Infrastructure Financing through Islamic

Finance in the Islamic Countries

26

institutions and insurers that can provide coverage for various commercial risks. A key risk

that the government can reduce is political and regulatory risk by creating a stable and

conducive environment that can encourage long-term and large investments. The contracts

should identify clearly how the different risks will be distributed and the overall regulatory

system should ensure that the terms of the contract are implemented throughout the project

life.

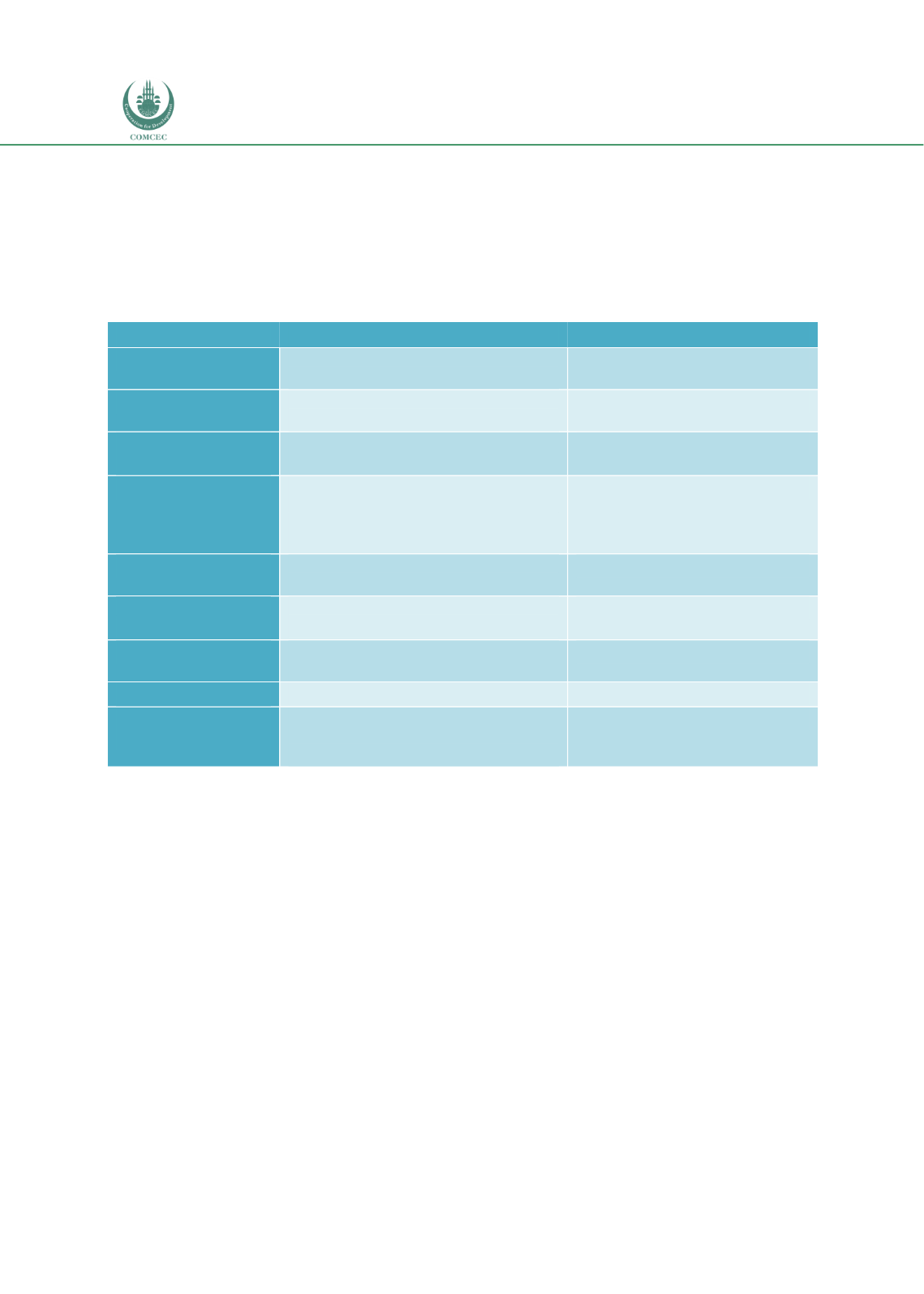

Table 2.3: Risks Arising in Infrastructure Projects

Risk Types

Explanation

Project Phase

Construction risk

Risks of design problems, delays in

construction and cost overruns.

Construction and warranty phase

Operational risk

Risks arising from staff management,

maintenance and operations.

Operations phase

Demand and Revenue

risk

Risks of low demand and resulting low

revenues.

Operations phase

Network risk

Risks arising from factors related to

other stakeholders/elements in the

network to which the project is related

or dependent

Throughout the project’s life

Technological risk

Risk of technology malfunctions or it

becoming obsolete

Throughout the project’s life

Financing/investment

risk

Risk of the non-availability or higher

costs of financing

Throughout the project’s life

Environmental risk

Risk of adverse environmental impacts

and hazards

Throughout the project’s life

Force majeure

risk

Risks arising from calamities and war

Throughout the project’s life

Political,

sovereign

(regulatory) risk

Risk of changes on regulations and other

requirements

related

to

the

infrastructure project

Throughout the project’s life

Source: Chan et. al (2009: 15) and Grimsey and Lewis (2002).

The government can provide the right incentives to encourage the private sector to invest in

infrastructure projects. This can be done either by providing price support to ensure a stable

revenue stream or by providing guarantees to minimize risks. In the former, the government

would ensure supply of inputs and/or purchase of output at certain fixed prices either directly

or through providing subsidies (Ernst and Young 2008). Guarantees can also be provided to

financial institutions providing financing to infrastructure projects by national or multilateral

development agencies in the form of partial credit guarantees (PCGs) and partial risk

guarantees (PRGs). For example, the Multilateral Investment Guarantee Agency (MIGA) of the

World Bank Group provides political risk insurance (PRI) for both debt and equity (Matsukawa

and Habeck 2007). Some public national bodies provide additional guarantees and insurance

to cover equity and debt investments and trade. One of the benefits of guarantees and

insurance is the improvement in credit ratings which can lead to lower borrowing costs and

enable the securitization of assets. The distribution of risks among the public and private

sector stakeholders under the key contractual arrangements are shown in Figure 2.2.