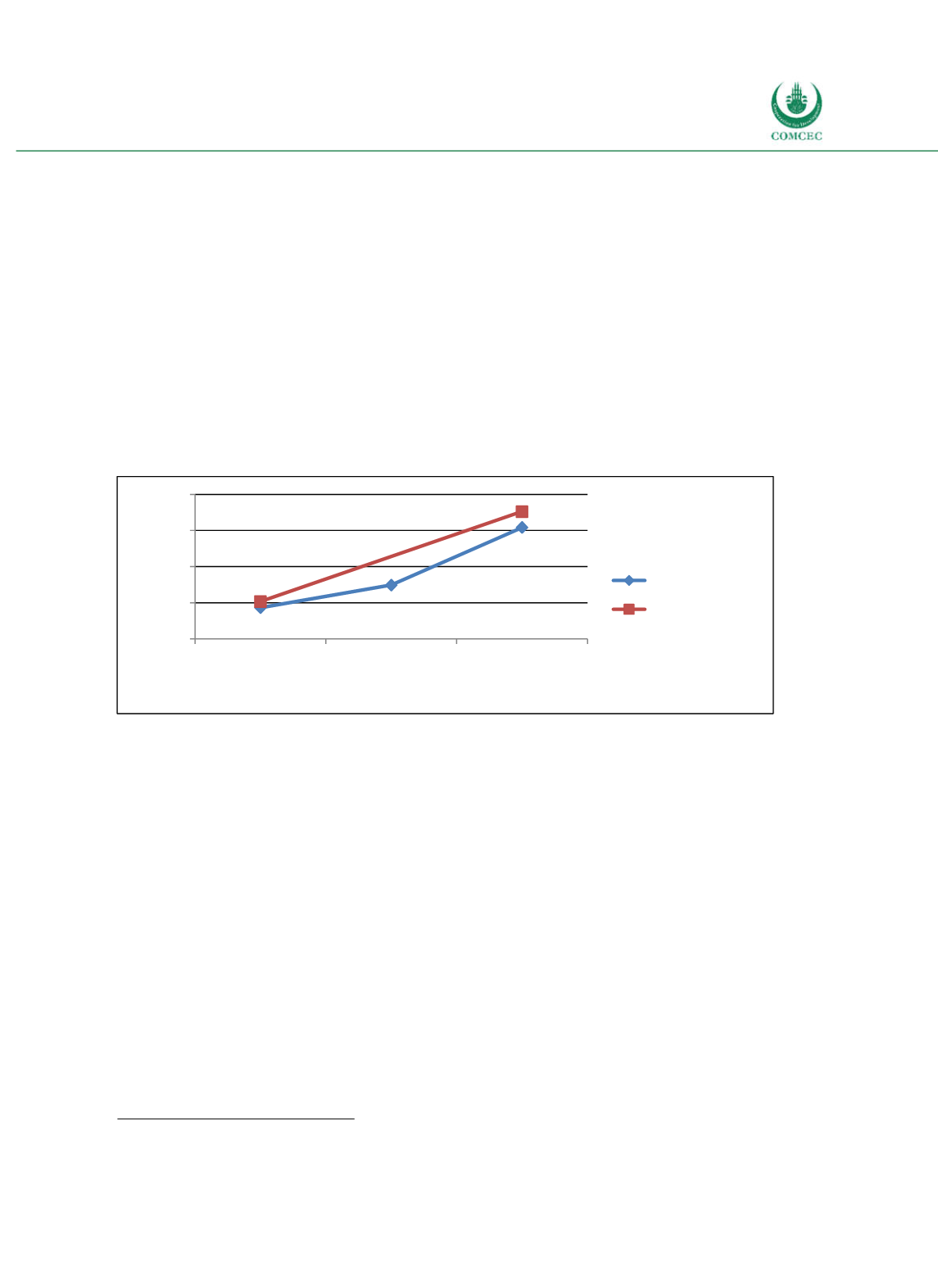

the form of classical yield curves (see Figure 42).

Figure 4-2: Gambia - Yield Curves of T-Bills and Sukuk (2016)

Sources: Central Bank of the Gambia (2016), calculations by the Ifo Institute.

C) Policy Recommendations

Public debt management in Gambia needs to be improved although “efforts are underway”

(IMF 2015, p. 9). The government has installed a public debt management office but still

several institutions and committees are involved in debt management. The MTDS does not

include numerical strategic targets and benchmarks regarding the risks the government’s debt

portfolio is facing.

15

Domestic debt is confronted with high interest rate risk and refinancing risk because of short

maturities. The government is advised to use more longterm debt instruments to lengthen the

average time of maturity of domestic debt. The strong reliance of the government on

borrowing from the banking sector gives rise to a crowdingout of private credit. The

government is advised to take measures to develop the domestic debt market and diversify the

creditor structure. It is recommended to strengthen market oriented practices and reduce debt

at the central bank that currently holds about 37% of domestic debt.

External debt is influenced by the depreciation of dalasi. Monetary policy is likely to reduce the

effect of depreciation on the national currency. The CBG needs to use the monetary policy tools

15

Numerical targets are, however, included in the Annual Public Debt Bulletin.

14 16 18 20 22

91days

182days

364days

Yield (in %)

Maturity

TBills Sukukalsalam