Improving Public Debt Management

In the OIC Member Countries

173

and governments. Regarding private credit, these countries have difficulties to finance

themselves on international capital markets. Official creditors lend at preferential interest

rates and at longer maturities than private creditors. Consequently, the case study countries

with a high share of external public debt have lower interest rates and longer average

maturities in their government debt portfolio.

Other case study countries such as Egypt and Lebanon strongly rely on the domestic debt

market. High interest rates on government debt and preferences for safe lending reduce the

incentives of banks to provide credit to the private sector in these countries, giving rise to a

crowdingout of bank loans to the private sector. Banks tend to invest in shortterm

instruments to avoid asset and liability mismatches with shortterm bank deposits.

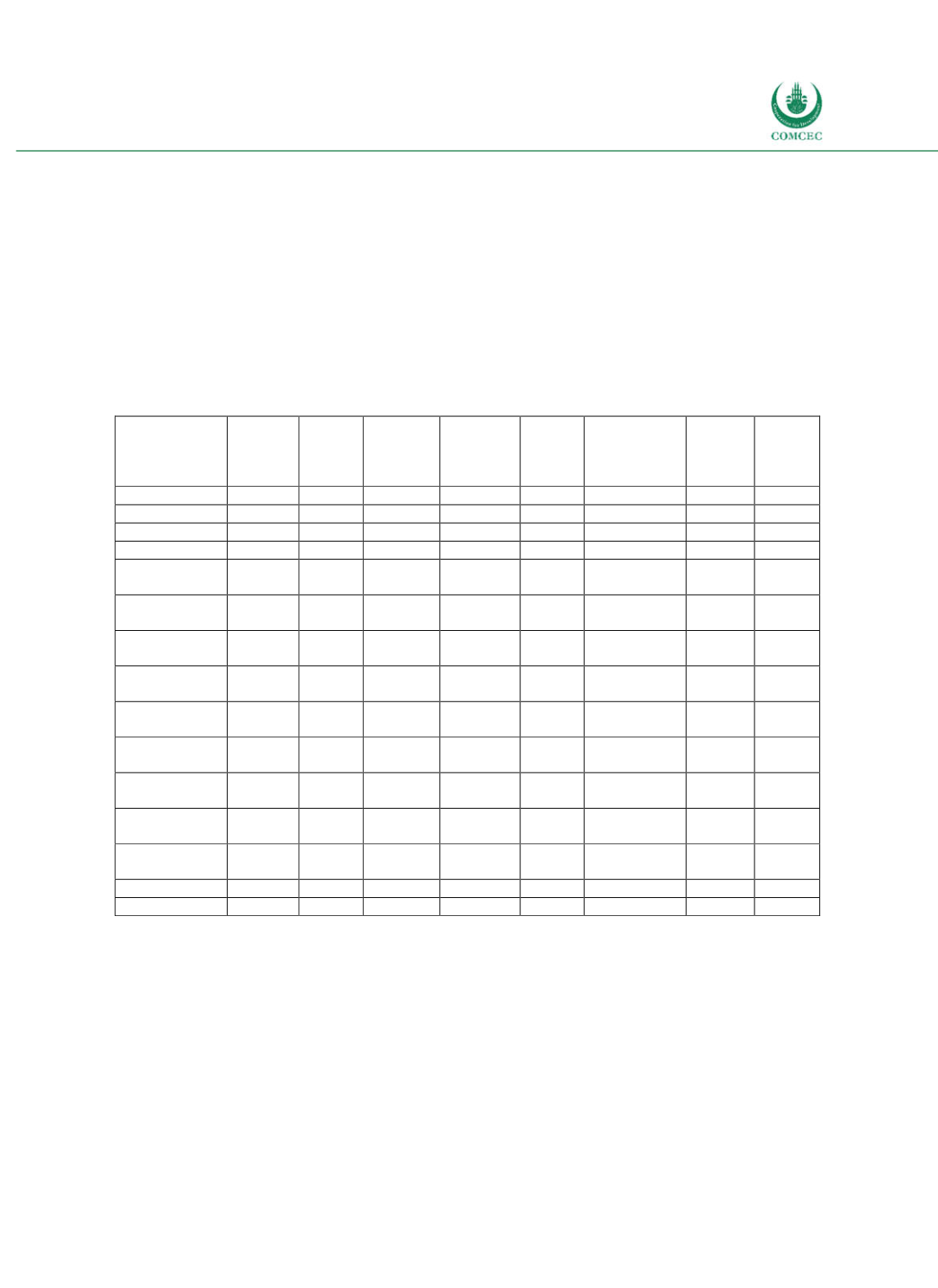

Table 4-12: Comparison of Debt Levels and Structures in Case Study Countries (2015)

Country

Income

group

Debt (%

of GDP)

Share of

ext. debt

(% of

total)

Avg.

interest

rate (%)

ATM

(years)

Debt

maturing in 1

year (% of

total)

ATR

(years)

Fixed

rate

debt (%

of total)

Gambia

Low

91.6

54.8

6.0

7.5

7.3

97.1

Mozambique

Low

74.8

83.2

2.9

13.5

2.7

12.6

Togo

Low

61.9

46.9

3.3

5.7

18.9

5.7

88.8

Uganda

Low

35.4

62.9

4.0

11.9

14.1

11.6

Egypt

Lowermiddle

87.7

8.7

11.3

2.2

55.1

2.2 100.0

Indonesia

Lowermiddle

27.3

58.7

9.4

8.8

86.3

Nigeria

Lowermiddle

11.5

18.1

10.8

7.2

36.1

7

99.0

Sudan

Lowermiddle

68.9

88.8

Albania

Uppermiddle

71.9

46.9

4.9

55.9

3.2

Iran

Uppermiddle

17.1 13.6*

Kazakhstan

Uppermiddle

23.3

26.0

100.0

Lebanon

Uppermiddle

139.1 13.8

6.4

4.3

20.4

4.3 100.0

Turkey

Uppermiddle

32.6

35.1

6.4

67.6

Oman

High

20.6

59.8

100.0

Saudi Arabia

High

5.8

0.0

Note: ATM = Average Time to Maturity; ATR = Average Time to Refixing, * = value for 2013.

Sources: WEO (2016), World Bank, public debt management strategies, calculations by the Ifo Institute.

Given the different debt levels and structures, debt management strategies vary among the

case study countries. Out of the 15 case study countries, eleven countries have developed

formal debt management strategies (see Table 413). Uganda, Egypt, Indonesia, Nigeria,

Albania and Lebanon have published numerical targets for risks in the public debt portfolio.

Turkey has set numerical targets but does not disclose these numbers. Gambia, Mozambique

and Togo have set general objectives but do not formulate specific targets. Saudi Arabia, Sudan,

Kazakhstan, and Oman have not or do not disclose targets.