Improving Public Debt Management

In the OIC Member Countries

164

Borrowing and related financial activities

Operations (incl. Islamic finance)

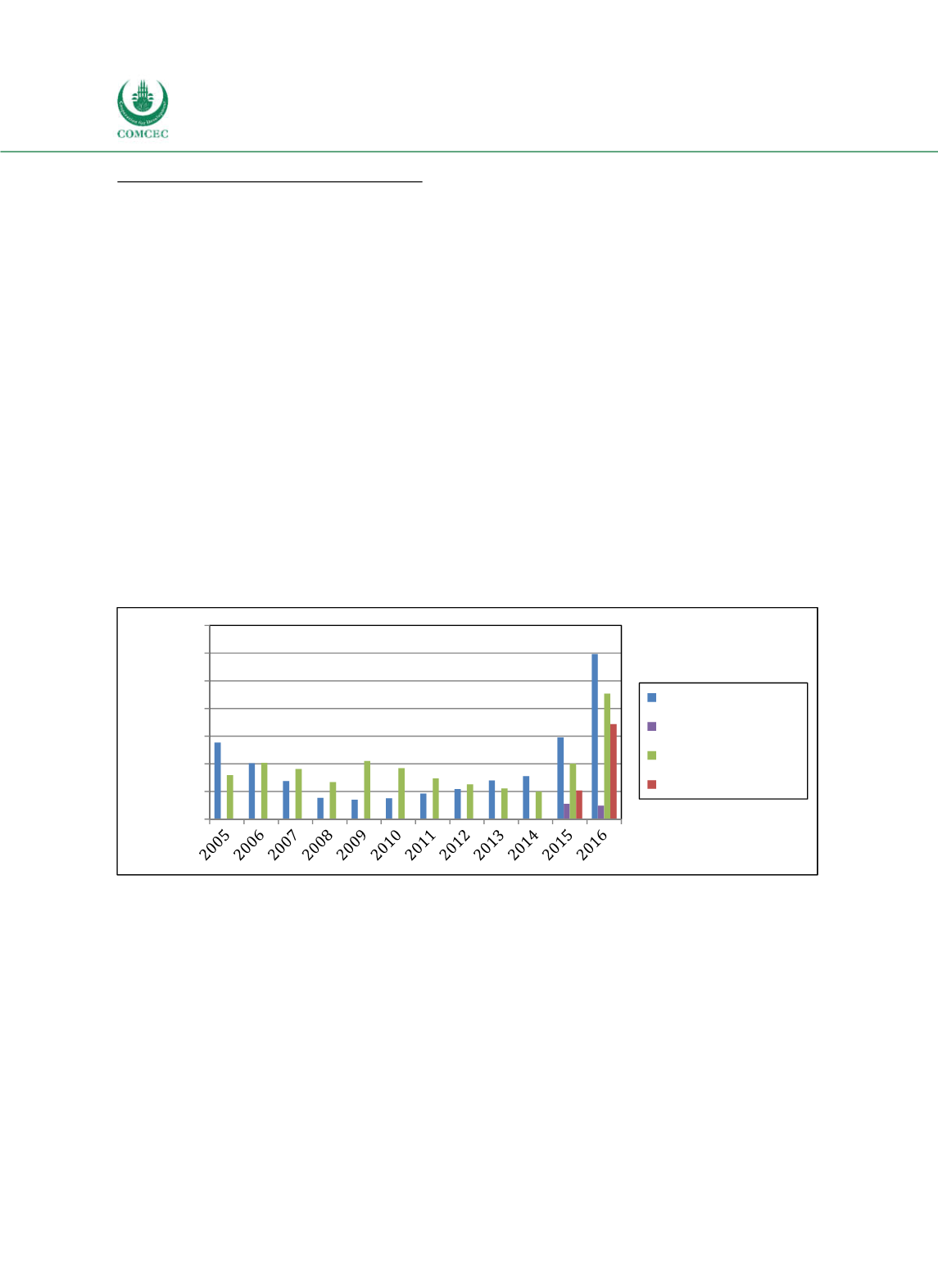

Oman uses Government Development bonds (GDB),

sukuk

, loans and TBills in public debt

management. The amount of outstanding GDBs steadily declined until 2011, but has increased

again significantly in the last years (see Figure 440).

In October 2015, Oman issued sovereign

sukuk

for the first time, totaling $649.3 million and

having a maturity of five years (Economist 2015). The strong investors’ demand for Oman’s

sukuk

encouraged the government to return to the debt market in the coming periods. In June

2016, Oman issued

sukuk

again, totaling $500 million with a profit rate of 3.5% per annum.

The

sukuk

are based on an alIjara structure and have a maturity of six years (Moody’s 2016).

Issuing

sukuk

supports developing Oman's Islamic finance market and opens a new channel to

raise money for the government. Plans to issue

sukuk

denominated in U.S. dollar again in the

near future exist.

In March 2015 the CBO issued TBills i.e. shortterm highly secured financial instruments, with

maturities of 91 days and less frequently 364 days to domestic banks for the first time after

several years of nonissuing TBills. The outstanding amount of TBills was RO 64.2 million

($166.7 million) at the end of 2015. In June 2016, domestic banks invested RO 420.5 million

($1092.6 million) in TBills (Central Bank 2016).

Figure 4-40: Oman - Outstanding Public Debt by Instruments

Source: Central Bank of Oman (2011, 2016), Economist Intelligence Unit (2015), Moody’s (2016), Wall Street

Journal (2016), calculations by the Ifo Institute.

Domestic debt market

The share of domestic debt in total debt was about 40% over the period 20052016. Banks

hold the largest share of GDBs (55.1%), followed by pension funds (36%) other financial

institutions (8.5%). Individuals only hold about 0.2% of GDBs. In order to augment liquidity in

the banking sector and encourage investments, Oman decided in April 2016 to permit banks’

investments in TBills, GDBs and Oman sovereign

sukuk

to be part of eligible reserves up to a

maximum of two percent of deposits (Central Bank 2016). The scope for further domestic

borrowing is limited, because the liquidity of the local market is relatively shallow.

0% 2% 4% 6% 8% 10% 12% 14%

Share of GDP

Development bonds

Sukuk Loans Treasury Bills