Infrastructure Financing through Islamic

Finance in the Islamic Countries

21

flow of the project itself and the liability of sponsors is limited to the equity capital and the

financiers have no recourse to their assets. Since project financing has non-recourse features,

the debt providers are to take security on all the project’s assets. Some risks that the SPV and

stakeholders cannot manage are mitigated through guarantees and insurance to create

incentives for financial institutions to provide debt financing. Rating agencies play an

important role in intermediating debt by providing useful information on the credit features of

the project. This is particularly true if the project company issues bonds to raise funds from

financial markets (Engel et. al. 2010: 48).

The non-financial contracts relate to building, operations and maintenance. The Project

Company undertakes the construction of the project by using the services of an Engineering,

Procurement and Construction (EPC) Company through a building contract. After the project is

completed, the Project Company may use the services of an Operations and Management

(O&M) Company through a service contract. The O&M Company operates and manages the

project by selling the services to the ultimate customers. It should be noted that in some cases

the Project Company may take the role of EPC Company and undertake the construction

responsibilities or operate/manage the project instead of assigning it to the O&M Company.

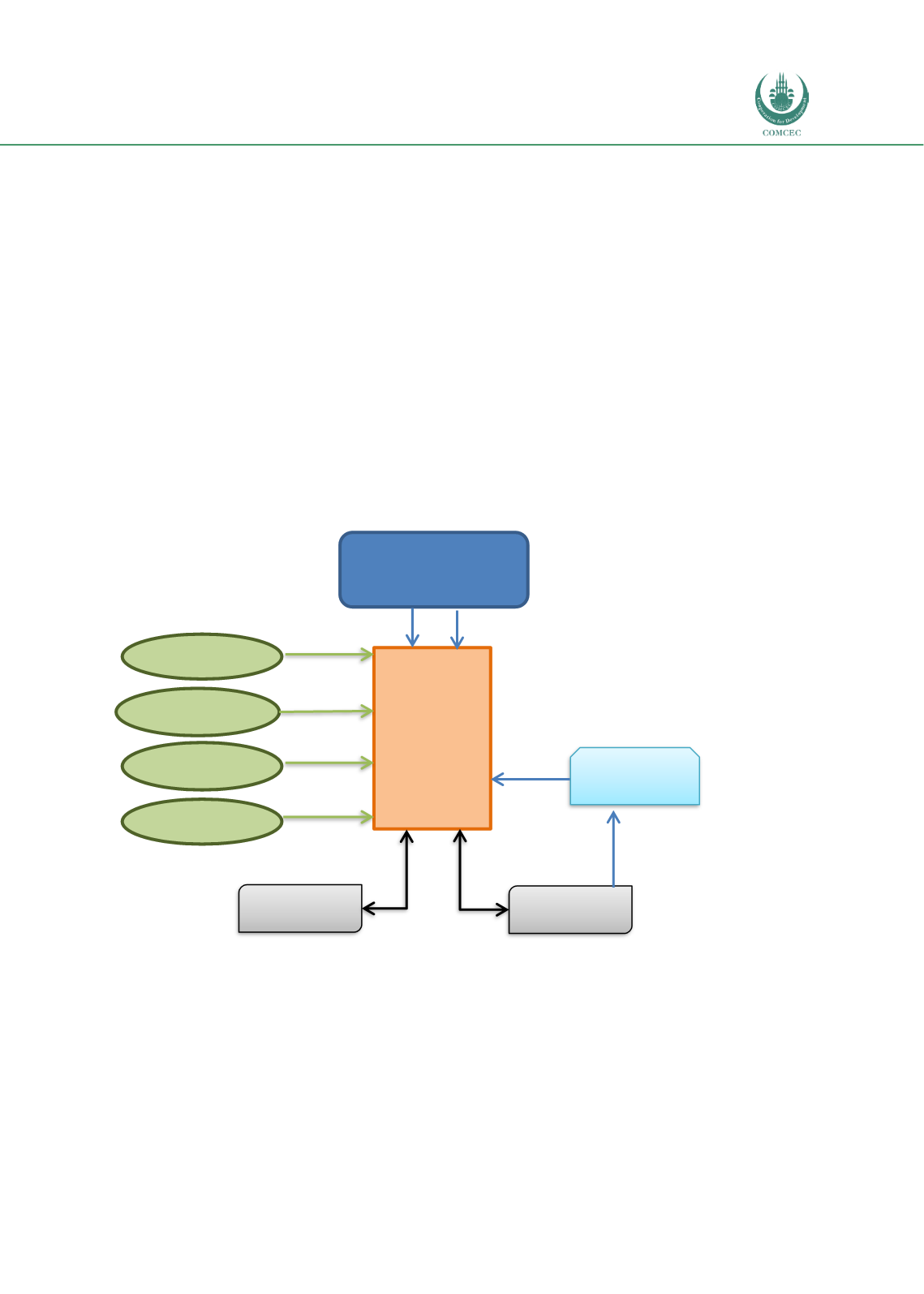

Figure 2.1: Stakeholders and Relationships in Infrastructure Development and Finance

Source: Adapted from Engel et al. (2010) and Miller and Morris (2008)

The issues arising for the key stakeholders at different stages of infrastructure development

are shown in Table 2.2. In the design or planning stage, the equity investors make

arrangements for debt financing. Since in the initial stages the risks of the projects are

relatively higher and the term of the financing is longer, early debt investors require higher

returns. The construction of the project is funded by equity and debt raised in the planning

stage. If there are cost overruns, these have to be covered by raising either more equity or

debt. In the operational phase, there are risks of cash flows, but once the revenues start to

Procuring Authority

(Government)

Insurance

Companies

Debt Holders

Sponsors

Project

Company

(SPV)

EPC Company

OM Company

Building contract

Service Contract

Users/

Customers

Service & Quality

Delivered

User fees

Rating

Agencies

Service fees & subsidies

Contract

enforcement

Insurance/

guarantees

Debt finance

Equity finance

Rating

Construction Phase

Operations/Maintenance

Phase