National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

227

have separate divisions within the IFSB dealing with issues related to Islamic banking, takaful

and Islamic capital market segments. Both AAOIFI and IFSB have published Shariah

governance standards for Islamic financial institutions. However, there are no guidelines for a

national Shariah board. Given that national Shariah boards can contribute to harmonization of

practice and reduce Shariah compliance risks within jurisdictions, there is a need to come up

with a framework for it. Furthermore, the work on developing Shariah standards, parameters

and templates for Islamic financial products by AAOIFI, IsFA and IIFM need to continue to

enhance cross-border and international transactions by reducing legal and Shariah compliance

risks.

Though the sukuk market is growing, its size is still small in terms of global financial markets.

Globally the secondary markets for sukuk in most countries are shallow making them illiquid.

Although LMC and IILM are making available tradable

sukuk

catering to the liquidity needs of

Islamic financial institutions, the supply of instruments that fulfil the Basel III liquidity

requirements is small relative to the demand. Furthermore, IFSB and IIFM can develop

guidelines and templates to strengthen money markets, secondary markets for Islamic

securities and LOLR facilities for Islamic banks. Furthermore, there is a need to establish an

Islamic Monetary Fund (IsMF) that can either provide Shariah compliant liquidity at the global

level or coordinate arranging liquidity from other central banks by using swap arrangements.

There is significant progress made in developing accounting and auditing standards by AAOIFI.

Furthermore, AAOIFI and IFSB has also published disclosure guidelines for the banking and

takaful sectors. However, there is a need to develop detailed disclosure guidelines for Islamic

capital markets and Shariah compliance of products and securities. Ratings agencies that can

assess Shariah compliance and risks in equity based instruments would further strengthen the

information infrastructure for the industry.

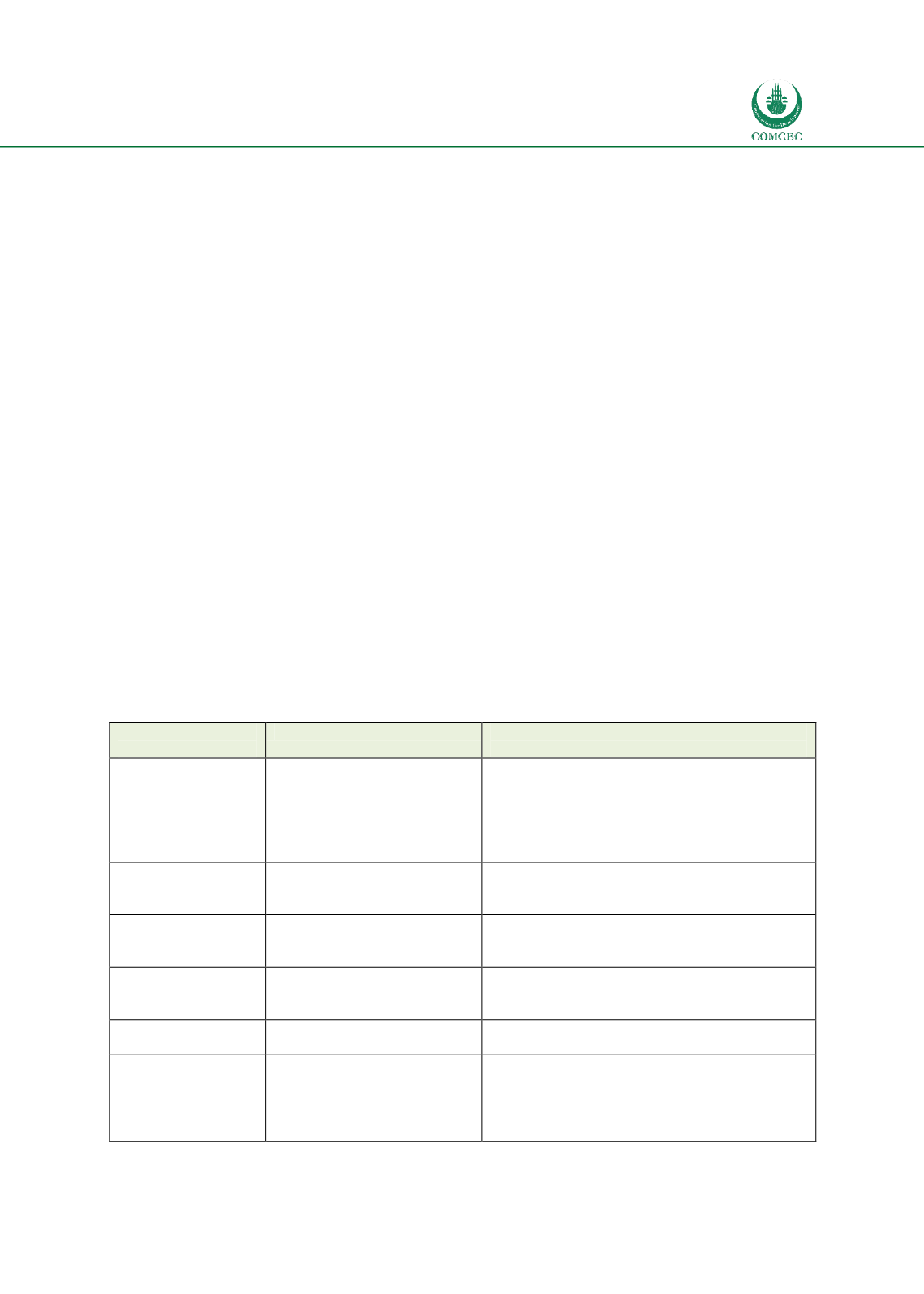

Table

8.2: Status and Responsible Stakeholders and the International Level

Infrastructure

Institutions

Gaps

Suggested Institutions and Initiatives for

Islamic Finance

Legal Infrastructure

Develop model Islamic

financial, tax and bankruptcy

laws

Create a new body/entity Stability Board for SBIF

(either by OIC/COMCEC or D-8)

IDB can initiate Islamic Law & Policy Program

Regulation &

Supervision

Framework

Strengthen existing institutions

and encourage implementation

of International standards.

Strengthen IFSB (have three Assistant Secretary

Generals for Banking, Takaful and Capital

Markets)

Shariah Governance

Regimes

Strengthen existing institutions

and encourage implementation

of International standards.

SBIF coordinate the Shariah issues with AAOIFI,

IsFA, IFSB and IIFM

Liquidity

Infrastructure

Strengthen existing institutions Establish IsMF to develop liquidity management

framework in coordination with IDB IFSB, IIFM,

IILM and LMC

Information

Infrastructure &

Transparency

Strengthen existing institutions

and encourage implementation

of International standards.

SBIF coordinate accounting and auditing issues

with AAOIFI, IFSB and IIRA

Consumer Protection

Architecture

Create new and strengthen

existing institutions

SBIF coordinate accounting and auditing issues

with IFSB, CIBAFI, IADI

Human Capital &

Knowledge

Development

Create new and strengthen

existing institutions

SBIF and IDB can coordinate with AAOIFI, CIBAFI,

GIFDC, IDB, IFSB SBIF and IsMF and develop

technical assistance programs to enhance

knowledge and skills related to Islamic financial

architecture