Risk Management in

Islamic Financial Instruments

98

Avg Equity (ROAE) are both higher for the Islamic banks (1.24% and 11.05%) compared to the

same of conventional banks (1.04% and 8.23%). But, the conventional banks have higher

dividend payout ratio. (See Chart 4.49)

Net

Interest

Margin

%

2013

Net Int

Rev / Avg

Assets

%

2013

Non Int

Exp / Avg

Assets

%

2013

Pre-Tax

Op Inc /

Avg Assets

%

2013

Return On

Avg Assets

(ROAA)

%

2013

Return On

Avg Equity

(ROAE)

%

2013

Dividend

Pay-Out

%

2013

Islamic

1.407

1.3655

0.765667

1.432833

1.415667

8.949333

0

Conventional

1.288938

1.156917

1.580448

0.617573

0.533073

5.263042 0.452708

Liquidity Ratios

Chart 4.50 shows that, on the average, Islamic banks in Tunisia maintain a better liquidity

position compared to the conventional bank. Interbank ratio of 139% of the Islamic banks

suggests that they are lenders to interbank market while the conventional are in general

borrowers, with average interbank ratio as 82.97%. For the Higher ratios of Net Loans / Cust &

ST Funding and Net Loans / Tot Dep & Bor. represent lower liquidity which is the

representative trend for the conventional banks as compared to the Islamic banks.

Interbank

Ratio

%

2013

Net Loans /

Tot Assets

%

2013

Net Loans / Dep &

ST Funding

%

2013

Net Loans / Tot

Dep & Bor

%

2013

Liquid Assets / Dep

& ST Funding

%

2013

Islamic

300.3363

30.7675

37.02433

37.00367

40.69917

Convent

ional

90.13026

32.76673

43.55769

38.42176

11.56496

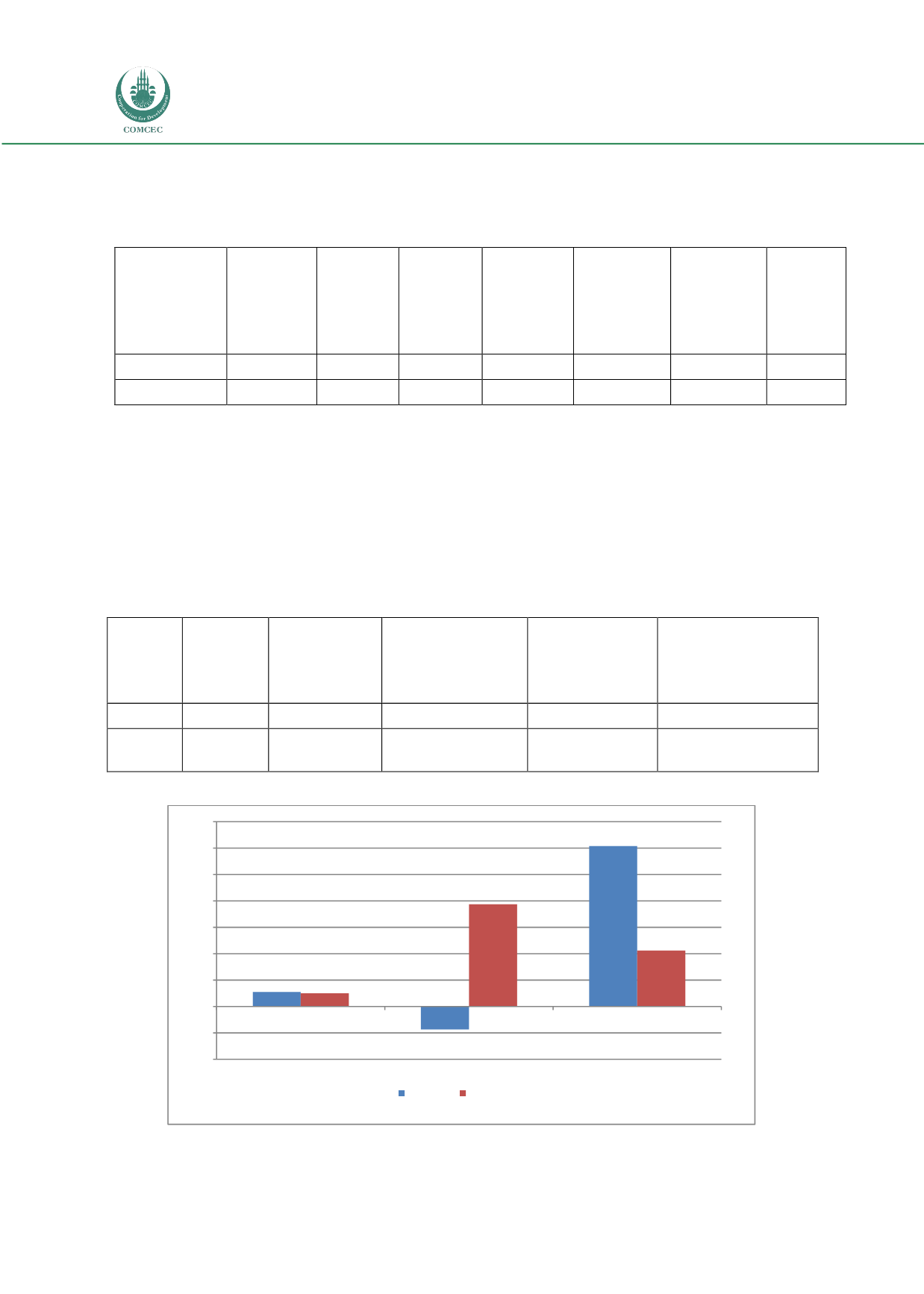

Chart 4.47: Asset Quality Ratios for Tunisian Banks

Source: BankScope Database 2013

2,73

-4,32

30,35

2,50

19,38

10,61

-10

-5

0

5

10

15

20

25

30

35

Loan Loss Res / Gross Loans

%

2013

Loan Loss Prov / Net Int Rev

%

2013

Loan Loss Res / Impaired Loans

%

2013

Islamic

Conventional