Improving Public Debt Management

In the OIC Member Countries

168

Borrowing and related financial activities

Operations (incl. Islamic finance)

Bond markets in Saudi Arabia have undergone a rapid evolution since 1988, when the first

sovereign bonds were issued. Issuance procedures, pricing mechanisms, maturity selection

and the utilization of Repos are fields that have experienced major changes in the last 15 years

(AlSayari 2003). While the government has mainly used its deposits at the central bank to

cover the deficit in the past, the bond market in Saudi Arabia is on the rise.

Government Development Bonds (GDBs) were lastly issued in 2007. Maturities of GDBs ranged

from two to ten years (AlDarwish et al. 2014). The investors in GDBs included domestic

financial institutions, banks and foreign investors (AlSayari 2003). The first sovereign bond

issuance since 2007 took place in mid2015 as financing needs increased following the

declining oil prices. The issuance in the amount of $4 billion was sold to domestic quasisovereign financial institutions (Reuters 2015). These conventional bonds, which were issued

with maturities of seven and ten years, had an initial yield of 2.57% and 2.88% (Reuters 2015).

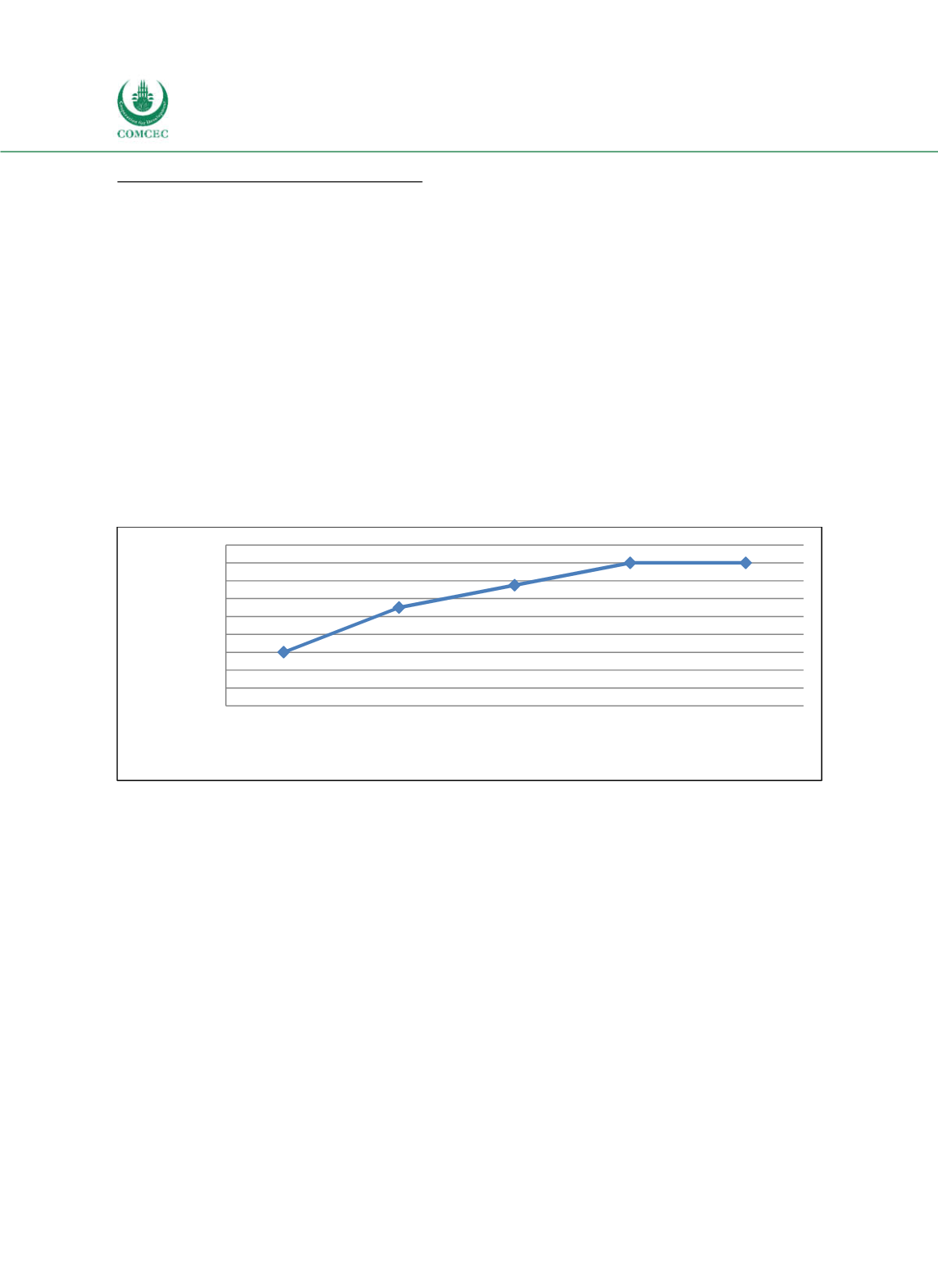

The yield curve of government bonds shows a normal positive slope (see Figure 442).

Figure 4-42: Saudi Arabia - Yield Curve of GDBs (2007) and Government Bonds (2015)

Note: The yield curve for the GDBs is based on data from 2007, when they were lastly issued.

Source: SAMA (2016b), Reuters (2015).

To support the development of the domestic debt market and to conduct monetary policy, the

SAMA uses its own instruments: Repo and reverse Repo overnight operations, and SAMA Bills

and SAMA

Murabaha

with maturities ranging from one week to one year (AlDarwish et al.

2014). The return of SAMA Bills equals 80% of the Saudi Interbank Bid Rate. This rate is the

key interbank rate in Saudi Arabia, and serves as a benchmark for commercial and consumer

lending rates. SIBOR is influenced by the policy of SAMA, which sets the reverse Repo rate. The

reverse Repo rate is the key policy rate and marks the rate that commercial banks in Saudi

Arabia get on their deposits with SAMA. Changes in the reverse Repo rate can therefore add or

reduce liquidity in the markets. As the SAMA uses an exchange rate anchor in its monetary

policy framework the reverse Repo rate is set with reference to the target rate of the U.S.

Federal Reserve (Algahtani 2015).

Figure 443 shows yields on SAMA Bills with three different maturities over time. Yields

drastically declined in 2008/2009, which is a result of the reduction of interest rates (Repo

and reverse Repo rate) by the SAMA following the financial crisis and the subsequent

reduction of the target rate of the U.S. Federal Reserve. Between 2010 and the middle of 2015,

4.7000 4.8000 4.9000 5.0000 5.1000 5.2000 5.3000 5.4000 5.5000 5.6000

Two years

Three years

Five years

Seven years

Ten years

Yield (in %)

Maturity