Improving Public Debt Management

In the OIC Member Countries

159

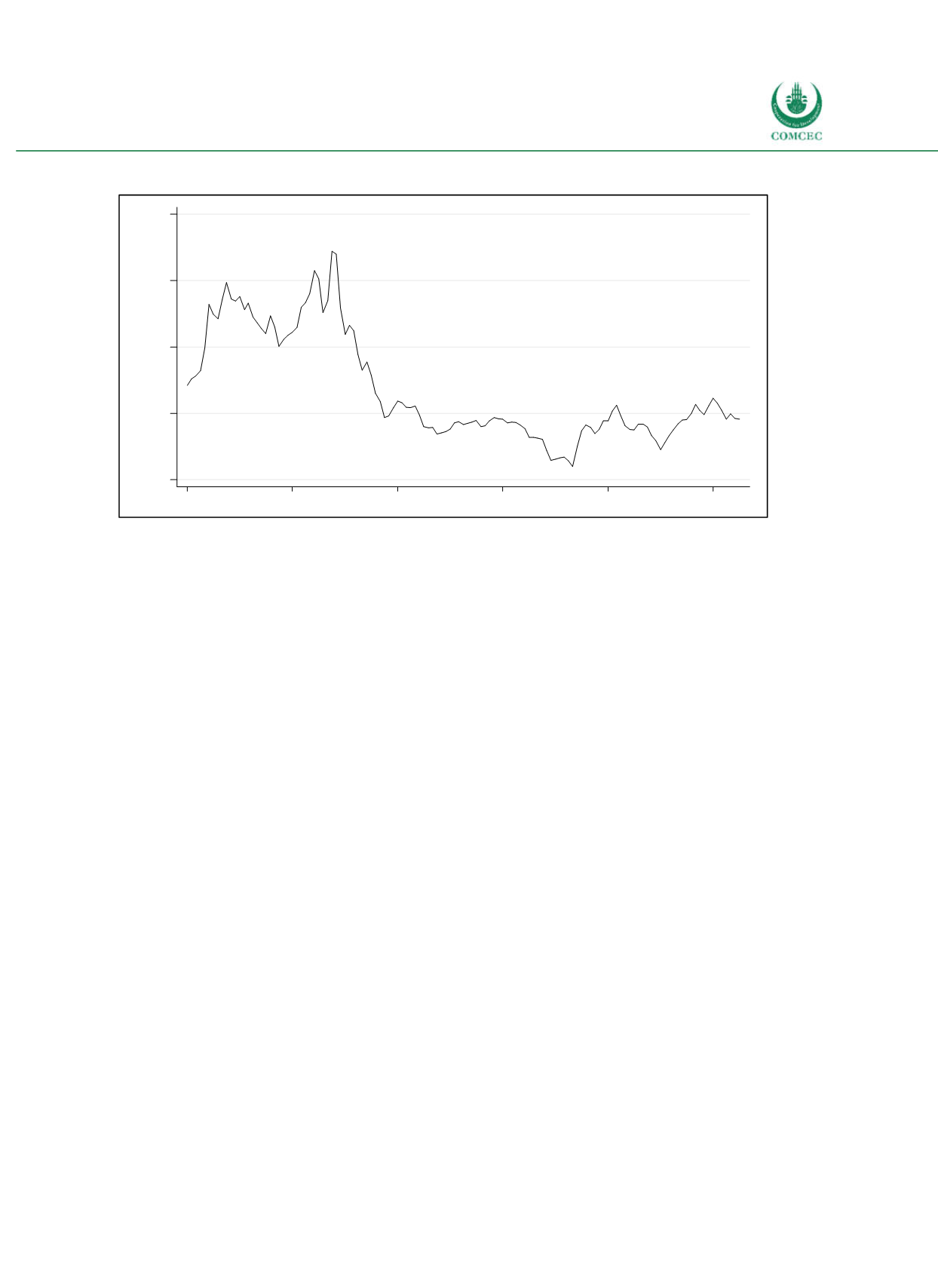

Figure 4-38: Turkey - 10-year Bonds Yields

Source: Eurostat (2017).

Changes in regulations dating back to 1983 allow the establishment of Islamic banks in Turkey

(Erol et al. 2014). Currently there are four Islamic banks operating in the Turkish banking

sector. Two Islamic banks, Albaraka Turk Participation Bank and Kuveyt Turk Participation

Bank are foreign owned. Bank Asya and Turkey Finance Participation Bank are privately

owned. In contrast to other OIC member states the regulation of the banking sector in Turkey

is based on Western type traditional banking systems as opposed to a regulatory framework

that is based on compliance with

shariah

. Since 1999, participation banks in Turkey are subject

to the same regulative rules as common commercial banks are. Regulations, such as a required

minimum stake in shortterm financial assets, which aim at sufficient liquidity provision,

present difficulties for Islamic banks (Erol et al. 2014). The confidence in Islamic banks in

Turkey was strengthened by the fact that none of them failed in the 2001 crisis, as opposed to

18 other banks. Typical characteristics of Islamic banks, namely that they are not (or only to a

certain extent) exposed to interest rate risks and exchange rate fluctuations, turned out to be

an advantage of Islamic banks over commercial banks (Erol et al., 2014). However, in

comparison to other OIC member countries the share of Shariacompliant deposits in total

commercial bank deposits is relatively small, accounting for only 6.6% in 2013 (Henry, 2016).

Concerning public bonds, the Public Finance and Debt Management Law (No. 4749; article

7/A) was amended in June 2012 allowing Turkey to issue

sukuk

, i.e. to issue government bonds

in line with Islamic law. Specifically, the law amendment allows the establishment of public

special purpose vehicles (SPVs), also called Asset Leasing Companies, which are fully owned by

the Undersecretariat of Treasury. Those Asset Leasing Companies are allowed to issue lease

certificates on domestic and international capital markets. According to Undersecretariat of

Treasury, starting with the first issuance in September 2012

sukuks

amounting to more than

TRY 20 billion were sold. The majority was denoted in domestic currency, a smaller part in U.S.

Dollar.

Domestic debt market

There is a functioning domestic market for public debt. The share of domestic in total central

government debt has decreased slightly in the last three years and amounted to 65% in 2015.

The absolute majority of Turkey’s domestic debt is held by residents, but their share of around

5.00

10.00

15.00

20.00

25.00

Yields on 10y Gov. Bonds (in %)

2006

2008

2010

2012

2014

2016