National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

229

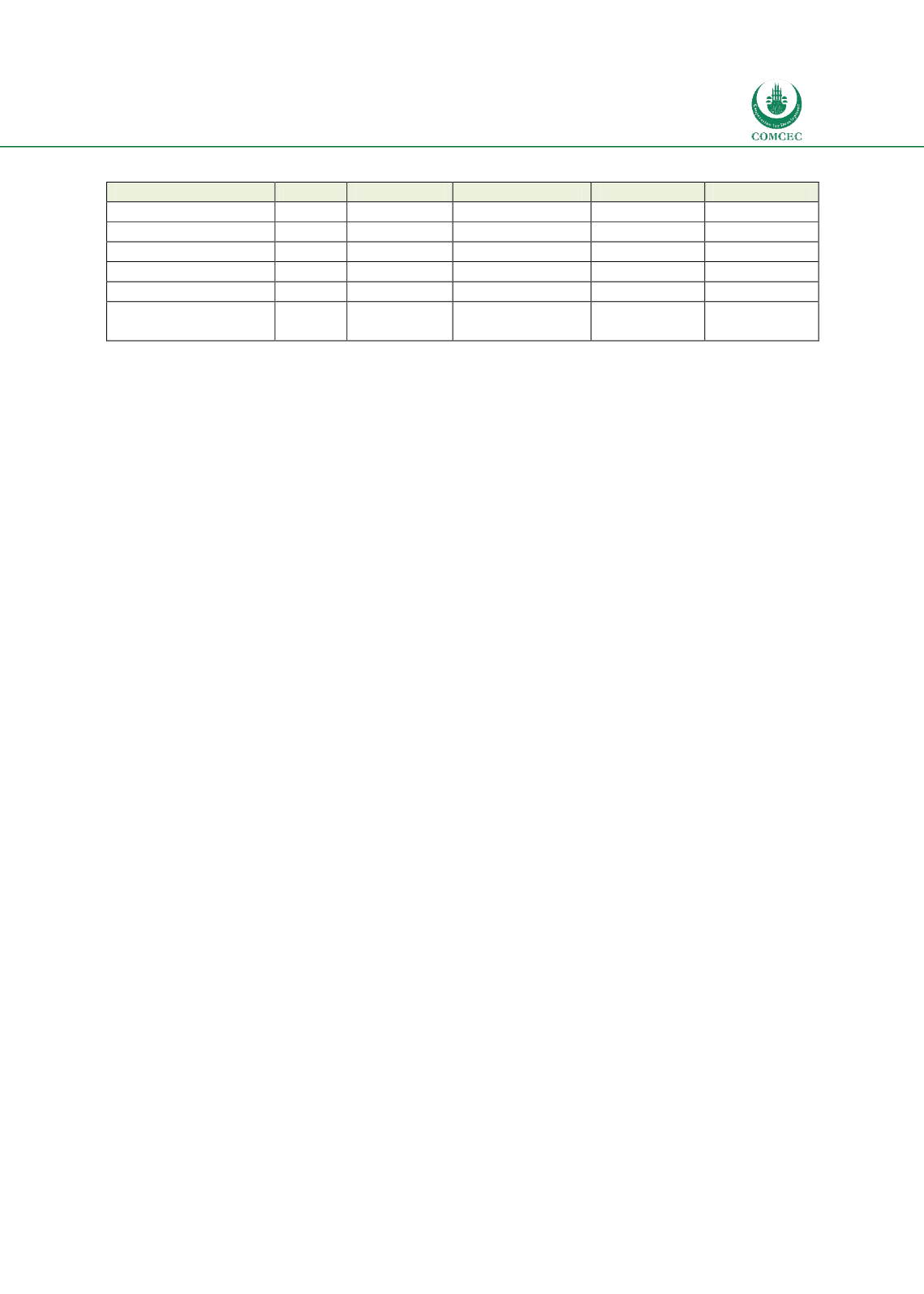

Table

8.3: Summary Status of Activities in Global Financial Centres

Activities

UK

Germany

Luxembourg

Singapore

Hong Kong

Retail Banking

Yes

Yes

No

Yes

No

Wholesale Banking

Yes

No

No

Yes

No

Takaful/Retakaful

Yes

No

No

Yes

No

Funds

Yes

No

Yes

Yes

Yes

Sukuk

Yes

No

Yes

Yes

Yes

Education/Training

Programmes

Yes

Yes

Yes

Yes

No

8.4. Concluding Remarks

A financial system performs certain core functions in the economy that contribute to growth

and development. The future growth of Islamic finance will depend on two key interrelated

factors: the levels of demand and the capabilities of financial sector satisfy the demands of

different stakeholders. Given that the financial sector is complex and one of the most regulated

industries, the ability of the financial sector to provide financial services will partly depend on

supporting infrastructural institutions. Appropriate infrastructural institutions are needed to

reduce the risks and vulnerabilities that can potentially lead to harmful and costly economic

downturns. Compliance with the Shari’ah introduces some unique risks in Islamic financial

institutions that may need specific attention. Supporting architectural institutions will become

important for the future growth and expansion of the Islamic financial sectors in the future.

As establishing the financial architecture is the prerogative of state institutions, the case

studies show that financial architectural environment under which Islamic financial sector

operates can be distinguished as facilitative and market driven. In the former, the government

and public bodies take an active role in providing supportive infrastructure framework. In

countries that do not have supportive legal and regulatory environments, the industry is

market driven and has to adjust its operations to laws and regulations. This not only affects the

type of products that the Islamic financial sector can provide but also introduces legal risks and

limits the growth of the industry. At the national level, the governments can introduce

supportive infrastructural institutions.

Moving forward, this study has identified some of the financial architectural elements that

need to be strengthened for the development of the Islamic financial industry. While the study

has identified the architectural elements that need to be strengthened, their development

would require in-depth work to come up with appropriate detailed solutions and models.

Different international Islamic infrastructure organizations can play a supporting role in this

regard by providing standards, guidelines, principles and templates that different countries

can use. These organizations can also collaborate with their conventional counterparts to

further enhance cooperation and provide the necessary tools for the sound and robust growth

of Islamic finance globally. Although these institutions have published various standards and

principles, their adoption by OIC MCs will depend on relevant public authorities in general and

regulators in particular.

The future growth of the Islamic financial sector will also depend on the demand for its

products and services. Significant parts of the growth in demand will come from Muslims who

opt for Islamic finance due to religious reasons. For this captive market, mitigating Shariah

compliance and reputational risks is important for further expansion in the future. Islamic