Infrastructure Financing through Islamic

Finance in the Islamic Countries

31

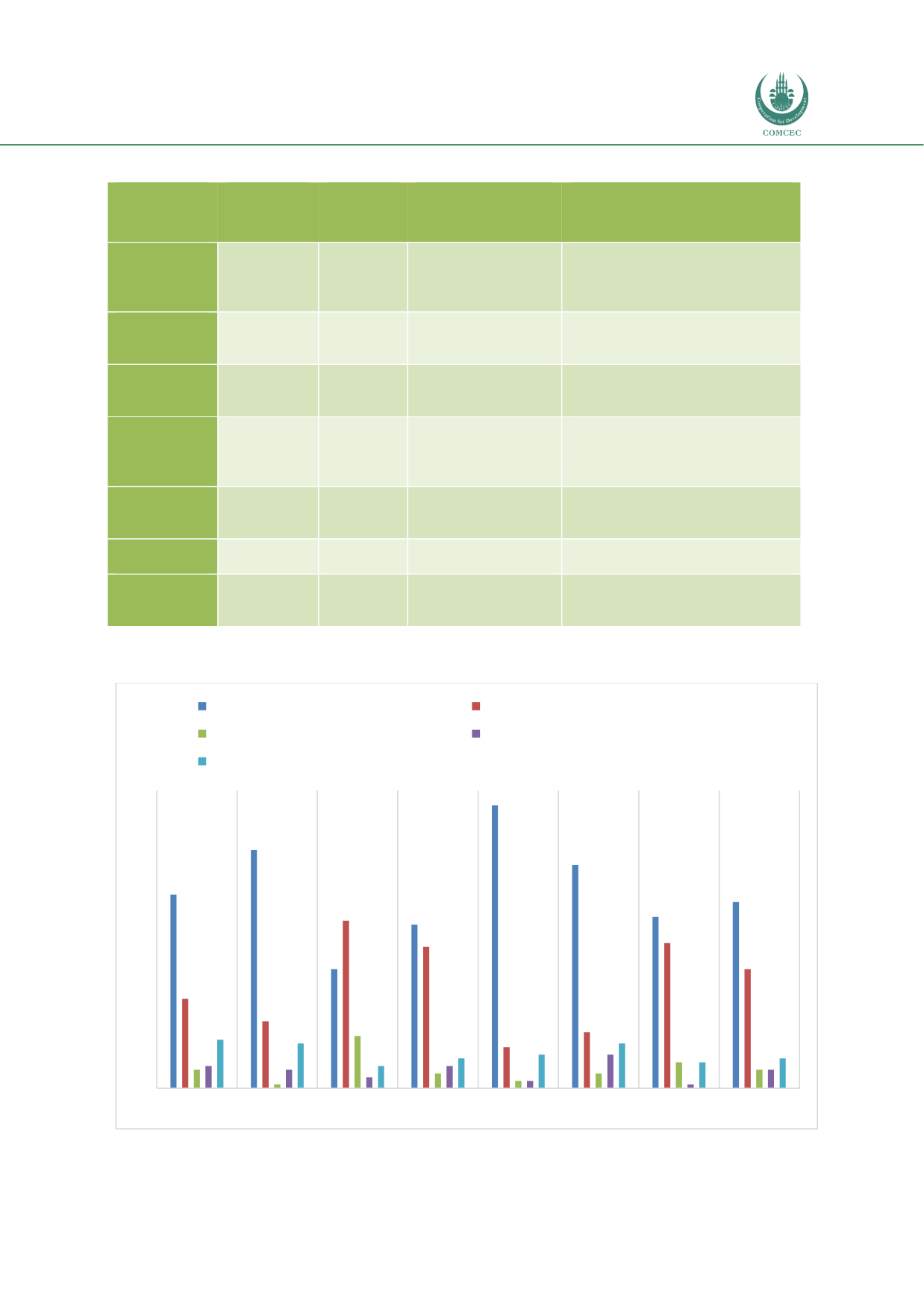

Table 2.4: Risk Appetite and Considerations of Different Financial Institutions

Institution

Investment

Horizon

Risk

Appetite

Investment

Objectives

Risks and Constraints

Commercial

Banks

Short term

Low

to

medium

Make net interest

margins

Asset-liability management (ALM)

mismatch risk

Intensifying

regulatory

environment (BASEL III)

Nonlife

insurance

Short term

Medium

Meet liability funding

costs calculated by

actuaries

ALM mismatch risk

Intensifying

regulatory

environment (IFRS II, Solvency II)

Investment

Company

Short

to

medium

term

Depends

on

funds

mandates

Maximize company

returns

Liquidity issue due to beneficiary

redemption

Life

insurance

and private

pension

Long term

Medium

Meet liability funding

costs calculated by

actuaries

ALM mismatch risk

Intensifying

regulatory

environment (IFRS II, Solvency II)

Public

pension

Long term

Medium

Meet liability funding

costs calculated by

actuaries

ALM mismatch risk

Rising longevity risk

Sovereign

wealth funds

Long term

Medium to

high

Maximize sovereign’s

wealth

Government mandate approval

issue

Endowments

and

foundations

Long term

High

Maximize

beneficiary’s wealth

Can have mandates that restrict

investment

in

developing

economies

Source: ADB (2018), African Economic Outlook 2018, African Development Bank, p. 109.

Chart 2.3: Global Infrastructure Investment-Equity and PPP by Type of Owner (%)

Source: PWC & GIIA (2017)

52%

64%

32%

44%

76%

60%

46%

50%

24%

18%

45%

38%

11%

15%

39%

32%

5%

1%

14%

4%

2%

4%

7%

5%

6%

5%

3%

6%

2%

9%

1%

5%

13%

12%

6%

8%

9%

12%

7%

8%

A F R I C A

A S I A

A U S T R A L A S I A E U R O P E

L A T I N

A M E R I C A

M I D D L E E A S T

N O R T H

A M E R I C A

G L O B A L

% OF TOTAL

Corporate

Infrastructure fund/investment firm

Pension fund

Sovereign wealth fund/government agency

Other