Infrastructure Financing through Islamic

Finance in the Islamic Countries

30

development assistance (ODA) and multilateral development banks (MDBs) are in the range of

USD 40-60 billion.

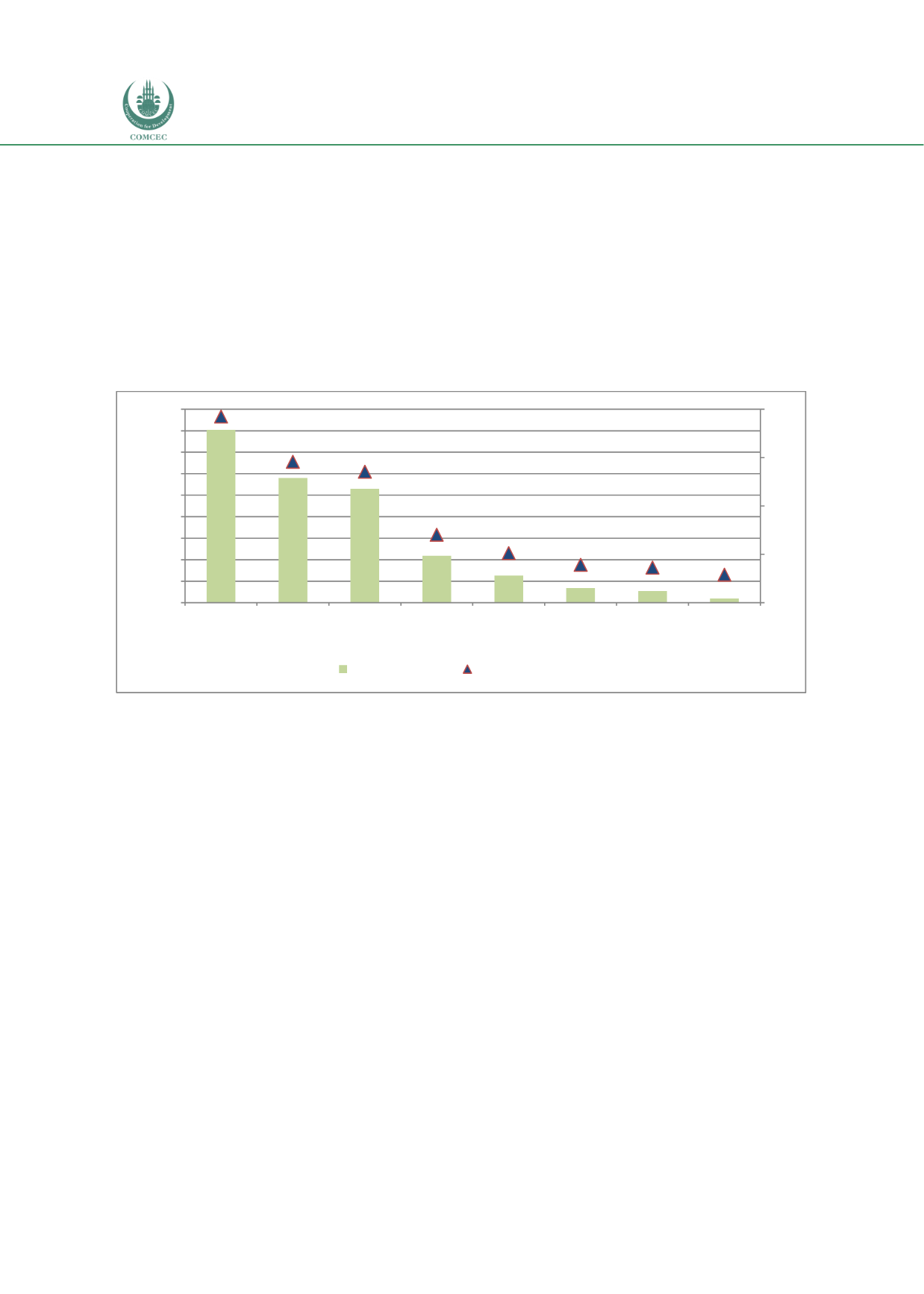

Chart 2.2 shows the relative size of different institutional investors globally. The largest three

institutional players are banks which hold 33.5% of the total global assets of USD200 trillion

followed by investment companies (24.2%) and insurance and pension funds (22.1%). The

extent to which different institutional investors can contribute to the infrastructure sector

depends on their balance sheet structures and risk appetite. The features of investment

horizon, risk appetite and considerations that different financial institutions have been shown

in Table 2.4 below.

Chart 2.2: Assets under Management of Institutional Investors (USD trillion)

Source: McKinsey (2016: p. 16).

Even though the banking sector has the largest assets under management, Table 2.4 shows it is

difficult for them to invest in large infrastructure projects due to the features of their balance

sheet. Given the nature of deposits that are liquid, it becomes difficult for banks to commit

large amounts of funds in infrastructure projects that are, by their nature, long-term and

illiquid. Larger banks would invest in infrastructure as an asset class but do so using

syndications. Since other institutional investors such as life insurance, pension funds,

sovereign wealth funds, endowments and foundations have relatively longer-term investment

horizons, they are well suited to invest in infrastructure projects.

In terms of the instruments used for financing long-term infrastructure, there is a difference

between providing direct financing versus raising funds from capital markets. Direct financing

either in the form of equity or debt makes investments illiquid, which can increase the risks

and costs. However, if capital markets are used to raise the funds by issuing tradable securities,

it would encourage financial institutions to invest in infrastructure projects. For example, if

tradeable project bonds are issued to raise funds, banks and other institutional investors

would also invest in infrastructure projects since, in case they need liquidity, they will be able

to sell the securities on the secondary market.

40.2

29

26.5

10.9

6.3

3.4

2.7

1

33.5%

24.2%

22.1%

9.1%

5.3%

2.8% 2.3%

0.8%

-5%

5%

15%

25%

35%

0

5

10

15

20

25

30

35

40

45

Banks

Investment

Companies

Insurance

Companies &

Private Pensions

Public Pensions &

Superannuation

Plans

Sovereign Wealth

Funds

Infrastrucure

Operators &

Developers

Infrastrucure &

Private Equity

Funds

Endowments &

Foundations

USD (trillion)

AUM ($ trillion)

Percentageof total