Improving Public Debt Management

In the OIC Member Countries

169

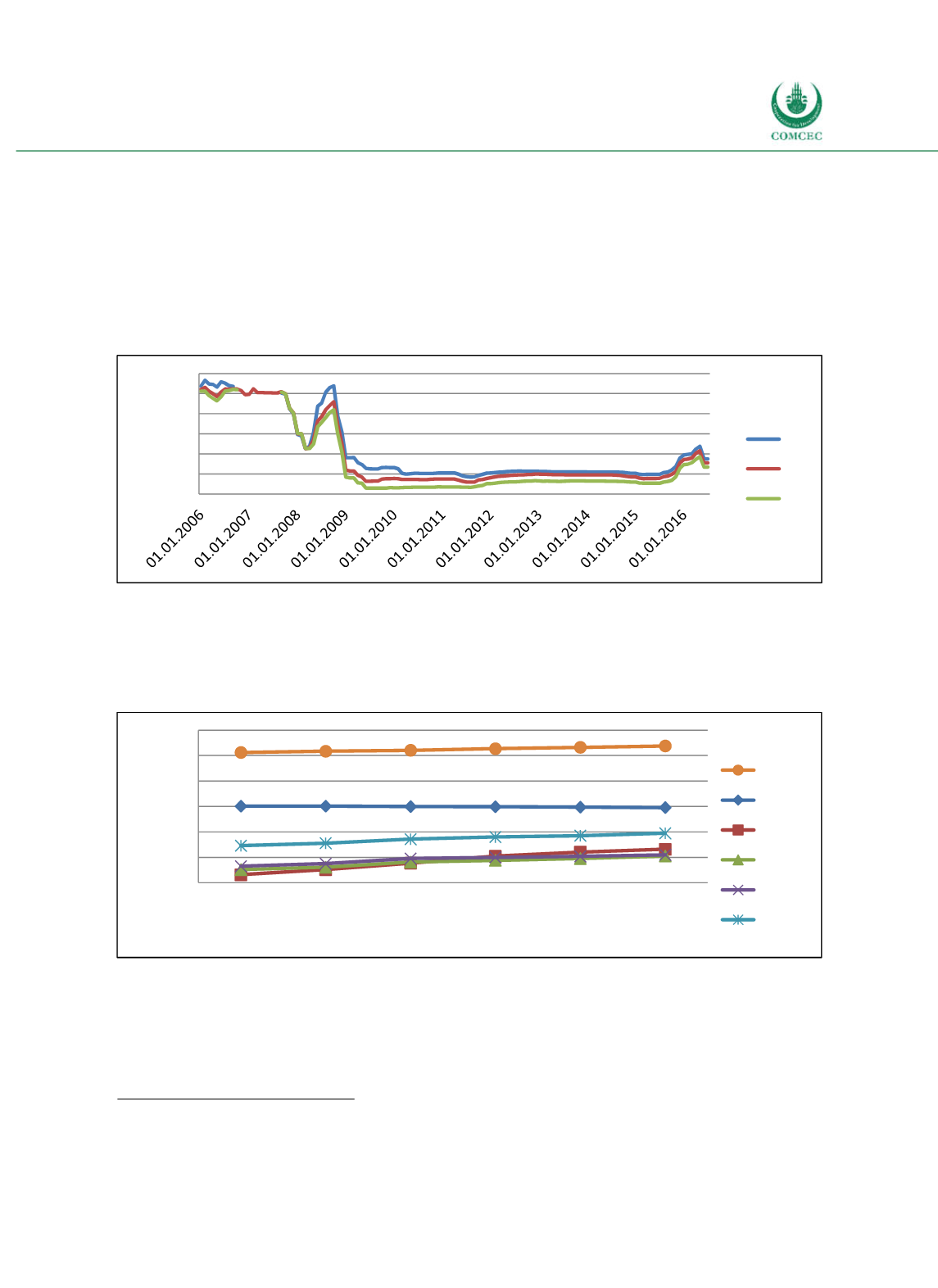

yields on SAMA Bills were stable but in the second half of 2015, yields began to increase.

Currently, yields on SAMA Bills with one year maturity note at 1.755%. Interest rates on

government bonds are likely to increase further, because rating agencies have downgraded the

creditworthiness of Saudi Arabia as a response to the drawback of deposits, which were used

to cover the decline in oil revenues (Financial Times 2016). However, the SAMA (2016a)

expects that overall investor confidence in Saudi Arabia will not diminish further as the

speculative behaviour in the foreign exchange market was quickly selfcorrected because of

the SAMA’s strong commitment to its fixed exchange rate policy.

Figure 4-43: Saudi Arabia - Yields on SAMA Bills

Source: Investing (2016).

Figure 444 shows that the yield curves of SAMA Bills had a positive slope in all years except

for 2008. The flat yield curve in 2008 can be seen as an indicator for the anticipation of slower

economic growth during the global financial crisis.

Figure 4-44: Saud Arabia - Yield Curves of SAMA Bills

Source: Investing (2016).

Saudi Arabia is one of the leading countries in Islamic finance (COMCEC 2014). Saudi Arabia

does, however, not officially recognize the concept of Islamic banking. Instead it is argued that

“all banks operating in Saudi Arabia are by definition Islamic” (Warde 2000, p. 208).

33

Although some commercial banks have an internal

sharia

board, there is no such board on the

33

Critics argue that banks in Saudi Arabia can circumvent Islamic banking practices, for instance by declaring interest

income as “special commission income”, “service charges” or as “bookkeeping fees” (Warde 2000, p. 208).

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Percent

1Y

3M

1M

0.0 1.0 2.0 3.0 4.0 5.0 6.0

1M 2M 3M 6M 9M 1Y

Yield (in %)

Maturity

2006 2008 2010 2012 2014 2016