Improving Public Debt Management

In the OIC Member Countries

166

4.1.15

Kingdom of Saudi Arabia

A) Public Debt Dynamics

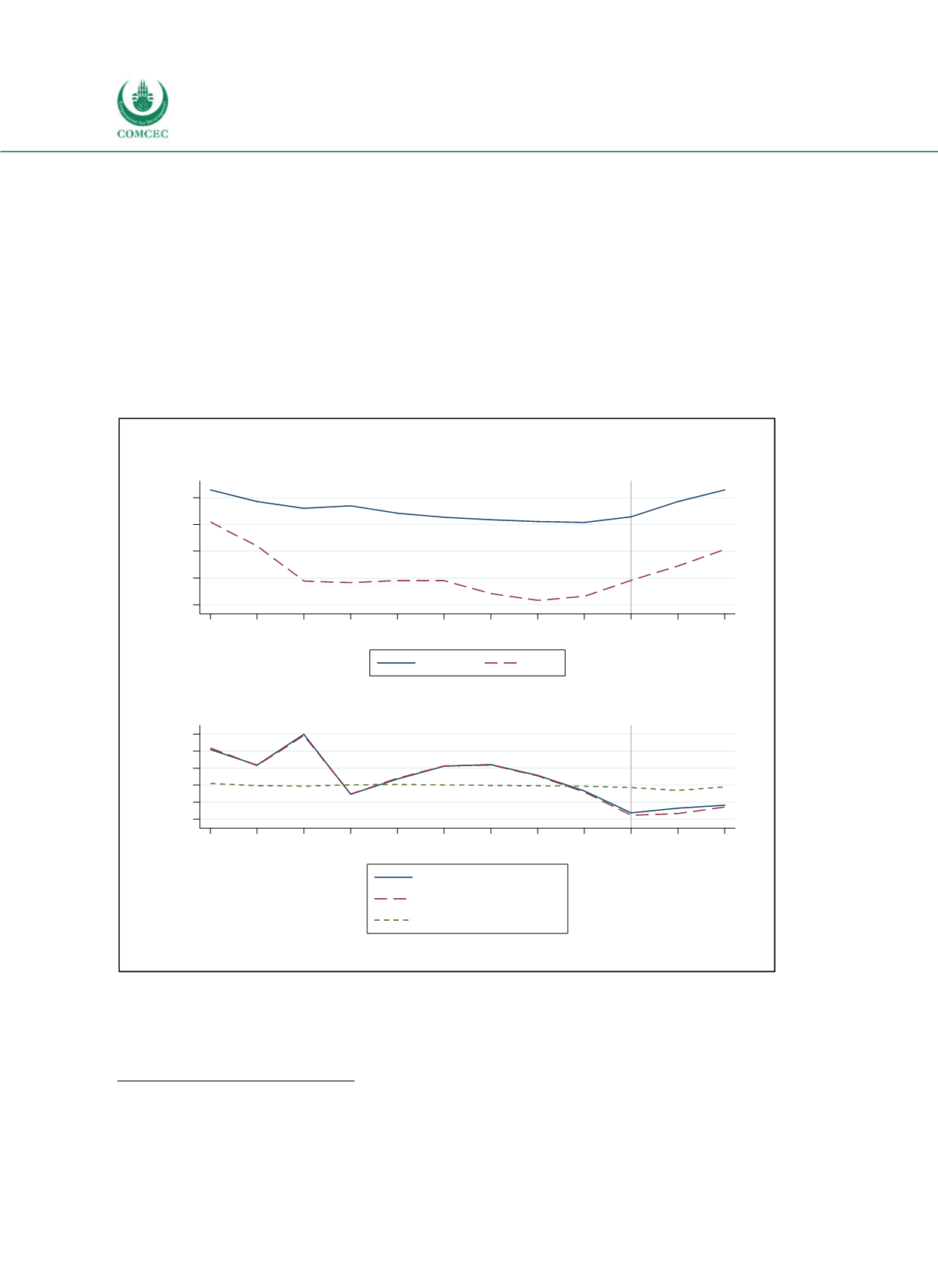

The Kingdom of Saudi Arabia’s general government debt levels have been low until 2014

because of high oil revenues (see Figure 441).

32

Since 2007, when the debttoGDP ratio was

about 17.1% of GDP, Saudi Arabia has even managed to reduce the ratio to 1.6% in 2014 and

the country had deposits in the banking system in the amount of 56% of GDP at end2014 (IMF

2015b). Until 2015, the government of Saudi Arabia mainly used its financial reserves to cover

budget deficits (Torchia 2015). Net lending was always positive between 2006 and 2014 with

the exception being 2009, when the global financial crisis hit the oilproduction based

economy.

Figure 4-41: Saudi Arabia – Public Debt Dynamics

Sources: WEO (2016), IMF (2015a, 2016b), calculations by the Ifo Institute.

The decline in oil prices starting in 2014, however, gave rise to a decline in oil revenues. Since

then, the government has been in a net borrowing position, which reached its maximum at

16.3% of GDP in 2015. Saudi Arabia used deposits in the central bank to finance the deficit, but

32

Oil revenues accounted for about 90% of central government fiscal revenues before 2015. The share of oil revenues is

expected to decrease to around 80% for the years 2015 and 2016 because of the decline in oil prices (IMF 2015a,

2015b).

-60 -40 -20 0 20

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Gross

Net

Projections

Public Debt

-20 -10 0 10 20 30

% of GDP

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Net lending

Primary net lending

Net interest payments

Net Lending