Infrastructure Financing through Islamic

Finance in the Islamic Countries

32

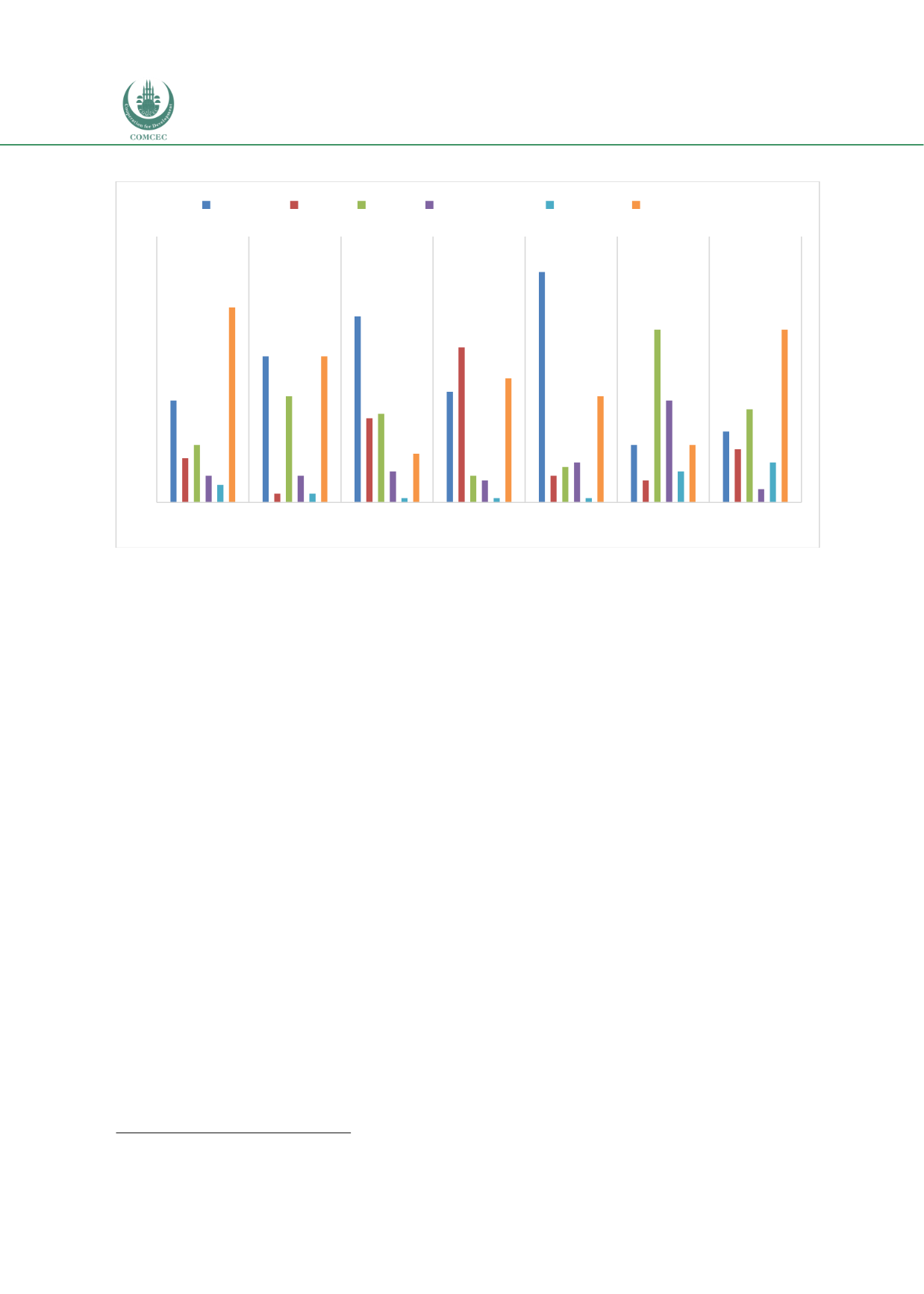

Chart 2.4: Global Sector-wise Infrastructure Investments (%)

Source: PWC & GIIA (2017)

Chart 2.3 shows the involvement of different institutional investors’ stakes in the

infrastructure projects under PPP arrangements globally. While in all countries the

corporations are the major investors in the infrastructure sector, in developed economies such

as Australia, Europe and North America the infrastructure funds and investment firms also

contribute significantly to the sector. Chart 2.4 shows the global investments in different

sectors of infrastructure. Investments in the transport and energy sectors dominate in

developing economies such as Africa, Asia and Latin America. In developed economies such as

Australia and Europe, the social sector has also received significant investment.

2.4.

Factors Affecting Financing Long-term Infrastructure Projects

Infrastructure can be considered as a separate investment class with risks and returns lower

than equity and higher than debt. Infrastructure assets, however, have some unique features

that affect the decisions for investment. Infrastructure projects are large, involve many

stakeholders and investment arrangements, and entail complex legal documentations and

intricate financial planning. The legal contracts have to ensure the proper allocation of risks

and returns to create the right incentives for attracting capital. The long timespan of

infrastructure projects also makes them less liquid. Investments in sustainable infrastructure

investments also appeal to ethical, green and impact investors. Some infrastructure projects

such as highway or water supply can be natural monopolies and governments would control

them directly or indirectly to ensure that monopoly power is not abused. The key factors that

affect private-sector financing of infrastructure projects are presented next.

5

2.4.1.

Infrastructure Policy Framework

The enormity of investments and the long-term nature of infrastructure financing require

appropriate policies and capabilities for implementation. Being large and long-term

5

Ehlers (2014), McKinsey (2016), GCEC (2016)

23%

33%

42%

25%

52%

13%

16%

10%

2%

19%

35%

6%

5%

12%

13%

24%

20%

6%

8%

39%

21%

6%

6%

7%

5%

9%

23%

3%

4%

2%

1%

1%

1%

7%

9%

44%

33%

11%

28%

24%

13%

39%

A F R I C A

A S I A

A U S T R A L A S I A E U R O P E

L A T I N

AM E R I C A

M I D D L E E A S T

NO R T H

AM E R I C A

% OF TOTAL

Transport

Social

Power

Environmental

Telecoms

Renewal energy